In this article we are going to discuss B2B financing from the technical point of view, consider types of B2B loans, and ways to automate loan origination and loan management in commercial lending.

According to Small Business Credit Survey 2019, the average commercial loan obtained in a bank is around $417,316. However, due to their size, B2B business loans in banks are associated with a prolonged credit risk evaluation process and lots of paperwork. This is why SMEs tend to build the demand for non-banking funding options causing the growth of B2B financing companies.

Alternative lending allows smaller businesses to grow: SMEs apply for B2B loans to purchase real estate, finance payroll, finance inventory expenses, or scale up their businesses. Non-banking lenders usually have a solid technology base, so let’s take a look at what B2B lending tech provides today.

Advantages for Business Borrowers

Commercial lending solution powered with an upscale business lending platform allows more speed and flexibility, as well as a higher approval rate when compared to commercial lending in banks. For example, in 2018 the approval rate for big banks loans reached 27.7%, while alternative lenders approved 56.8% of business loans. Additionally, non-bank lending institutions may specialize in a wider range of loans, lending in specific industries, and in general, can create new loans faster.

Automation & Mitigation of Human Error

A business lending platform allows breaking down tedious manual tasks into fully automated and straightforward business processes. Simplified workflow, better user journeys (in the back-office and the frontend), and increased revenue from process optimization – are just a few of the advantages of commercial lending automation.

To issue B2B loans, lenders need to assess the customers’ borrowing capacity, implement credit scoring algorithms, process personal data and verify identity and perform loan calculations. When automated all these operations contain fewer human errors and significantly speed up the loan process allowing instant decision making.

Under-the-hood technologies of B2B lending software may include machine learning, document management, digital identity verification, smart payment processing, and more.

Looking for automated software for lending?

Support of Various Types of B2B Business Loans

B2B lending from alternative sources provides a lot of value-added services, from digitizing the existing processes to providing more opportunities due to additional metrics used in underwriting. The most outstanding B2B lending companies include C2FO, Fundera, Kabbage, and Funding Circle.

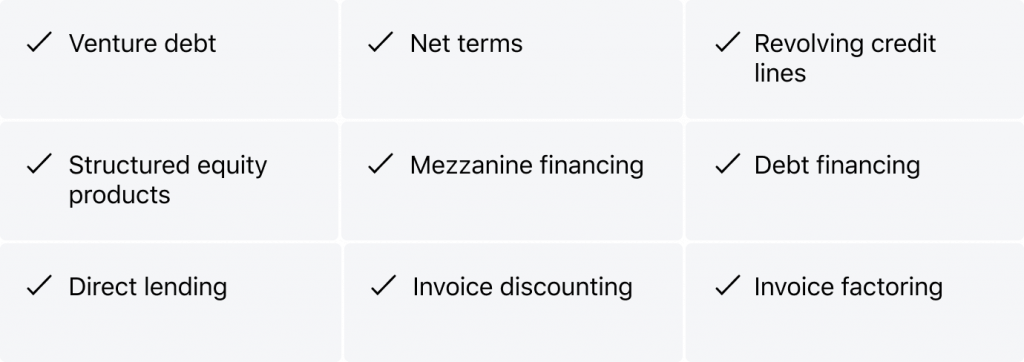

B2B lending may offer various types of loans. When creating a business lending platform, primary functional requirements include the support of specific loan types used by the business. Here are the most common types we implement as a software vendor:

1. Direct lending

Being very similar to a basic bank loan, direct lending is based on a capital raise from investors and funding loans of borrowers (businesses, entrepreneurs, or other investors). Direct lending is very popular in the SME loan industry: along with the rise of small and medium-sized businesses and a growing number of rejected loan applications in banks, alternative lending occupied this niche. At the same time, larger companies may prefer non-bank lenders as well and borrow billions of dollars, like Bombardier Inc, a large manufacturer of aircraft and trains, Ardonagh Group, a major insurance business, or media giant Gannett.

