Cautious lending is back on the table for organizations worldwide as inflation remains higher than usual. As a result, interest rates on loans have continued to rise in correlation with governments across the world scrambling to manage their countries’ economies and prevent a recession. With few signs of ease predicted this year, many lenders are seeking new ways, such as consumer lending technology, to improve their businesses and ensure they offer valuable services.

Consumer lending basics in 2023: the stats

Emerging Consumer Lending Trends of 2023Before we dive into consumer lending innovation, let’s take a look back at the statistics driving the trends this year.

- Consumer lending in the US was 6.6% higher in March 2023 than March 2022.

- Debt hit just over $17 trillion in the US in Q1 2023—a market high and increase of $148 billion on previous results.

- New mortgages are at new lows, totalling $323.5 billion, a number unseen since 2014.

- Delinquency rates on consumer loans are rising—totaling 6.5% on credit cards, 6.9% on auto loans, and 3% on average.

- Debt is rising. Mortgages at $121 billion, student debt at $9 billion, home equity line of credit at $3 billion.

What this indicates is that the times of carefree lending are over. With debt rising, delinquency rates slowly increasing, and consumer caution, now is the time to head back to the drawing board and adjust the strategy and consumer lending technology for the future.

Consumer lending 101: a guide to best practices

As Steve Jobs, founder of Apple, once said, “Innovation is the ability to see change as an opportunity, not a threat.” That’s why as we ride out the economic storm together, one of the best things founders and decision-makers can do is use this as a learning experience and get digital consumer lending ready for the evolving market.

Assessing creditworthiness a new way

The lending industry is currently undergoing a massive shift. Past credit assessment practices are no longer keeping up with market demands, and this, in part, is due to how the Millennial and Gen Z generations are managing their work and finances.

Gone are the days of 9-to-5s with a steady wage. Instead, it has been replaced with the much more uncertain gig economy and challenges, such as economic crashes, a pandemic, and strikes, which have greatly impacted how these generations work and earn. However, that doesn’t necessarily mean they’re not creditworthy.

