No matter what stage your financial business is at, it’s never too late to start thinking about how you can improve your digital offerings. Whether you’re a brand new early-stage or scale-up fintech, a more mature financial technology firm, coming from a traditional brick-and-mortar background, or somewhere in between, fintech application development should be your top priority for the coming years.

The latest statistics show that over 73% of smartphone users have utilized a fintech app in the last month to manage their finances, and that number is growing. That’s why now’s the time to answer that burning question: “how to create a fintech app?” and see the potential for your business in the coming years. In this guide, we’ll cover:

- The basics of fintech app development: what types there are, features, and more.

- How to create a fintech app step-by-step? Including planning and strategy to release.

- How much does it cost to build an app? Breakdown of the finances, financial app planning, and more.

Basics of Fintech App Development

Fintech is a growing trend worldwide as people gain digital access to their finances, but what is fintech exactly? Fintech is short for financial technology, it covers all elements of the financial world from banking apps to NFT platforms, trading to insurance and everything in between, making it an extremely diverse field. So, before we get into the details of how to build a fintech app and its steps, let’s take a look at the basics of fintech app development.

What types of fintech apps are there?

Top 9 B2B Financing Types and How They Can Be Automated As we’ve previously said, fintech is diverse and that means when it comes to your fintech app development strategy, it pays to know which precise areas of fintech you’re working in. Here are some of the biggest categories within fintech today:

Digital banking

Whether a Neo-bank or part of a traditional brick-and-mortar bank, digital banking apps allow users to take care of their personal finances. This may include completing transactions, opening accounts, investing, and more depending on the bank and its consumers’ needs.

Digital wallets

Payment Gateway Integration in Lending: How to Choose Once for All Think PayPal, ApplePay, and even the more contemporary cryptocurrency wallets, such as Coinbase. These digital currency holders store and keep track of your finances, protecting them online. They also offer a more secure way to pay for goods or services digitally.

Investment, trading, and financial management

Forget about heading into your local bank branch or trader’s office to open an account. Now, trading and investing can be done on a smartphone.

Consumer solutions

These apps allow consumers to access a range of financial services, such as lending, etc. They may also be integrated in the form of SDKs to other platforms, such as stores, to offer wider potential.

Wanna know more about our consumer lending solutions?

Insurance

Insurtech is a subsection of fintech. These apps offer extensive functionality potentially both directly to consumers and as an integrated solution. They can comprise of CRM, show insurance policies, and calculate risk.

Regulatory

Regtech (regulatory technology) aids fintechs in staying compliant with the numbers regulations they work under. They can help a company monitor performance and alert to risk in specific areas.

Real estate

Mortgage Lending Trends 2022: Rates, Technologies & Forecasts From financing to lending, property development to management, real estate fintech apps revamp the property experience and make it digital.

This list is not extensive. As fintech continues to mature, it’s likely we’ll see new examples added here.

What features should your app have?

HES Core: Digital Lending Engine Behind HES Software Now that we know the types of fintech software solutions available for finance app development, let’s take a look at the types of features they should have. As with many things in the technology world, this list may be as long as a piece of string, so the best solution is to choose wisely in the tools that you require your app to have.

General features:

- Onboarding—this will be the process, usually a series of screens, that you will use to add clients to your app. Depending on the field that you operate in, it’s likely this will include KYC and AML checks as standard. (Must-Have)

- Personal account—this is a user’s dashboard. It allows them to view all related account information in one place. It should be user-friendly and easy to use.

- Basic financial operations—depending on the type of app you’re creating the understanding of this term may vary. For example, it might be making card payments, storing digital cash or something else entirely. (Must-Have)

- Security features—digital security is a major concern with rates of cybercrime growing year-on-year. Your app solution should involve data protection and encryption features such as RSA, 2FA, biometric controls, mandatory password changes, etc. (Must-Have)

- Payment options—the greater variety that you can offer here, the higher the chances of success for your business. Having an accessible payment option should be a top priority.

- UX/UI—gone are the days of reams of texts and charts, your users want an easy-to-use and understand app that works for them.

- API integrations—as much as you want to, you may not be able to create all the features that you need solely from your own technology. API integrations allow you to adjust and adapt features with additional technology.

- Data visualization—whether you’re looking at consumer spending, insurance policies, or money-owed, data visualization makes it clear to your client how their finances are going immediately and any potential steps they may need to take.

- Biometric sign-in—biometric sign-in helps keep your clients’ accounts secure and ensure that they are the only ones that have access.

- Accessibility features—voice sign-in, voice-assisted banking and other tools make fintech more accessible to a wider community and this is a growing trend. In addition, technologies such as Siri and Alexa have popularised this among the wider community as well with voice assistance set to grow by 258% between 2019 and 2024. (Must-have)

- Support—this is where your clients will get the help they need when they need it. It can be anything from live chat with customer service agents to a chatbot to an email form to connect with your company to a set of in-built FAQS that help to navigate all the nuances of your app. (Must-have)

Looking for unique software for lending?