2. Revolving credit lines

Unlike a business loan, the amount is not an exact sum paid upon request, but the sum available when necessary. In addition to paying back the borrowed money, the borrowers are due interest at a pre-determined rate. A line of credit resembles a credit card for businesses. The primary benefit of revolving credit lines is their flexibility: business customers that are uncertain about the amounts to be borrowed can change their decisions at any time. The development of revolving credit line software has its specifics with integrations and business process flow. In 2021, HES FinTech has successfully implemented a revolving credit line project for a major Canadian-based lender. It allowed us to gain valuable experience for future projects in the field of commercial lending.

3. Venture debt

Used by Airbnb and Uber, venture debt is an alternative to equity investment for startups. This debt financing type allows lenders to rely on the borrower’s most recent venture capital equity as a measure for the terms provided. Venture debt is provided to businesses that require capital for a specific purpose, usually young companies and startups with a high growth tempo. The technical implementation of commercial lending using this B2B loan type includes additional collection functionality that allows strong actions forcing borrowers to repay.

4. Net terms

Also known as ‘credit terms‘ or ‘trade credit‘, net terms imply a 30/60/90-day grace period from when businesses need to pay for goods or services.

5. Structured equity products

The variety of structured equity products is quite a popular financial support method for B2B customer financing, however, constantly shifting market trends may unveil the drawbacks. The implementation of structured equity products within a commercial lending platform is better to be performed with an experienced loan origination software vendor due to the specifics of documentation and requirements.

6. Debt financing

Upgrading Consumer Collection Management System to Reduce Income Loss Debt financing types may include non-bank cash flow lending, recurring revenue lending, home equity loans, debenture, and more. HES FinTech develops custom lending software platforms for B2B loan management of all types, including the debt financing types we mentioned.

7. Mezzanine financing

Some B2B financing companies use this debt type. Mezzanine debt is hybrid: it is subordinated to other debt from the same lender thus creating a bridge between debt and equity financing. The business processes seem complicated, but they can also be automated with the help of customizable loan management system.

8. Invoice discounting

Invoice discounting is a B2B customer financing, which implies borrowing part of the value of the unpaid invoice from a third party. Having the invoices as collateral, invoice discounting is essentially simply a type of business loan. This way of B2B financing is a seamless cashflow booster and is widely used by SMEs.

9. Invoice factoring

The Ultimate Guide on Factoring Platform Development Invoice factoring is similar to invoice discounting in using invoices as collateral for improving the cash flow. The only difference is the factor is paid directly by the client, and the client is aware of this type of financing used. Just as well, the factor provides additional services, for example, collections and monitoring of invoice items paid. The factoring software can speed up the document management process, and automated notifications and have a clear picture of all transactions in a single digital space. You can read more about factoring software development on our blog.

Get a digital roadmap for your B2B lending business

Want to get a readymade digital strategy for your commercial lending business? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your lending company. Your answers are totally confidential.

What Makes a Good B2B Lending Software Solution?

When you’re evaluating a B2B loan platform, there are a couple of important questions to ask:

Custom or out-of-the-box?

Automated Lending Software: Custom Vs. Out-Of-The-Box HES FinTech provides both depending on your business needs and customizations requirements.

Is it scalable and flexible enough?

A commercial lending business may require additional functionality with time, while HES lending platforms can be supported and upgraded with no vendor lock-in.

Does it have future-proof cloud functionality?

Why Cloud Lending is Leading the Way in Digital Transformation We support businesses on their way to digital transformation and provide both on-premise and cloud-based lending solutions.

Custom vs OOTB: What’s your choice?

To Sum It All Up

While SMEs are applying for more loans, the B2B financing industry is growing faster every year, requiring cutting-edge technology and highly functional platforms to serve as a sufficient alternative to bank lending.

Advanced B2B loan software allows businesses to provide multiple loan products and expand their portfolio, improve their cash flow, decrease loan turnaround time, and benefit from growing customer satisfaction.

Want to automate commercial lending? Contact HES FinTech now.