Chances are that you’ve heard the benefits of cloud technology—it allows remote access, data storage costs follow a flexible subscription model, and it delivers almost endless expansion and capabilities for businesses. Despite all these benefits, it’s only in recent years that financial companies have taken notice of the rapidly expanding industry. And this should come as a surprise.

After all, according to estimates, the cloud industry could be worth as much as $1251.09 billion (approx. 1 trillion USD) in the next 7 years—a 19.1% CAGR. To put this in perspective, that’s the entire GDP of a country such as Spain or Australia, or Elon Musk’s estimated soon-to-be net worth.

But just why is cloud banking, and by extension cloud lending, so essential in digital transformation for the financial industry? Let’s take a look at some of the key benefits.

Read also

Why Your Digital Strategy Needs Cloud Lending Solutions

The general benefits of cloud computing for businesses are transparent. They improve efficiency, allow remote working, and promote greater collaboration. However, in the financial technology industry, they could also prove to be one of the greatest shifts that we have seen for a long time. Let’s break it down and explore the three main areas of gain for businesses seeking to onboard cloud banking solutions.

Adds efficiency at almost every level

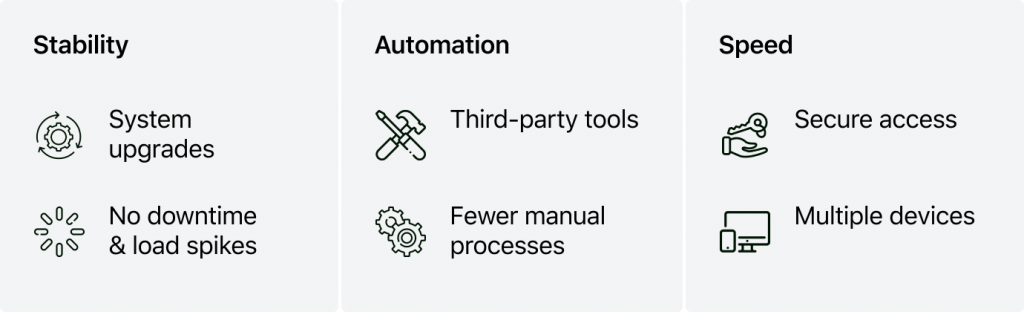

When it comes to lending procedures speed and accuracy are everything. That’s why getting cloud technology on board could make all the difference to who your client chooses to lend from.

- Shortened loan origination & approval times—cloud technology provides secure access where it’s needed most. Not only can users apply for loans via a variety of devices—smartphones, tablets, etc.—in addition, they can get their loan decisions back faster. This is due to the increased connection in the loan origination system, which accesses all the information you need when you need it to give your client a lending decision faster than through traditional methods.

- More automation—cloud computing also empowers your business to explore additional technologies, such as automation. By backing the business with the tools it needs, you can increase efficiency by automating manual processes, such as document management. In addition, it’s all stored on the cloud so you can access the data you need when you need it.

- Updated continuously—Unlike inhouse systems that require meticulous planning and management, cloud systems are managed externally. This means that the third-party provider is responsible for the system's upgrades, ensuring you have the latest technology and safety features at all times. Forget about load spikes, down time, and more, that responsibility now lies on your cloud provider.

Puts security first

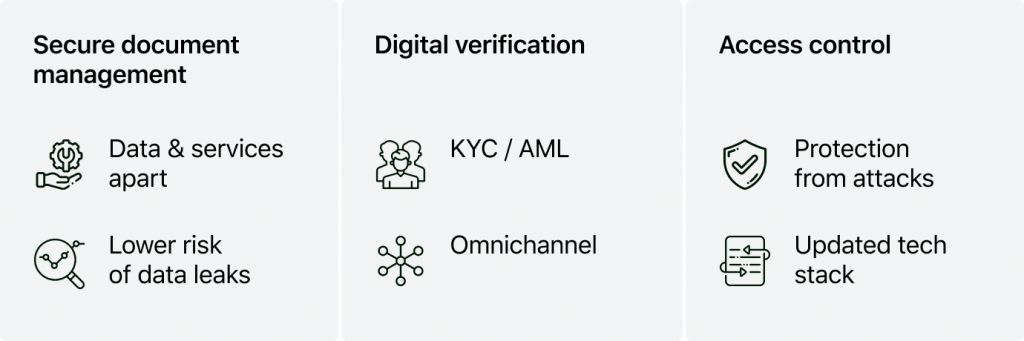

While some may argue that the more connected we are, the more vulnerable we are, that isn’t always the case when it comes to cloud lending. In fact, the added levels of security and verification could be more secure than traditional methods. However, we should note that it would be naïve to believe that cloud is risk-free. Today, cyber-attacks continue to pose a challenge to companies, with 79% of businesses reporting a challenge in the last 1.5 years.