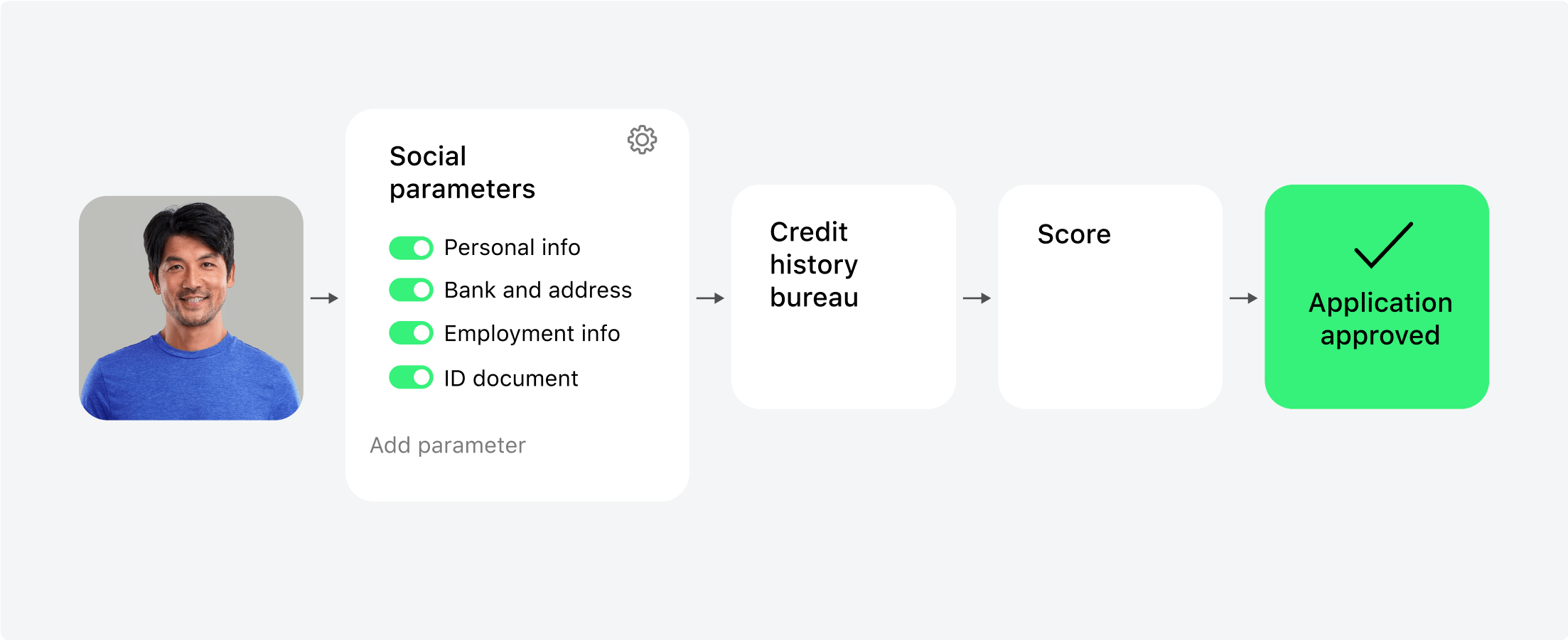

Because of this, older methods of creditworthiness don’t meet market demand. Instead, new consumer lending technology must be put in place that can assess creditworthiness, among other factors, in a new way.

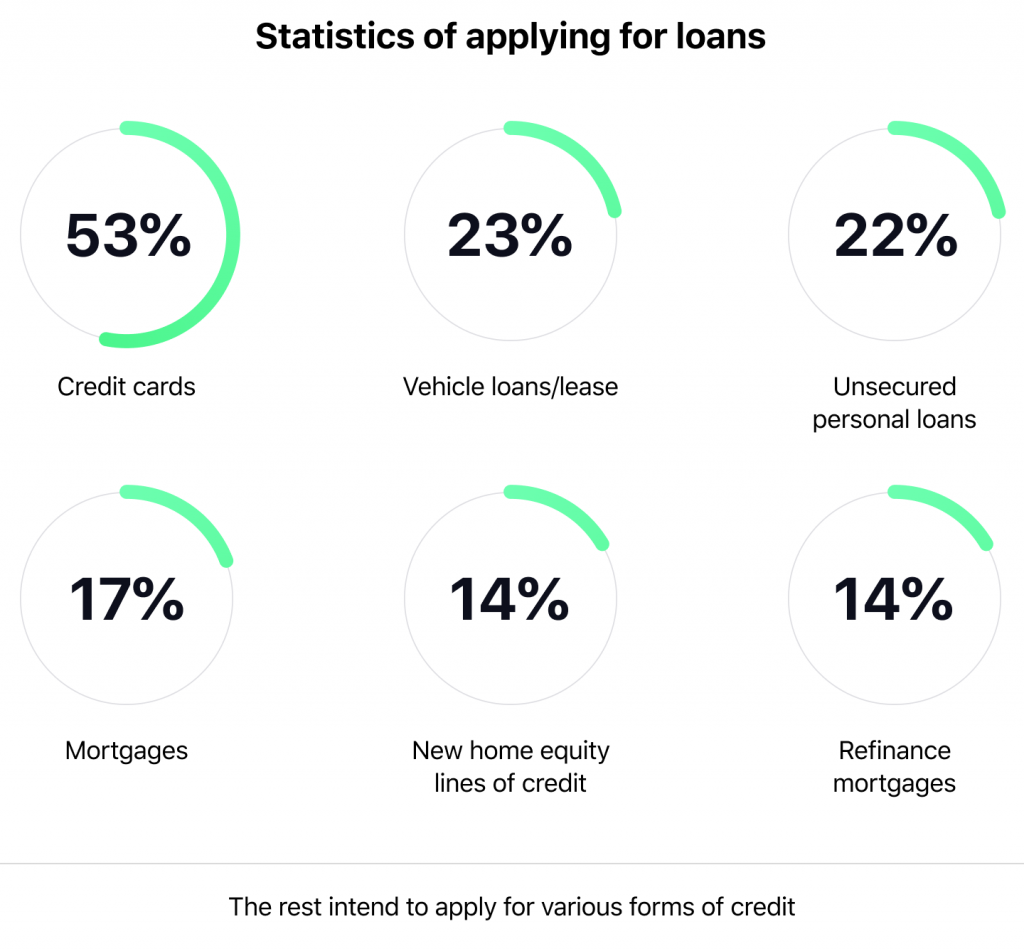

Do you use alternative credit scoring?

For example, innovative credit scoring models, coupled with alternative data sources (social media, etc.), and machine learning algorithms are stepping up to deliver some solutions. By analyzing a wider range of data a more holistic approach can be taken to a potential client, and their loan approved depending on the actual risk not a supposed one.

According to data from Experian, this approach to credit could potentially give a face to the over 106 million US consumers who previously could not secure credit via traditional means. Credit invisibility impacts 42% of the US adult population, targeting this issue could provide a welcome boost to the current market.

