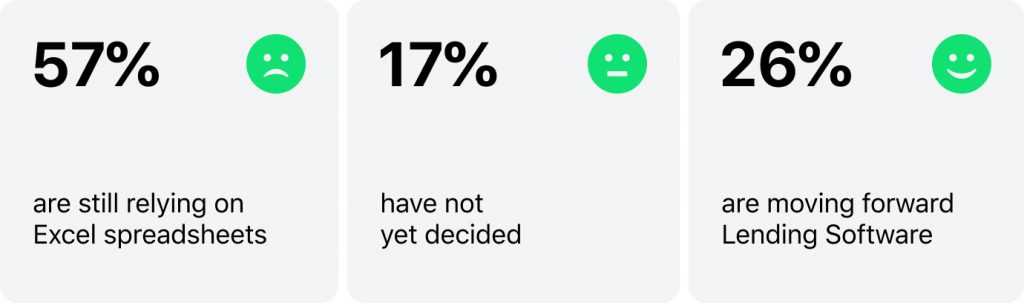

Why Digital Lending is More Powerful than Ever If it’s not broken, don’t fix it, right? When it comes to Excel loan spreadsheets, it might be time to throw this phrase out the window and explore other options. Excel lending solutions continue to remain popular despite the growing digital transformation of the lending industry as a whole. But why? Well, they work, and employees know how to use them. That makes it difficult for a company to make a solid case for changing from Excel loans to a software solution, even if they really should. Here’s why.

Why's It Difficult to Give up Excel Finance Sheets for Software Solutions?

Choosing whether to undergo a digital transformation or not to undergo a digital transformation can be a dilemma for lending providers.

Excel finance sheets have served well and changing them will take time, energy, and money. But that’s not the only reason decision-makers remain on the fence. For example:

“We’re used to it”—this is a tough argument to win as debatably, starting any digital transformation process, whether it’s about an Excel finance sheet or something else, is a challenging process. Estimates show that such endeavors can fail better 70%-90% of the time, so why bother in the first place? Because the future is digital and if done correctly it can truly benefit your business. Digital transformation is happening. In 2020, it was valued at $469.8 billion. By 2025 that number is expected to reach $1,009.8 billion. Additionally, choosing to switch to new technologies can benefit your business in its acceleration by as much as 22%.

Saudi Aramco and Customers from Africa - the Footprint of HES is in 30+ Countries Now “Software is too expensive”—it’s true. Digital transformation and especially upgrading Excel lending systems aren’t going to come cheap. But have you ever heard the saying “the cheap pay twice?” 88% of spreadsheets contain 1% errors or more in their formulas, meaning it’s likely that if you already use spreadsheets some errors have been kept in there over time. And it’s no wonder with an estimated 463 exabytes of data expected to exist globally in the next couple of years. Although your business won’t be handling all of it, it’s likely that if you are working with Excel for finance you have a significant amount of data already. So, when it comes to software cost, it’s vital to consider both the risk of error and the Total Cost of Ownership for the proposed lending management software solution.

“We don’t know what the software can do”—statistics show that while everyone understands there are benefits to digital transformation, 26% also see it as a risk. Fear of the unknown is genuine, whereas tried and tested systems (even if a little faulty) have always worked. That’s why, when it comes to onboarding a new solution, be it an upgrade to your current loan sheets to tailored micro-financing software, it’s vital to develop a complete strategy outlining the pros and cons of Excel vs. software before embarking on internal approval processes, and find out specifically what they can do for your business.

Looking for a top-notch platform for lending?

Pros and Cons of Excel Spreadsheets for Lending

Still not convinced that the disadvantages of Excel are enough to encourage you to consider a switch? Let’s look at some of the things only a non-Excel lending solution can do.

Disadvantages of Excel for Lending

Lending platforms, such as HES LoanBox, offer more customization, scalability, work efficiency, and, overall, an improved customer experience. In addition, modularity is always your brand to adjust the software to your specific needs so there’s no “added fat.”

Conversely, Excel loans tools can be rather rigid in their approach, which causes challenges as it slows your business down when adapting to market changes. Although we like to think of the market as reasonably predictable, recent events, such as COVID-19 and the incoming market dip, do have an impact on lenders. Coupled with worrying inflation USA at 8.6%, the UK at 9.1%, Ireland at 8.2%, and Germany at 7.9% (as of May 2022), the short and long-term impact on buyers is likely to cause some anomalies in once-reliable sheets, causing either an under-or over-cautious approach.

Excel lending sheets are decent at storing data. They can be used to keep payment records, manage escrow processes, send notices, and calculate late fees and other payments, which does on the surface sound like an all-in-one loan pack. However, it’s not.

Modern loan solutions, for example, payday loan business software, digital mortgages, or even business loans, need to do more. For example, loan origination software can cover risk management, decision-making modules, underwriting tools, lifetime servicing, reporting, collection, management, compliance, and more. All of which necessitates massive amounts of data to process, manage and utilize to ensure lending runs smoothly.

The alternative to Excel loans, software solutions, allow businesses to automate their lending data, processes, and decision-making to save time, reduce risks, and keep on top of the ever-changing financial market.

Pros of Excel for Loan Business

At the same time, moving from old-school Excel for finance tools to modern solutions isn’t for every business. There are times when it may pay to stick to tried and true tools. When companies find themselves faced with tight budget margins, don’t have a scaling strategy, or their team is simply not prepared for change. These are times when it might be best to hit pause on any technology upgrade process.

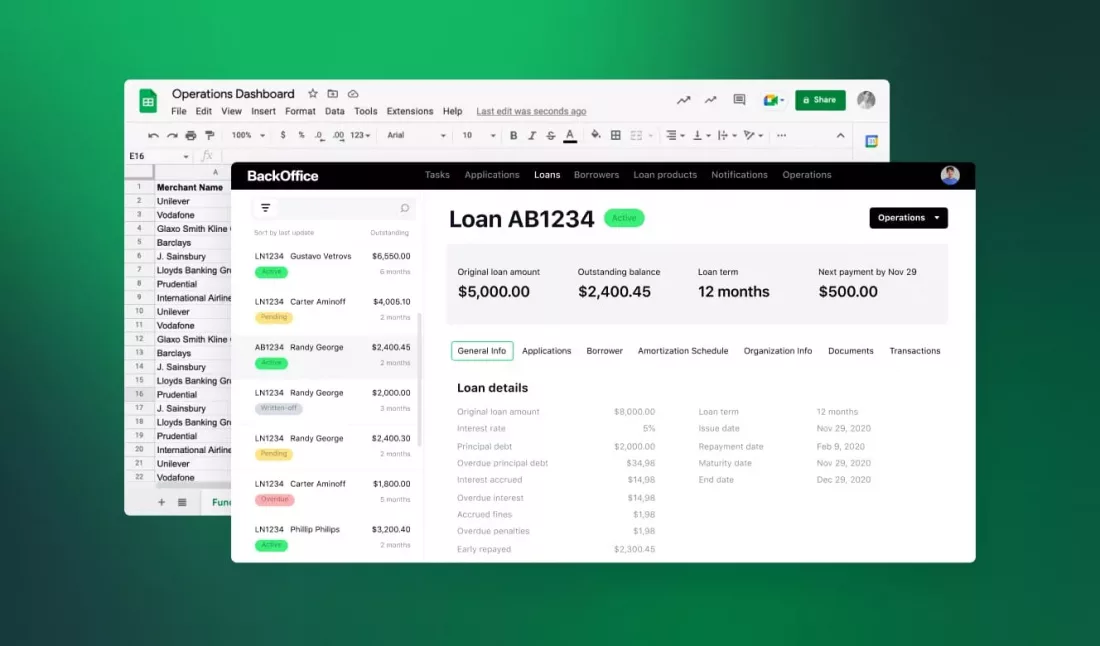

Case study: HES LoanBox as an Alternative to Excel

Depending on your company’s individual needs, there are numerous alternatives to Excel loans out there. One of them is HES LoanBox. But what is HES LoanBox and why does your business need it?

A three-in-one digital lending solution, HES LoanBox comprises a digital onboarding page that functions as a seamless branded customer acquisition channel, a borrower portal complete with an online space for digital interactions with the financial institution, and a back-office that covers everything from application to repayment with ease.

In practice, this encompasses several functionalities including:

- Loan management, origination, onboarding solutions

- Full KYC compliance, risk evaluation, credit decision-making, and loan underwriting

- Collateral management and debt collection when things don’t go to plan

- Reporting, SMS and email notifications, activities dashboard, and document templates to add visibility

- Security that ensures data remains as safe as it should

- Capacity to integrate with payment providers, BI tools, and more.

All this tech is nothing without being able to dispatch when and where it is needed. Promising a swift launch in just 2 to 4 weeks, HES LoanBox allows businesses to tailor the software to their company needs to launch quickly and efficiently. Equipped with a new landing page and the possibility to track conversion, customization opportunities, and integration, HES LoanBox is a diverse, yet simple, piece of kit that promises a lot and delivers even more.

Kickstart your lending in 3 months

Of course, HES LoanBox is not the only tool on the market. When it comes to your unique needs, start with a business strategy, and find the perfect solution for your needs.

To Excel or Not to Excel: that is the question

Whether you choose to stick with Excel loans spreadsheets or march forward into the folds of modernity, the most important thing is to analyze how it fits within your company’s overall plan for the future.

Remember that while Excel might work ok now, as your organization's data continues to grow, it might be worthwhile investing in a more robust solution for the long haul.

Wanna try HES LoanBox in action? Hop on a live demo tour with our team.