- Adds a layer of safety to the document management process—with cloud computing, it’s likely that your data storage is distributed, and it is this separation that increases its security. By keeping data and services apart, you cut the risk of a singular data leak or issue becoming critical to your business. In addition, you can ensure that you have all the data required to complete the transactions, whether this means a minimum data packet or a complete verification process, being connected to the cloud streamlines the process to ensure efficiency.

- Verification is now digital—no longer do you have to rely on an individual staff member to perform those all-important KYC and AML procedures. Instead, cloud technology offers various types of verification to ensure your client is who they say they are. These can include document checking technology, verification apps, and other privacy and security protocols, put in place to ensure client safety.

- Access control—cloud systems by nature require access to log in. By utilizing the latest technologies, it's possible to protect your cloud system from attacks or fraud by ensuring the right access control procedures are in place in the first place.

Drives customer satisfaction

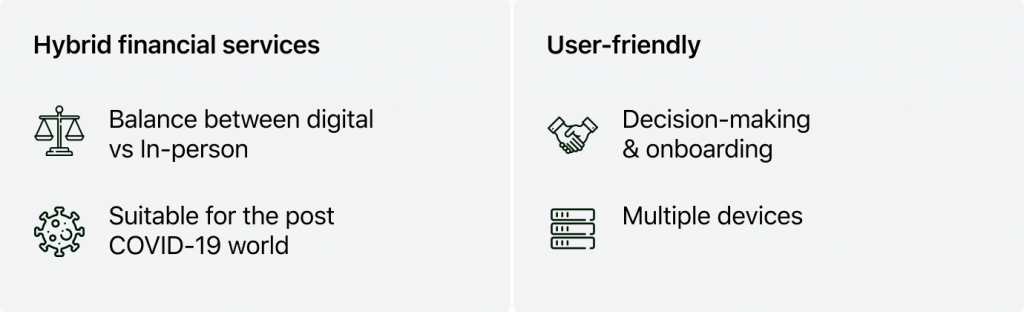

With high competition in the financial industry, the thing that will set you apart from your competitor will come down to the finest details of customer care. Here’s how cloud lending as a service solutions put clients first.

- More user-friendly systems—speed may be key, but so too is efficiency, and your clients value how easy it is to use your service. Cloud technology gives businesses the power to streamline processes and focus on creating a user-friendly experience. For example, cloud technology can aid onboarding by seamlessly processing documents and delivering a decision as soon as possible. Or for example, it can allow for the storage of educational content systems that inform others about all the need to know about lending.

- Ideal for the post-coronavirus world—the coronavirus pandemic truly forced us to rethink how we do business. Instead of in-branch visits, nowadays, we are spoiled for choice in terms of digital financial providers—and this is a good thing. However, companies will need to try harder to win customer loyalty. Cloud lending solutions work by allowing a client to make an application and get a reply wherever they are and no matter their vaccine status. This means your business can excel in providing service in the post covid world.

How to Onboard the Latest Cloud Banking Technology

Staying ahead in the highly competitive financial industry isn’t easy. With fintech service providers increase in number, both new contenders on the market and traditional providers need to ensure that the services they offer meet and exceed consumer demand. That means getting the right technology on board at the right time.

As more and more companies undergo digital transformation in the wake of COVID, it’s becoming ever more vital to develop a robust cloud banking digital strategy that meets clients’ needs now. But before jumping headfirst into digital transformation, it’s vital to follow these top tips:

- Ensure your digital transformation fits closely with your organization’s overall strategic aims. Fail to do so and you could start yourself on the path to failure.

- Consider compliance and security at all steps. As a lending provider, security comes first. That’s why no matter how great a solution might seem, security takes priority.

- Get the right support on hand at the start. Digital transformation can be a tricky process when done without help. Instead, get the right people and team on board in advance to ensure success.

Need to try cloud lending solutions in action? Get in touch with HES FinTech for a free demo tour.