At the same time, risk is reduced due to smart data analytics methods that calculate repayment likeliness and even extends to personalised credit options.

Streamlining loan origination

68% of consumer drop-off during any fintech app onboarding process—more than half. Couple that with the newest mortgage application drop-off rates at 6.8%, and it’s clear that there is a blocker somewhere in the process. Although not everything can be solved with a little sticky tape and consumer lending technology, some things can be done to improve the overall picture.

There is hesitation from both borrowers and lenders in today’s market. This factor isn’t easily solved and depends heavily on external factors, which aren’t easily shifted. Instead, what companies can do is focus on the factors they can control—optimizing the loan origination process.

Each technology case can be as individual as the organization itself, and generally should be treated as such. However, there are some common factors that companies should consider, such as:

- automation in form filling,

- streamlined data collection,

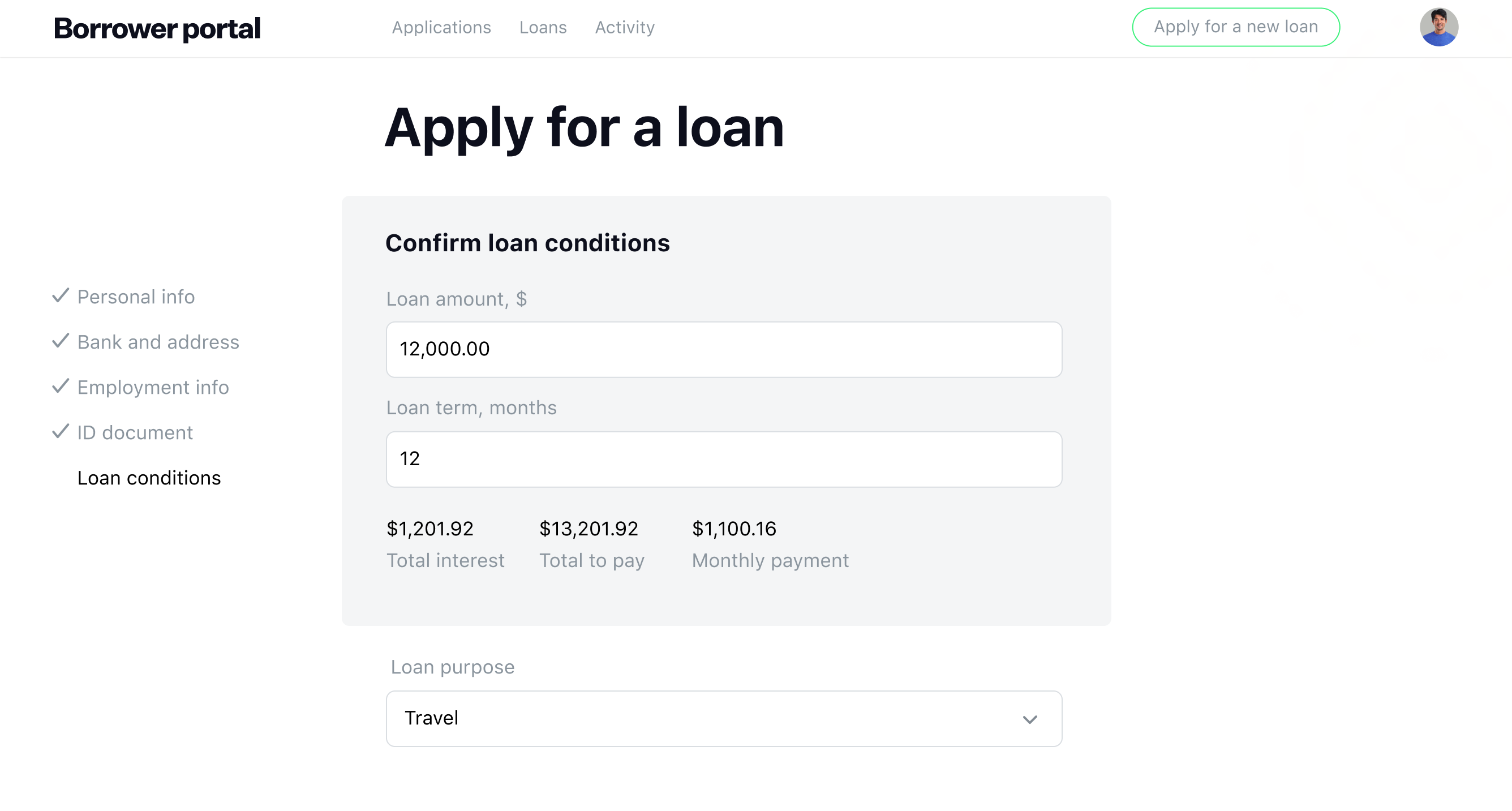

- upgraded online applications,

- electronic document management.

These help the client complete the onboarding process as seamlessly as possible.

After all, it’s no secret that modern fintech apps are dominating the market, so there’s no better time to relook at your technology offering.

Managing risk more effectively

With delinquency rates slowly but surely creeping up, especially on non-mortgage-style loans, risk management could not be a more important part of a company’s repertoire. However, many continue to lean on tried-and-tested methods that aren’t always fit for the modern market.

Enhancing the client experience while managing risk is the dream combo for success, but it is easier said than done. Effective debt collection, early intervention, and a clear communication plan go a long way to achieving higher repayment rates from borrowers by nipping delinquency in the bud and creating achievable repayment scenarios.

Strategy plays a key part in all this, alongside the right technology. For example, AI consumer lending solutions allow companies to more accurately assess risk and design strategies that account for a client’s finances, debts and circumstances to ensure risk is minimized and debts are repaid.

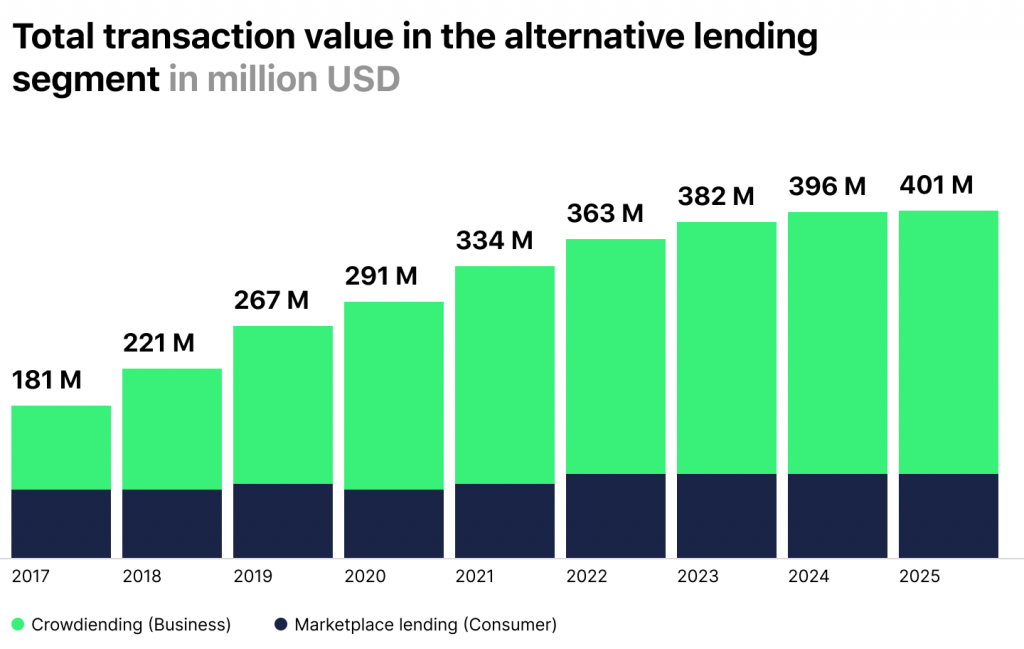

Enhancing client experiences

Fintech is still on the rise with an estimated 5.62 billion users globally. Digital payments, in various forms, account for a large proportion of this. However, it is a good indicator that the age of digital banking technology has truly arrived. The fintech lending market is set to reach an estimated $4,957.16 billion by 2030, up from $449.89 billion in 2020. With banking fintechs, getting in on the market by offering loans alongside their banking services, this number could grow even further. So what is the secret to these technological unicorns?

Client-centered experiences. Driven by data, fintech companies draw on a vast range of insights to make hypotheses about the services they offer. They are able to become more agile, adapt faster, and implement new features based on the individual client and their needs. But how can a more traditional business even hope to keep up?

Luckily being a market player doesn’t always mean being head of the pack. Instead, it just means being competitive and offering what the market needs at this time— consumer lending innovation.

There are numerous companies out there that can help businesses adjust their tech stack and create digital platforms and apps for borrowers that meet the market demand. After all, tried and trusted doesn’t always mean stale—a revamp could boost your service exponentially.

Get ready for a consumer lending technology upgrade

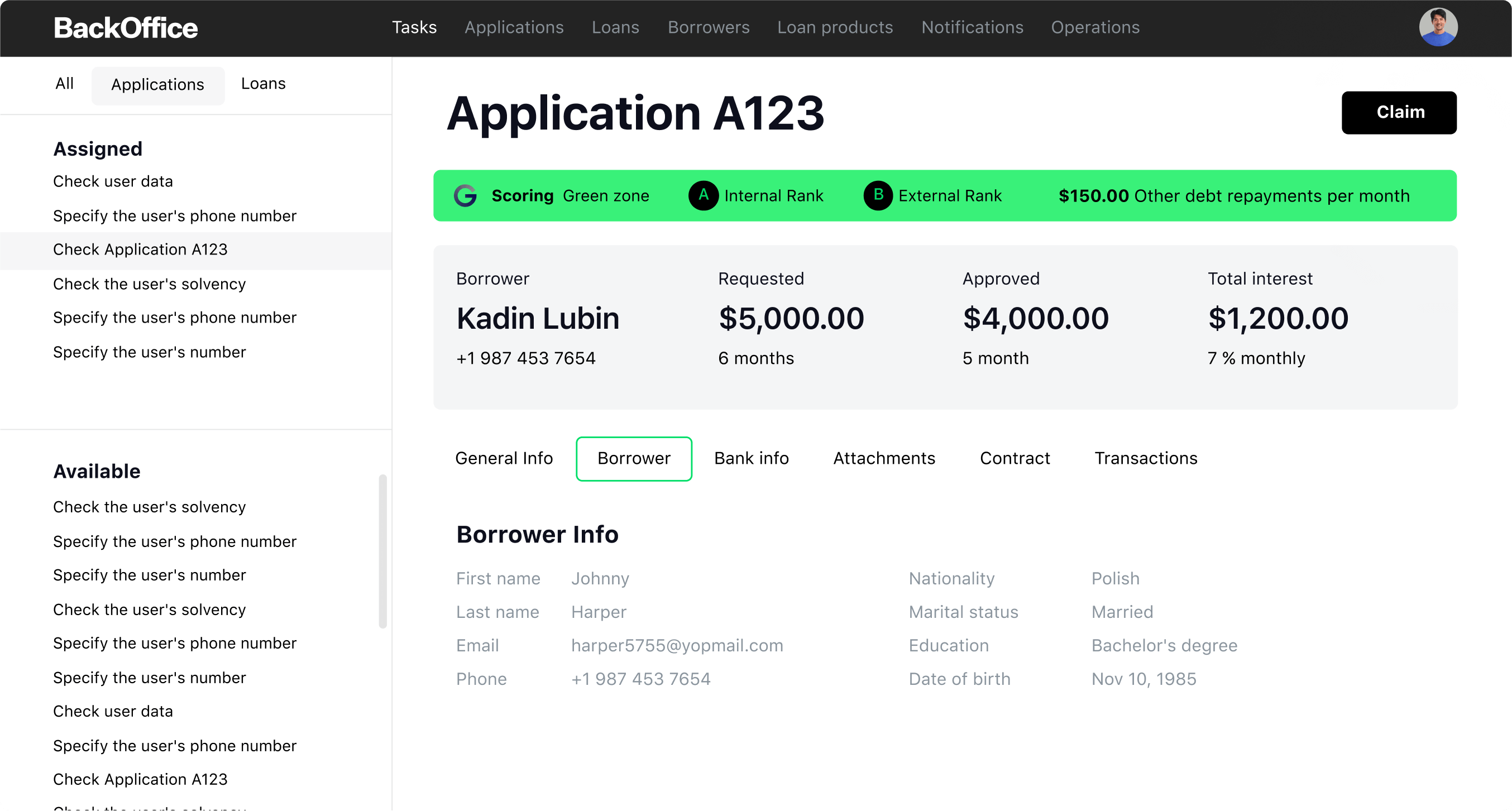

Innovation sounds complicated, but it isn’t. At least not with the latest technology on hand. HES LoanBox for Consumer Lenders is a leading industry tool that helps businesses upgrade their lending offerings without diving too in-depth into the nitty gritty of tech.

By integrating LoanBox’s features into your current tech stack, you can take advantage of the latest consumer lending technology, such as creditworthiness tools, loan origination and management functions, automation and more to ensure that your product stays ahead of the curve.

Sounds like what you’re looking for? Get in touch with the HES team today to book a demo and explore what HES LoanBox can do for you.