Loan origination software (LOS) helps lenders reduce costs, save time, and improve customer satisfaction. That's why more and more businesses are adopting it instead of relying on outdated loan origination methods.

The market is expected to reach $9.1 billion by 2030, increasing with a CAGR of 10.5% from 2024. The triggers that drive growth include personalization in lending, the spread of AI, the expansion of digital solutions, and other lending trends.

Banks, credit unions, lenders, and other financial institutions use loan management solutions to cover their needs. They might need it to increase the processing speed, to eliminate human errors, or to adapt to the rising market demands. Before choosing a vendor, it is important to determine the "pains" you wish to cover with the software. In this overview, we'll focus on the most attractive features of LOS, give clues on how to choose the right tool according to your company's needs, and offer a list of the most popular solutions in the market.

What Are the Top Loan Origination Software Features?

Loan origination software streamlines the workflow and reduces the risks of errors. And it does so due to the following functionality:

Application processing: LOS provides a possibility to store and process loan applications. The digital onboarding version of the software allows borrowers to submit applications online, eliminating the necessity to manually fill in paper forms. It saves time and reduces mistakes.

Document management: LOS allows lenders and borrowers to store their documents digitally. Therefore, authorized stakeholders can access any files instantly from anywhere. Possibilities like the generation of promissory notes, deeds of trust, and eSign increase customer satisfaction.

Credit decisioning: At this stage, the documents provided by the borrower are saved, and the lender makes a decision regarding their creditworthiness. Different factors and data sources are taken into consideration, such as borrowers' personal data, external data from credit bureaus, or directly from banks, etc. The data is scored either manually in Excel or with a special LOS algorithm, or by AI smart scoring solutions. Additional automatization of the process allows for fast analysis and relevant decision-making.

Compliance with regulations: There are multiple regulations that govern the lending industry. An LOS system is designed to support compliance with regional regulations governing security, accountability, and transparency. Key examples include TILA and RESPA in the United States, and the Consumer Credit Directive (CCD) and GDPR in the European Union. These controls and audits lower the threat of financial penalties and legal challenges.

Reporting and analytics: The software provides lenders with valuable insights regarding application trends and metrics such as pull-through rates, loan volume, abandonment rate, etc. These KPIs help to make data-driven decisions regarding pricing and credit policy, resource allocation, etc.

Integration capabilities: Powerful and modern LOS systems provide integration possibilities. The easier the connection is, the better and more convenient the software is for the lender. Possible integrations might include core banking systems, CRMs, credit bureaus, and document verification services via APIs. It results in fast information exchange and convenient operations.

Credit product management: Modern LOS allows for configuring the lender's entire portfolio of credit products. Administrators may create new loan types, define their specific parameters, such as interest rates (fixed or variable), fee structures, repayment terms, and eligibility criteria, and scale these rules across different channels. This results in rapid product launches and precise targeting of customer segments.

Workflow configuration: This functionality allows lenders to create, customize, and scale the exact journey a loan application follows. Lenders can build workflows by defining rules for tasks like credit scoring, document collection, verification, approval, and funding. The result is a faster, more efficient process that reduces manual handling and shortens turnaround times.

Pricing and terms engine: The feature defines and assigns interest rates, fees, repayment schedules, and other loan conditions for each product. This allows for flexible pricing strategies based on risk and customer profile.

Best Loan Origination Software in 2026

We have compiled a list of the best LOS software providers with the key pros, cons, and ideal use cases. Examine the key facts in the table and find the details below.

HES LoanBox

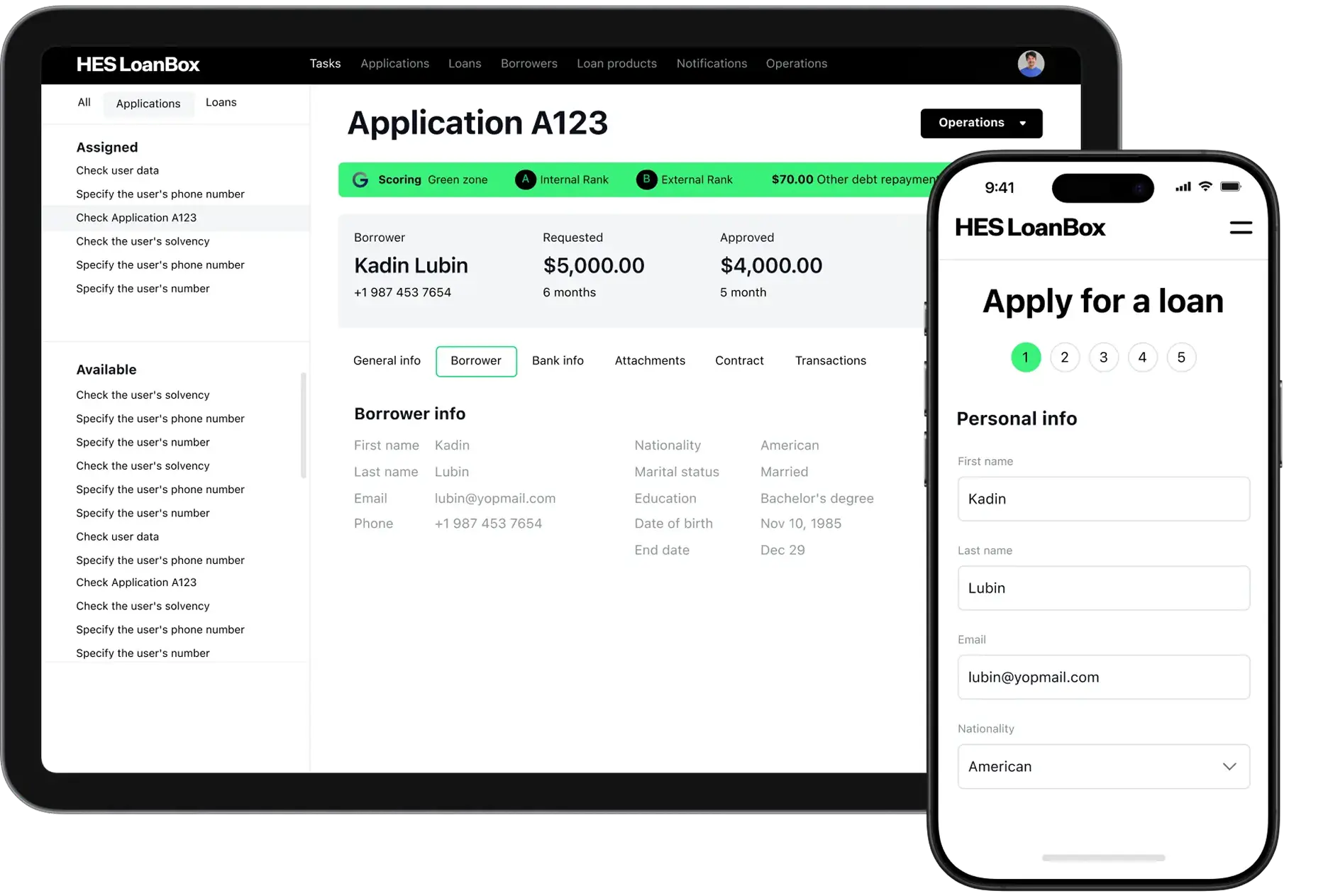

HES LoanBox represents the next generation of intelligent lending technology, transforming loan origination through advanced AI and machine learning.

The platform delivers measurable competitive advantages: processing speed increases by 2.5 times, while decision accuracy improves by 3.5 times compared to traditional systems. Built with bank-grade security and ISO 27001 certification, HES LoanBox ensures enterprise-level data protection and regulatory compliance.

Its modular architecture offers unparalleled flexibility: institutions can implement specific modules to enhance existing infrastructure or deploy a complete end-to-end solution fully customized to their unique processes and workflows. The platform adapts to your business logic, not the other way around.

Built on open-source technologies including Java and Camunda, and others HES LoanBox eliminates vendor lock-in risks and gives customers the opportunity to purchase a developer license.

Main HES LoanBox Features

- Loan origination management: Automate applications, document handling, credit scoring, approval, and disbursement end-to-end.

- AI-powered credit decisioning: Generate real-time risk scores and loan decisions with advanced, customizable AI models.

- Loan servicing module: Manage repayments, rescheduling, delinquency tracking, and automated payment collection within one unified system.

- Configurable product engine: Launch any loan type with flexible terms, interest rates, and repayment schedules through a simple configuration interface.

- Debt collection automation: Maximize recovery with AI-driven communication, predictive analytics, and region-specific compliance support.

- Full customization and flexibility: Adapt every component to your workflows, scoring logic, compliance policies, and user interface preferences.

- BPM workflow automation: Modify and optimize business processes with no-code tools, multi-workflow support, and role-based access control.

- Multi-entity and multi-currency: Manage multiple legal entities, currencies, and jurisdictions from a single platform instance.

- Extensive integrations ecosystem: Connect with 100+ APIs, data providers, CRMs, payment gateways, and internal business systems.

- White-label digital suite: Deliver a branded borrower portal, landing page, and back office tailored to your corporate identity.

- Security and regulatory compliance: Enterprise-grade security framework ensuring complete data protection and regulatory compliance. HES LoanBox is ISO 27001 certified and supports KYC/KYB procedures. The platform employs advanced encryption, access control, and secure audit trails to safeguard sensitive financial data across both cloud and on-premise deployments.

- Modular achitecture: Implement specific modules independently or deploy the full end-to-end solution, customized to your organization's unique processes and infrastructure.

- Real-time analytics: Track KPIs, loan performance, and portfolio metrics through interactive dashboards and BI integrations

Ideal for: Lenders that search for a robust end-to-end solution that is still flexible for customization at every step according to their needs and wish to improve loan origination with AI.

Main pros: End-to-end lending cycle automation, full customization freedom, support for all loan types (from consumer lending to commercial finance), and a robust AI-powered predictive model that optimizes every stage of loan origination.

Cons: May be complex to implement in case a client needs an extensive feature set.

What users say: Reviews on Capterra consistently praise HES LoanBox as "real turn key out of the box solution" with exceptional ease of configuration and integration capabilities. Users on G2 highlight the platform's flexibility, noting it allows extensive customization including multi-entity, multi-currency support, and connections with local banks and data vendors. On Capterra, a Head of Technology with 2+ years of experience emphasizes the importance of the platform being "Simple, Helpful and Clear" while remaining proportionate for their needs.

Free trial: available

Price: upon request. Fixed subscription (no limits on users, products, or applications).

Notable clients: ID Finance (unicorn), Fintuinity, Wa'ed, Alraedah, etc.

Lendr

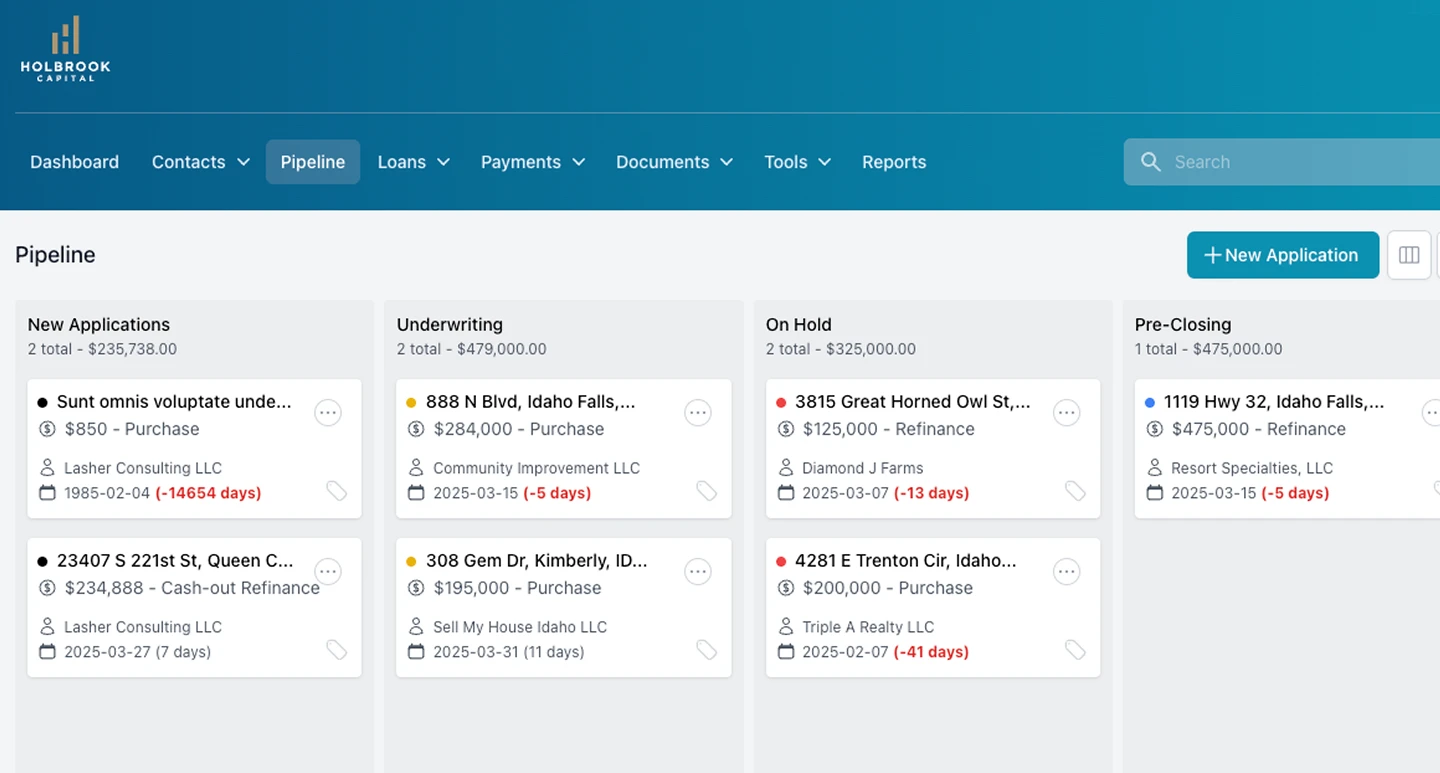

Lendr is a specialized loan origination and servicing platform designed for private and hard money lenders. It focuses on the specific needs of this niche—managing investors, tracking capital, and servicing loans such as fix-and-flip or rental property financing. The platform supports the full loan lifecycle, from origination and underwriting to servicing and payoff, with dedicated borrower and investor portals providing transparency and real-time visibility into loan and portfolio performance.

Key Features:

- Dashboard pipeline view: Visual pipeline for tracking loans through all stages—from application to closing—using an intuitive drag-and-drop interface.

- Loan origination workflows: Streamlined application management, document handling, and underwriting within a unified environment.

- Investor portal: Secure access for lenders and investors to monitor deals, view earnings, and analyze portfolio performance.

- Automated payments: ACH-based payment processing with integrated tracking and reporting.

- Dynamic document generation: Automated creation of loan documents, payoff statements, and investor reports.

- Borrower portal: Self-service borrower interface for checking application status, payments, and loan details.

- AI-enhanced automation: Built-in AI tools to reduce manual tasks in origination and servicing workflows.

Pros: Purpose-built for private and hard money lending; strong investor management tools; combines origination and servicing in one system.

Cons: Not designed for traditional consumer or conventional mortgage lending.

Ideal for: Private lenders, hard money lenders, and real estate investors managing loans or investor capital.

What users say: According to reviews on G2 and Capterra, Lendr is "super straightforward" and "does everything you need right out of the box." Users note that the platform makes the lending process seamless from first contact to final payoff, with major workflow improvements compared to manual tools. Customer support receives consistent praise for responsiveness and onboarding assistance.

Free trial: not publicly available

Price: from $1000/month

Get your free lending product estimate.

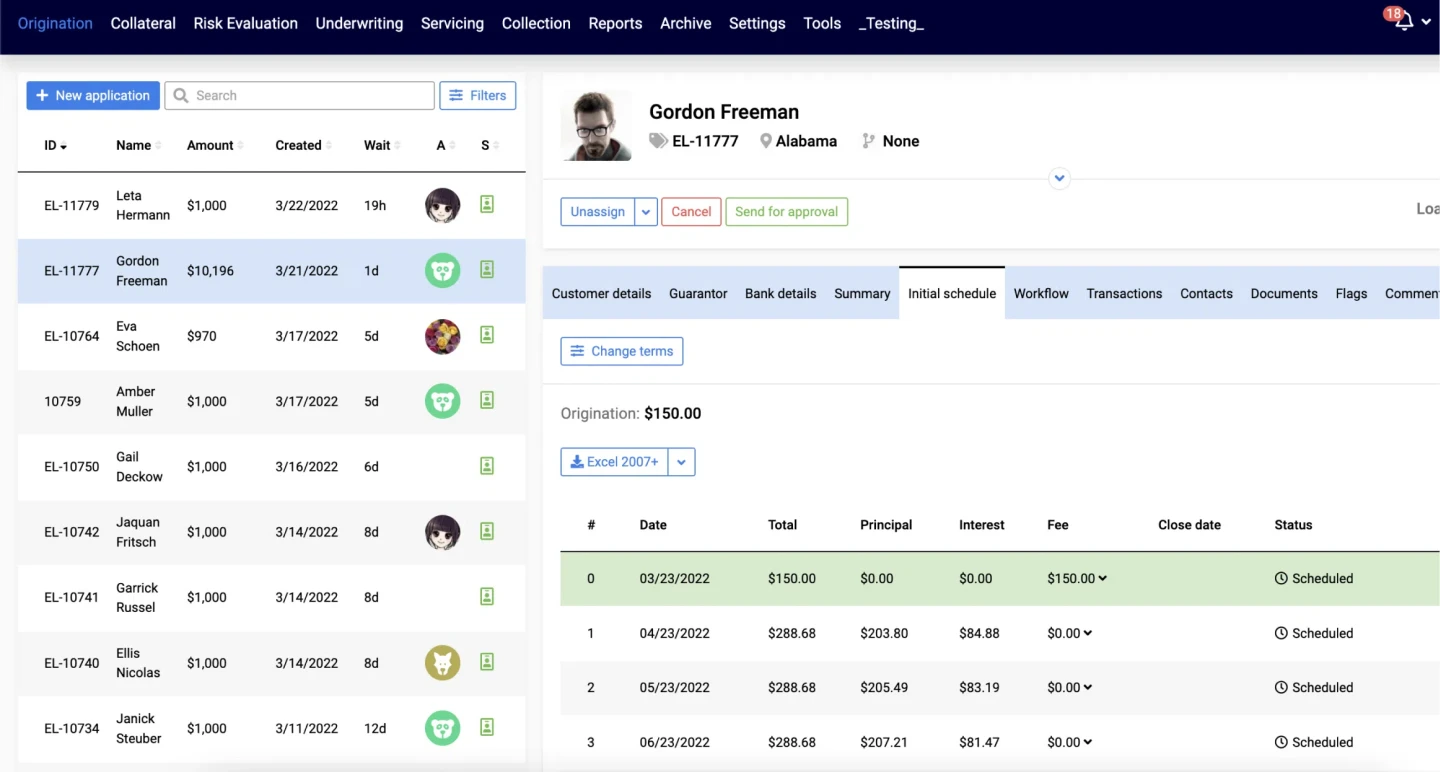

TurnKey Lender

TurnKey Lender is a global, AI-powered lending automation platform that supports the full lending lifecycle—from origination and underwriting to servicing and collections. The company states that it serves clients in over 50 countries and integrates AI-driven decisioning, configurable workflows, document management, and collection strategies.

Key Capabilities:

- AI-based decision engine using neural networks and alternative / conventional data

- Configurable loan application flows with document templates and custom fields

- Modular servicing and collection tools with configurable collection strategies

- APIs and integrations for credit bureaus, payment systems, verification services

- Interfaces for borrowers and back-office users with dynamic workflows

- Support for multi-product lending (consumer, commercial, embedded finance, etc.)

Pros: Powerful automation and configurability; broad international reach; robust decisioning and collection modules.

Cons: Customizations may incur higher cost; initial implementation can be complex; UI and terminology may require localization.

Ideal for: Global financial institutions, online lenders, and credit unions looking for a sophisticated, AI-driven platform that can scale internationally.

What users say: Users on review platforms emphasize TurnKey Lender's flexibility in launching new credit products "very easily", strong API support, and responsive teams. However, some report early-stage glitches and occasional limitations in document automation.

Free trial: not publicly available

Price: upon request

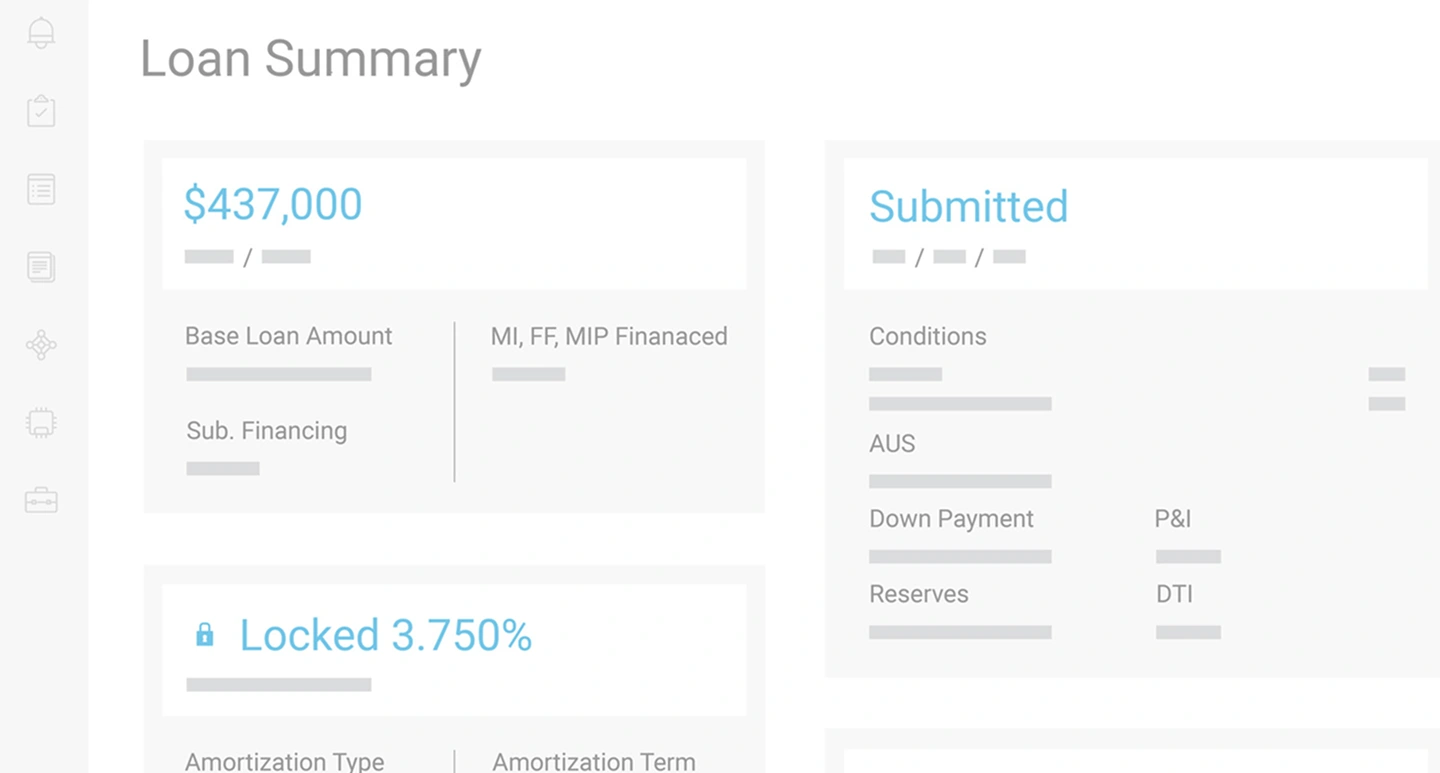

Encompass by ICE Mortgage Technology

Encompass is one of the most widely adopted mortgage loan origination systems (LOS) in the U.S., developed by ICE Mortgage Technology (formerly Ellie Mae). It provides a comprehensive platform for managing the full mortgage lifecycle — from initial borrower application and underwriting to closing and post-closing investor delivery. The system integrates seamlessly with the ICE ecosystem, including product and pricing engines, document management tools, and eClose solutions. Encompass is recognized for its strong compliance coverage, extensive partner network, and enterprise-level scalability, making it a cornerstone solution for many mortgage banks and credit unions.

Key Features:

- End-to-end workflow automation: Centralized loan management from origination to investor delivery.

- ICE Partner network: 500+ verified integrations with credit, appraisal, and title vendors.

- ICE PPE: Real-time rate quoting and best-execution pricing analysis.

- eClose functionality: Full digital closing with eSign, eNote, and MERS eRegistry support.

- Compliance engine: TRID, HMDA, and RESPA checks with real-time updates.

- Borrower portal: Online applications, document upload, and secure messaging.

- Document management: Intelligent document recognition and data extraction.

- Pipeline and analytics tools: Dashboards for loan tracking, profitability, and pipeline health.

Pros: Industry-leading LOS with robust compliance, extensive integrations, and high scalability.

Cons: Expensive and complex to implement; potential vendor lock-in; users report dated UI and slower performance under heavy loads.

Ideal for: Mid- to large-size lenders, mortgage banks, and credit unions needing a unified, compliant, and scalable LOS.

What users say: Reviewers on Capterra and G2 describe Encompass as "a solid, all-in-one tool for mortgage origination." Users appreciate the extensive functionality and integrations but mention the "antiquated interface" and "steep learning curve." Once mastered, it is considered the most capable LOS in the mortgage industry.

Free trial: not publicly available

Price: upon request

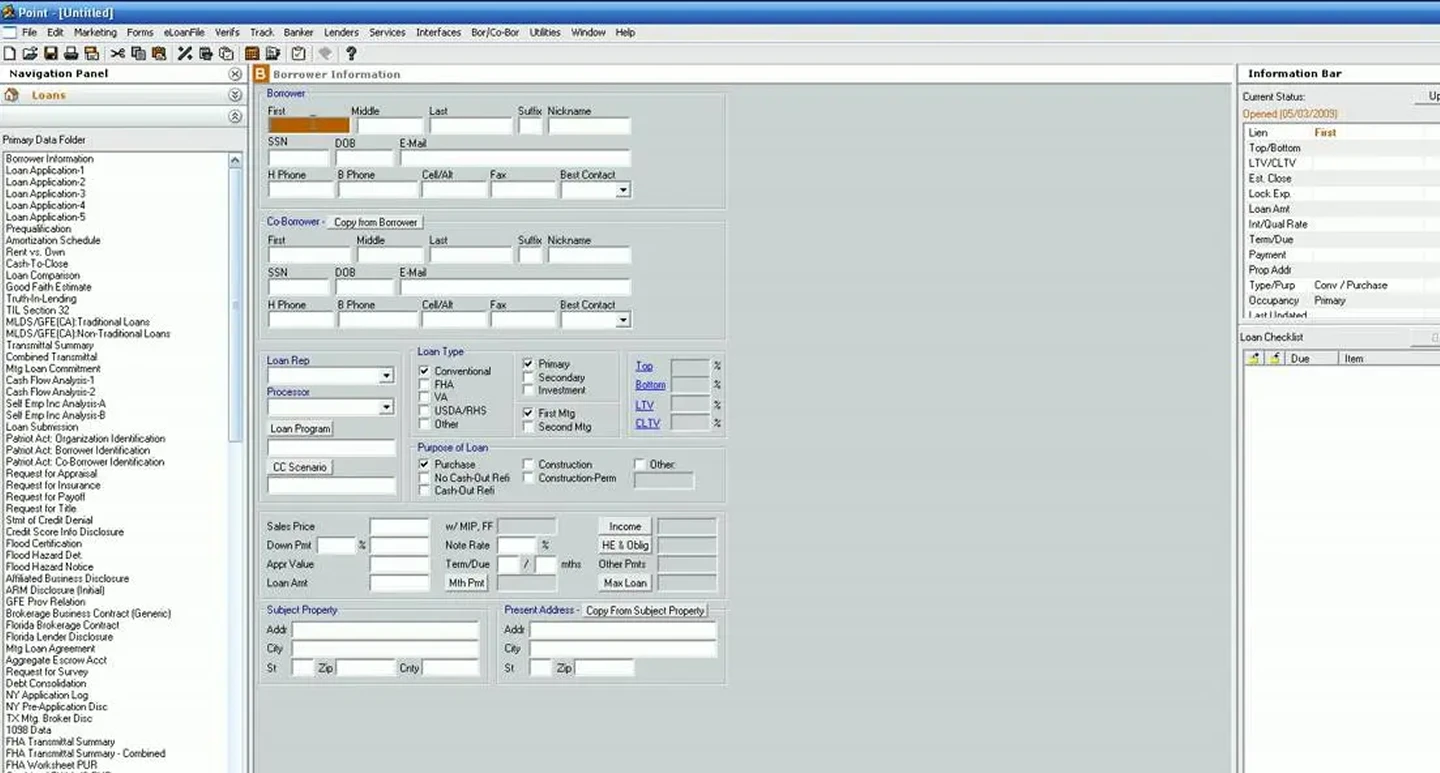

Calyx Point

Calyx Point is a long-established LOS built specifically for mortgage brokers and small lenders. With over three decades of market presence, Calyx focuses on affordability, reliability, and compliance for residential mortgage origination. The platform offers both on-premises (desktop) and cloud-based (PointCentral) deployment options, allowing flexibility for different operational models. Calyx's ecosystem, including Calyx Zip and Calyx Path, enables digital borrower onboarding, eSign, and direct submission to wholesale lenders. Its large network of integrations with credit bureaus, appraisal and title vendors makes it a popular choice among independent brokers.

Key Features:

- Deployment options: Local (Point) or cloud (PointCentral) with centralized data.

- Integrations: 200+ partners across credit, appraisal, and title services.

- Workflow configuration: Customizable processes per branch or user role.

- Compliance management: Automated federal and state form updates (TRID, HMDA).

- Calyx Zip: Web-based borrower application and document submission.

- Document generation: Automated disclosures and closing documents.

- Pipeline management: Loan tracking with task assignment and progress indicators.

Pros: Proven reliability and compliance; flexible workflows; cloud and desktop options.

Cons: Dated interface and user experience; slower customer support; limited multi-product lending capability.

Ideal for: Independent mortgage brokers and smaller lenders needing a stable, mortgage-specific LOS.

What users say: Capterra users call Calyx Point "complete and reliable," appreciating its affordability and integration network. However, many reviewers note "the UI feels stuck in the 2000s" and that support can be slow to respond. Despite its look, users praise its consistency and compliance accuracy.

Free trial: not publicly available

Price: upon request

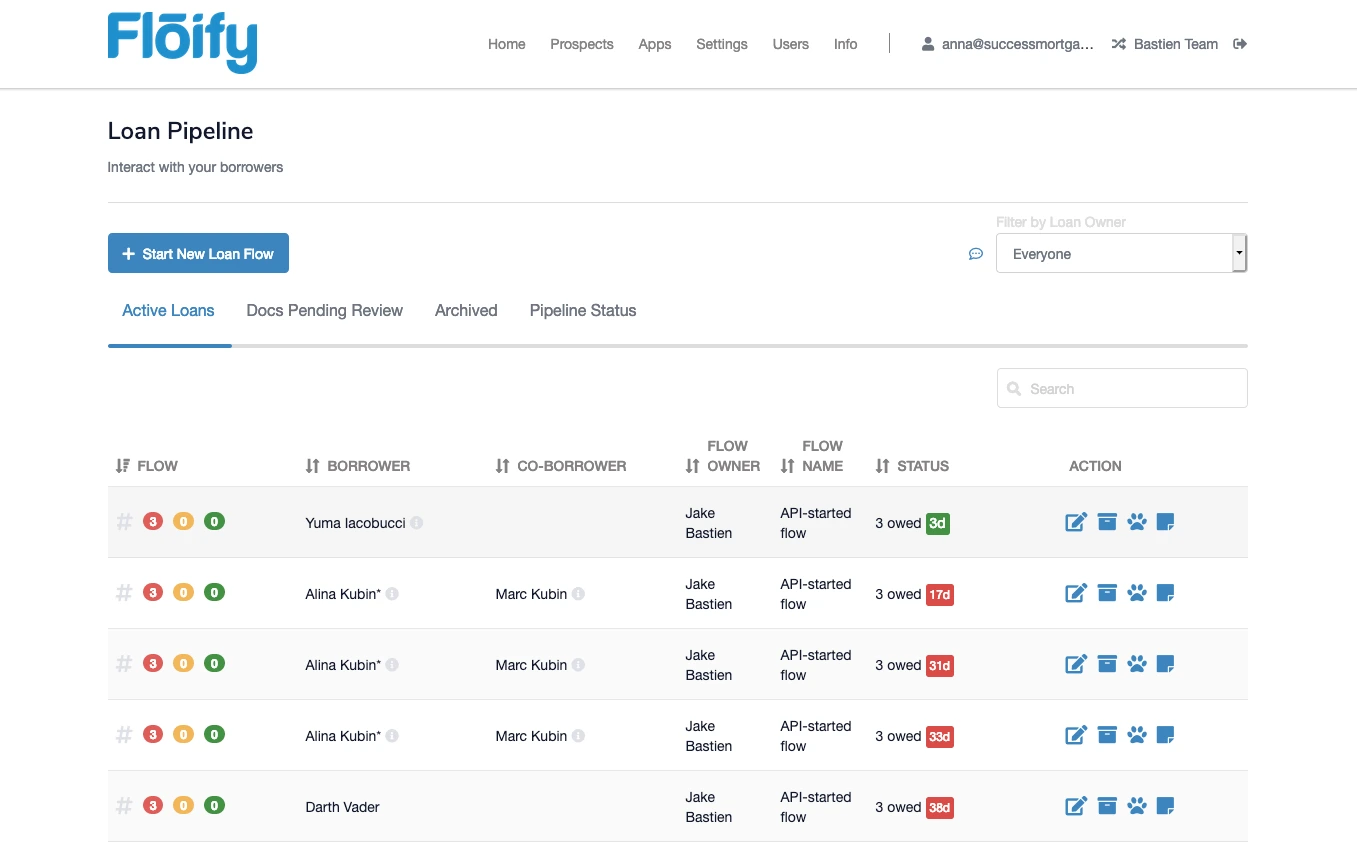

Floify

Floify is a modern point solution that optimizes borrower communication and document collection in the mortgage origination process. It is designed to complement — not replace — a lender's LOS by integrating directly with systems like Encompass, Calyx, and LendingPad. Floify's borrower portal allows users to securely upload documents, track loan progress, and receive automated notifications, reducing manual follow-up for loan officers. The platform is widely recognized for improving borrower experience and operational efficiency.

Key Features:

- Borrower portal: White-labeled, secure interface for uploading documents and monitoring loan progress.

- Automated notifications: SMS and email reminders for outstanding tasks.

- Document management: Real-time status tracking and organization of borrower files.

- LOS integrations: Native connectivity with major LOS platforms.

- Pre-approval letter tools: Generate and share custom pre-approval letters.

- Mobile accessibility: Full functionality via mobile browsers and apps.

Pros: Excellent borrower experience; reduces manual communication; easy integration with major LOS systems.

Cons: Not a full LOS; limited to document and communication management; feature pricing can scale with volume.

Ideal for: Mortgage brokers and lenders looking to streamline borrower interactions and document collection.

What users say: Floify users highlight its simplicity and impact on efficiency — "It saves hours of follow-up time." Reviews consistently praise its responsive support and intuitive interface, with both borrowers and loan officers calling it "a huge time-saver."

Free trial: available

Price: upon request

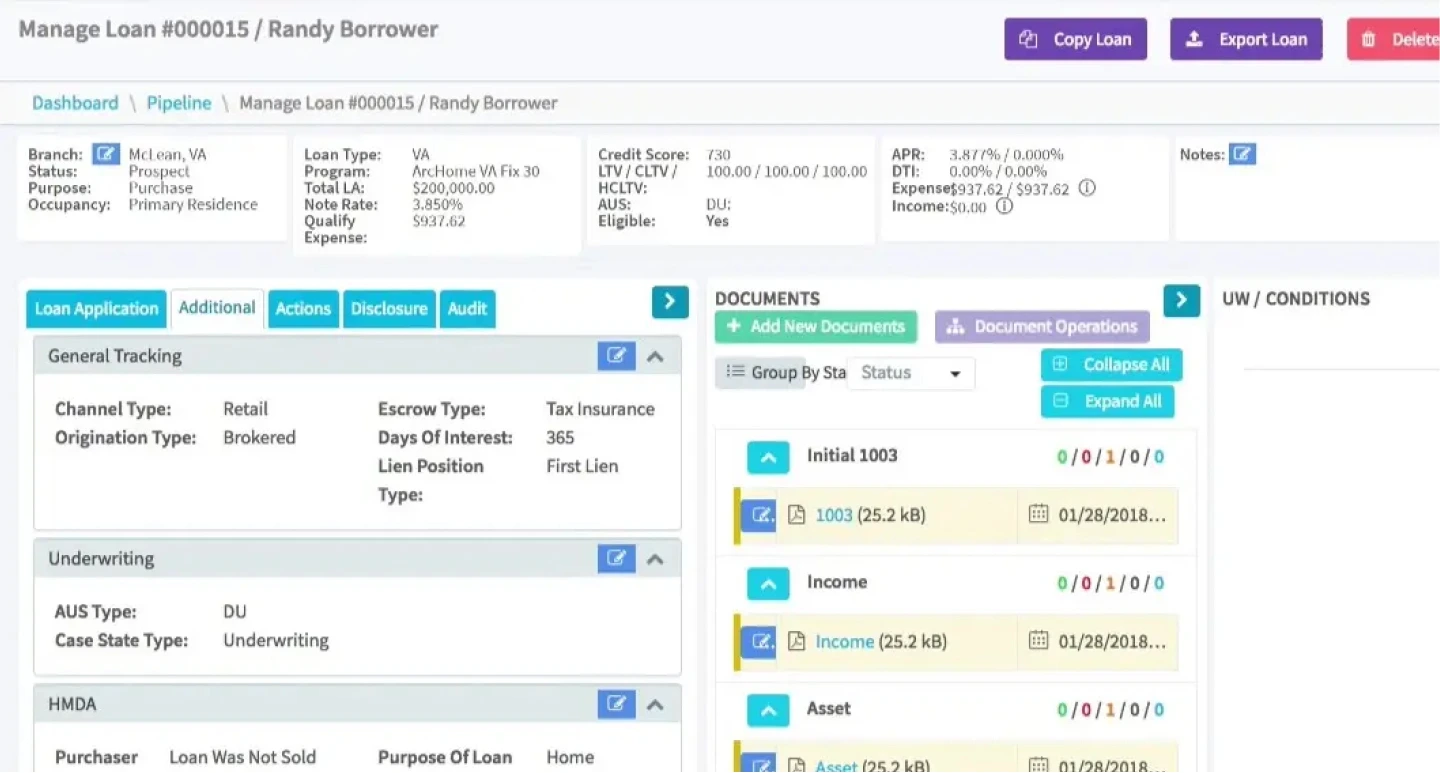

LendingPad

LendingPad is a cloud-native mortgage LOS developed in 2015 to modernize lending workflows through real-time collaboration and accessibility. The platform supports retail, wholesale, and correspondent lending, allowing multiple users to work simultaneously on the same loan file. LendingPad offers an integrated CRM, automated compliance tracking, and seamless integrations with credit bureaus, appraisal services, and title companies. It is known for its affordability and modern design compared to legacy systems like Calyx Point.

Key Features:

- Real-time collaboration: Multiple users editing the same loan simultaneously.

- Cloud architecture: 100% web-based platform accessible from any device.

- Integrated CRM: Built-in lead and campaign management.

- Compliance tracking: Automated QM and disclosure management.

- Third-party integrations: Credit, appraisal, and title connectivity.

- Document management: Secure cloud storage and e-signature support.

- Live pipeline dashboard: Real-time loan updates and notifications.

Pros: Modern, user-friendly interface; strong collaboration tools; cost-effective pricing; built-in CRM.

Cons: Some reports of non-automated disclosures; slower customer support response; limited document automation.

Ideal for: Mortgage lenders and brokers seeking a collaborative, cloud-based LOS with lower total cost of ownership.

What users say: Users on G2 and Capterra describe LendingPad as "intuitive, easy to use, and affordable." Many highlight its responsive support team and say it "modernized our workflow overnight." Some note minor delays in automation features but appreciate its constant product updates and real-time collaboration.

Free trial: not publicly available

Price: upon request

Originate / Mortgagebot by Finastra

Mortgagebot, part of Finastra's Originate suite, is an enterprise-grade, cloud-based mortgage origination platform tailored for banks and credit unions. It supports omnichannel loan applications through web, mobile, branch, and call center channels, offering deep integration with core banking and servicing systems. Mortgagebot automates disclosure generation, underwriting workflows, and post-closing operations. It is recognized for its compliance-first design, scalability, and alignment with Finastra's broader financial ecosystem.

Key features:

- Mortgagebot POS: Omnichannel point-of-sale for digital applications.

- Mortgagebot LOS: Integrated system for retail, wholesale, and correspondent lending.

- Automated disclosures: Compliance automation for early disclosures and approvals.

- Workflow automation: Rules-based decisioning and task routing.

- Core banking integration: Direct connectivity with Finastra's core platforms.

- Document management: Digital document exchange and e-signatures.

- Analytics and benchmarking: Performance comparison across 1,000+ institutions.

Pros: Deep core banking integration; enterprise-level compliance and scalability; robust analytics and security.

Cons: High implementation cost; lengthy deployment; less flexibility for non-standard lending models.

Ideal for: Large financial institutions and banks needing enterprise integration and compliance-driven lending.

What users say: Capterra reviewers note that Mortgagebot "improves operational efficiency and compliance readiness." Banks report reduced origination cycle times and appreciate the benchmarking capabilities against peer institutions. Users praise its stability and integration depth but mention long onboarding and customization timelines.

Free trial: not publicly available

Price: upon request

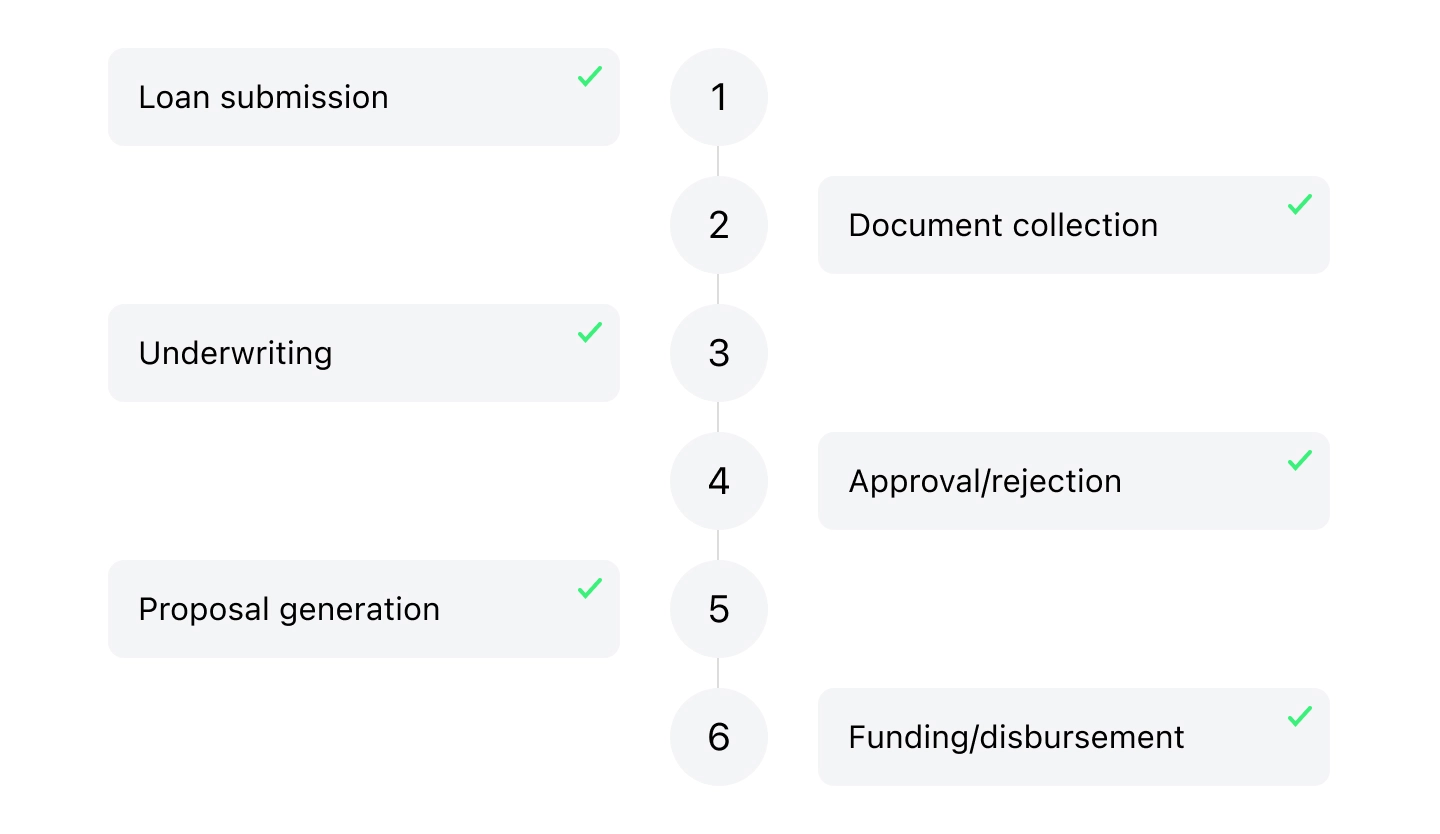

What Is Loan Origination Software?

The loan origination software allows for handling and monitoring the required steps and actions of the loan origination process. It might be limited to closing tasks related to loan origination itself, or it can be more extensive, turning into an end-to-end solution that also deals with loan servicing.

It covers some or all of the following stages:

- Loan submission

- Document collection

- Underwriting

- Application approval/rejection

- Proposal generation

- Funding/disbursement

How to Choose the Best Solution?

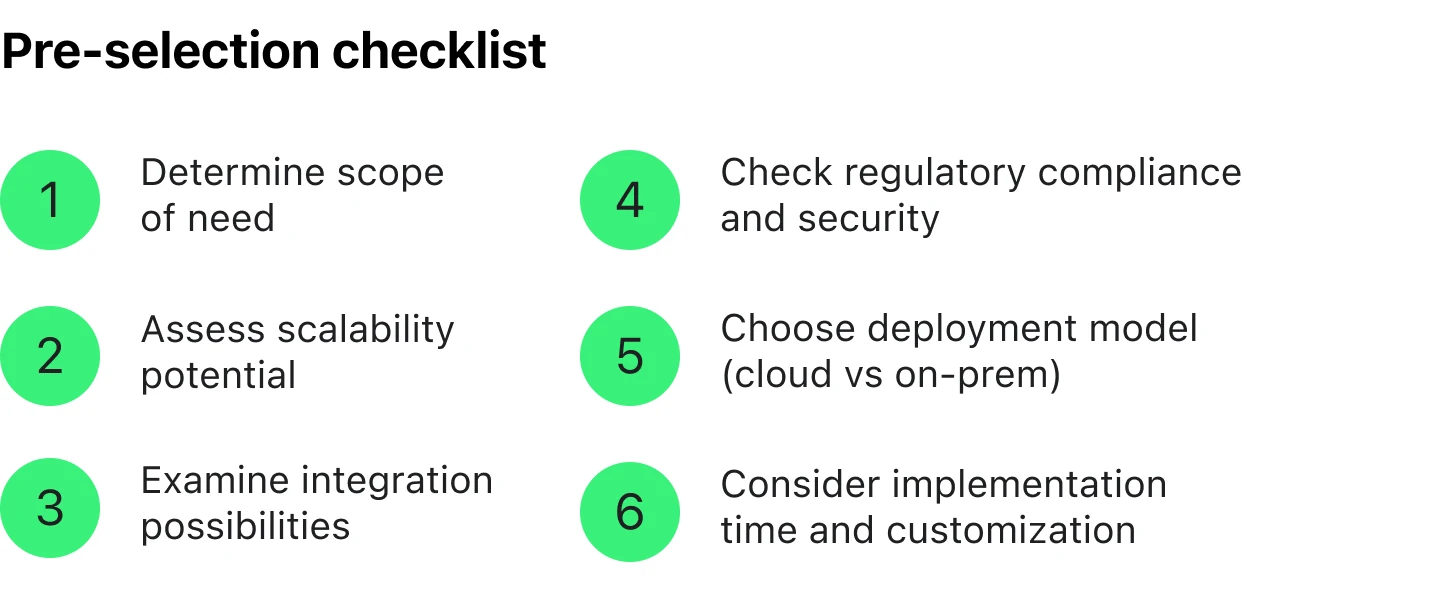

The LOS vendors mentioned on our list differ in size, experience, scope of functionality, and pricing. Before plunging into any digital transformation, it is recommended to develop a roadmap that will navigate the choice of an appropriate solution.

- Determine the scope of need. Do you need a system for the entire mortgage process, or do you need to solve specific tasks, such as document generation or compliance?

- Choose the deployment model. Do you require easy accessibility and updates of a cloud-based platform, or does your enterprise have specific security and control requirements that demand on-premise servers?

- Consider the implementation time and customization capabilities. