News of the collapse of SVB (Silicon Valley Bank), marking the biggest bank collapse in the US since the global financial crisis of 2008-2009, has sent shivers down the spines of bankers and SME bosses alike.

Coupled with the low economic growth of 2.9% (compared to 2022’s 3.4%) predicted by the IMF for 2023, and ongoing political discord across the world, the situation makes for a challenging economic climate in the year ahead. However, despite these disquieting factors, hope is on the horizon. The IMF predicts that by 2024 the market will again pick up the pace, and inflation is set to fall. For companies focusing on the future, knowing the consumer lending trends could help guide you through crises to greener pastures.

Ones to watch — consumer lending trends 2023

With a CAGR of 11%, digital lending solutions are a rapidly adapted technology that comes in many shapes and sizes to fit a variety of needs. Being able to onboard the right digital lending transformation for your business goes beyond following the trends in consumer lending and starts setting them. Let’s take a look.

Marketplace lending

Otherwise known as a lending marketplace or MPL, marketplace lending offers an alternative to traditional lending practices. It is a digital platform that connects investors and potential borrowers—both retail and commercial. With an estimated value of $31.68 billion in 2023, and a steady 1.93% growth rate, the MLP sector is set to hit $34.2 billion by 2027. So why is MLP becoming one of the consumer lending industry trends to watch?

- Ease of service—borrowers are able to apply for loans in a place that is convenient to them. Often this is coupled with automated onboarding processes for maximum comfort for the user.

- Faster than traditional lenders—automated underwriting, smart decision-making, MLPs utilize the latest technology to ensure these processes run as smoothly as possible.

- Access to a wider range of borrowers—due to smart credit risk software, MLPs can often assess potential clients who may have trouble applying through traditional credit methods, for example, with a limited credit history or other factors.

- Variety in lending options—with AI modules, MLPs can deliver a wider variety of lending services and lending repayment terms based on individual needs and risk analysis, not fixed rates, answering to the growing market need.

Get a digital transformation roadmap for your finance business

Want to get a readymade roadmap for the digital transformation of your finance business? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your lending company. It’s completely free, your answers are totally confidential.

Peer-to-Peer lending / social lending

How to Create a Peer-to-Peer Lending PlatformOne of the current trends in consumer lending isn’t all that new, in fact, we’ve been talking about this one for a while now. Industry growth is estimated at a CAGR of 6.4%, in an industry valued at $1.2 billion today. So, what is the draw of P2P systems?

- Able to service a wider variety of customers—nowadays, many clients experience limitations accessing credit from limited credit history, high debt-to-income ratios, or other factors. Alternative models like P2P navigate this by connecting lenders and borrowers directly.

- Potentially lower interest rates—traditional lenders offer interest rates based on fair fixed methods. P2P platforms offer more flexibility for both borrower and lender.

- Delivers portfolio diversity—varied risk profiles, differentiating investments, P2P lending allows lenders more choice in the groups they lend to and how they do so, bringing potentially greater portfolio diversity.

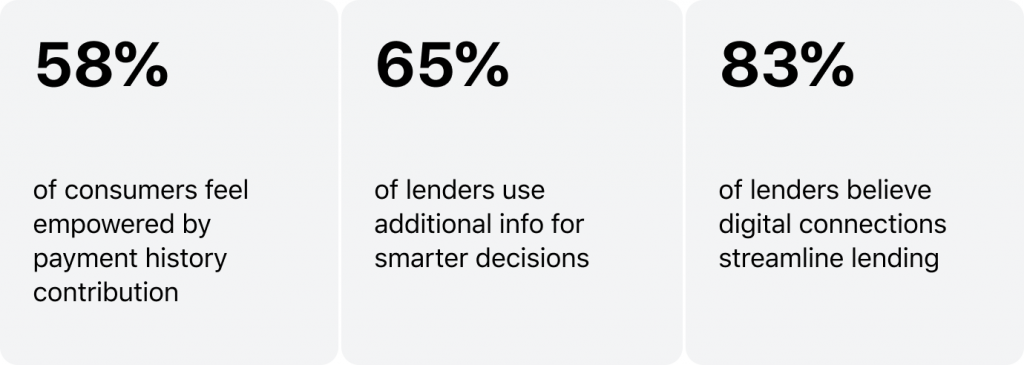

Alternative credit scoring

How SME Lenders Can Tackle ‘Invisible Borrowers’ with Alternative DataTraditional lending scoring immediately cuts entire groups of potential borrowers from the market. Alternative credit scoring, often done using AI models, opens a wider world of possibility. Currently, over 65% of lenders are now choosing to engage in alternative credit scoring systems, such as GiniMachine, that allow them to go beyond fixed credit histories to determine a borrower’s creditworthiness.

- Dives deeper into creditworthiness—by analyzing factors such as bank account balances and transaction history, history of utility and rental payments, social media and online behavior, alternative credit scoring can develop a wider picture of who a borrower is financially.

- Expands pool of potential borrowers—by not immediately cutting out younger borrowers or immigrants, alternative credit scoring seeks to engage a wider audience safely.

- Manages lending risk—at the same time, it reduces the risk, as it uses smart models to predict lending defaults more accurately.

Personalized loans

Everything is becoming more personalized—marketing, social media, company communications. To keep up, companies need to offer solutions that meet client-specific needs. The same goes for lending. Studies show that when borrowers receive personalized treatment, they are 5% less likely to be late on payments, and loan demand even increases.

- Tailored client service—from allowing borrowers to choose loan amounts specific to their needs, to custom repayment terms, to zero-penalty pre-repayment terms, clients gain more authority over their loans and become more likely to repay them on time.

- More lending interest—as consumers observe greater flexibility, they become more comfortable with borrowing and more likely to do so.

- Potentially higher repayment rates—tailored lending not only allows borrowers agency over their loans but increases their responsibility towards them, making defaults less likely.

Psss… Wanna lead the digital lending market?

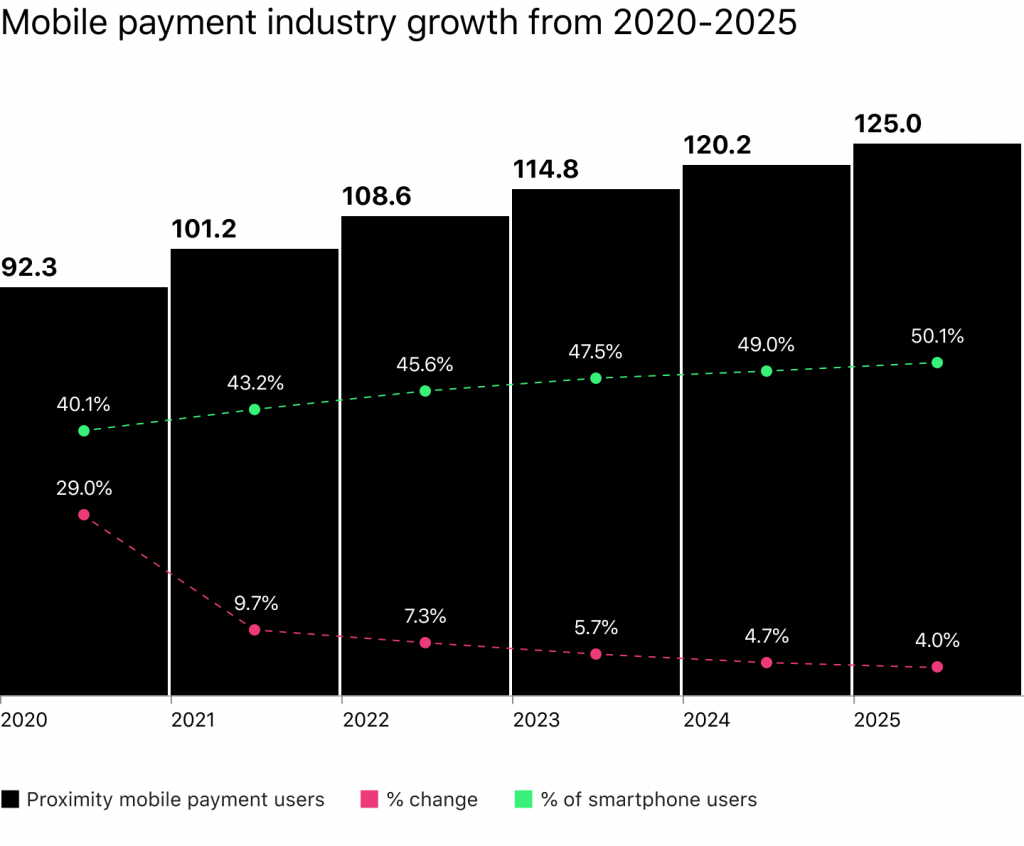

Mobile payments

With over 6.8 billion smartphone users worldwide, it’s no wonder that one of the top global consumer lending trends of 2023 is mobile payments. In a mobile-first world, cellphone-based payments are rising at a CAGR of 26.93%. This allows companies to capitalize on:

- Increased borrower responsibility—with more access to loan information, clients can easily access their accounts and repay loans. This helps avoid late fees and could transform them into return borrowers.

- Closer client connection—communication is key, and mobile payment platforms can prove a crucial tool for communication, increasing client trust in the brand.

- More security—encryption, multifactor authentication, and more help key borrowers’ data secure and less vulnerable to leaks.

Point-of-Sale financing

With an estimated market value of $391 billion, adding up to 3.5% of all consumer spending, the PoS financing sector is truly one of the leading consumer lending trends of 2023. Here’s why.

- Easy to integrate—ingrained into retailer systems PoS allows borrower to buy and finance all at one point. For businesses, it’s often as simple as choosing a trusted vendor and pricing model and proceeding to install.

- Encourages spending—borrowers are more likely to purchase slightly higher ticket items if they can pay back over a period of time. This encourages economic growth while offering the client higher-quality purchases.

- Flexible payment terms—from spreading the cost of a purchase to promotional offers, PoS allows businesses to service their clients’ needs on a new level. For example, with zero % interest rates or cashback on purchases.

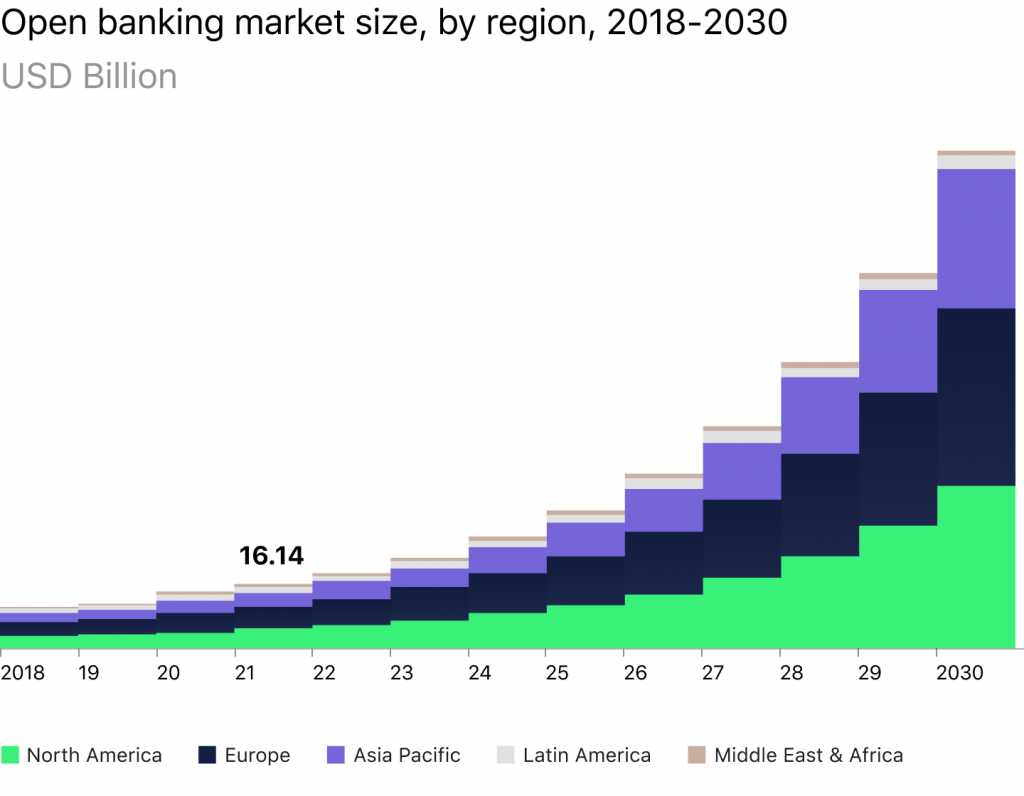

Open banking

Open Banking Can Change Lending Forever: Here’s HowWith a CAGR of 26.8% and an estimated value of 16.14 billion in 2021, open banking is another of the trends in consumer lending that is fast becoming a rule. By allowing greater transparency on the market, more flexibility, and increased security, open banking solves issues for both clients and lenders.

- Gives power to newer companies—with open banking systems, new market entrants can deliver services or products to the financial market, allowing for a more diverse financial ecosystem.

- Increase trust and transparency—banking has always been viewed as an obscure world; however, the advent of open banking gives more visibility into how financial data is used and where increasing trust and transparency.

- Greater security—clients hold the power of how their financial data is ultimately used. Unlike before, they now have access and control over their data and third-party usage, leading to better financial outcomes.

Loved reading about the 2023 global consumer lending trends?

Consumer Lending 101: Best PracticesTurn your passion into action. Despite the current market challenges, there couldn’t be a better time to review your strategy for the upcoming years and analyze if your current lending technology solution is truly serving you well enough. Consider whether onboarding new technology, including ones from our consumer lending trends 2023 articles, to help you evolve your business to meet the needs of the upcoming market.