Optional features (industry dependent):

- Saving management

- Trading profile

- Investment portfolio

- Digital cards

- Push notifications

- Cashback

- Transaction history

- Insurance functions

- Lending features, etc.

How to Create a Fintech App?

Knowing the types of solutions out there, it’s time to move to the basics of building a fintech app. While every company’s journey to fintech app development is different there are some common steps that many companies follow when exploring how to make a fintech app. Let’s take a look.

Step 1: Research

Before you can build your fintech app development strategy or team, the first stage is research. At this stage, it’s important to outline a quick plan of what your app should be, what you’d like it to look like, and what purpose you’d like it to serve. You may also start by analyzing your competitors and their market offerings, and the needs of your consumers.

Step 2: Gather a team

Whether you have the capacity to hire in-house or whether you choose to outsource, this will be an individual decision. There is no right or wrong choice when building a fintech app. Instead choose based on your needs, the cost, and the goal you wish to achieve.

You may need:

- UI/UX designers

- iOS/Android developers

- QA testing personnel

- DevOps engineers

- Web developers

- Content specialist, etc.

Step 3: Business analysis, tech documentation, and MVP

Loan Management Software Features to Invest in at the MVP Stage At this stage, your chosen team will help you discover more about your app solution in technical terms and strategy. They will outline project cost (estimate), timelines, and a minimum viable product (MVP) containing your app’s must-have features. This is also a good time to do a validity check of your idea to ensure its suitability for the market before you go further in the fintech app development process.

Step 4: Choose your technology stack and APIs

At this stage, you will rely on the experience of your team to know which technology you need for your project. This may range from knowing the programming language you will code in, platforms you will use, APIs to increase functionality and security elements you wish to implement.

Step 5: Design the app

Now that you know which technology you will use, your team is on its way to creating a functional solution. It’s time to turn your attention to the client-side of things. Designing your app and making it user-friendly is a challenge. This will include making it eye-catching, functional, and easy to use so your users don’t abandon the app during onboarding.

Step 6: MVP and Beta launch

The Value of QA Testing in Fintech Industry Your initial app—the MVP—is ready to go. What’s next? Testing it out. By this stage, you’ve done your internal QA tests but how will a live audience react. Roll out the app to the Beta testing phase and gather the feedback to improve.

Step 7: Update your app

Step back and make improvements based on user feedback. This will help boost satisfaction rates when using your fintech solution.

Step 8: Release

Although your app has now been released to the general public, your work doesn’t stop here. Fintech is a fast-moving environment so it’s likely you will need to iterate and improve your solution over time.

Have you updated your software within the last year?

How Much Does It Cost to Build an App?

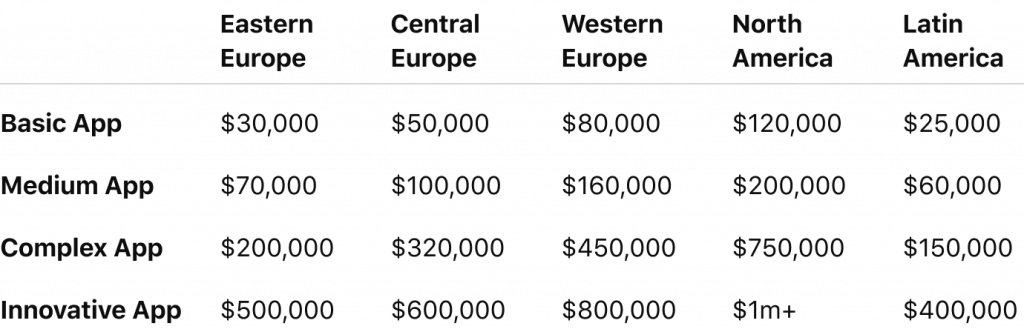

Even if you’re new to the fintech app sphere, it’s likely that you’ve heard some figures batted around in terms of how much it costs to build an app. The truth is this number can vary widely depending on your particular solution and how advanced you need it to be.

When it comes to how much does an app cost to build, it’s important to calculate team costs:

- Business analysis

- MVP and prototyping

- UX/UI design

- Backend work

- Frontend platform (s)

- QA

- Marketing

- Content

- More*

*These specialists may work in-house on a salary, per hour, or as part of an outsourced team.

You will also need to look at the initial costs, using an in-house team vs. an outsourcing provider vs. out-of-the-box software, the total cost of ownership (TCO), maintenance, and upgrade costs.

But what about the real numbers? How much does it cost to build an app for fintech?

Psss… Wanna start lending within 90 days?

Please note that these are very general figures, the average app start-up costs may vary depending on a number of factors, including the type of team, type of app, maintenance, upgrade needs, and more.

What’s Next When Building a Fintech App?

Inspired to make your fintech app development dreams a reality? Great! Now is a fantastic time to get started. Begin by following the simple steps in this guide or you can reach out to one of our experts here at HES to get to know more about the details of fintech app development specifically for your business.

If you need your project estimation and would like to get a quote for a lending platform development – contact the business development team at HES FinTech.

HES can help you design your solutions from the ground up to deliver on quality and cost-effectiveness.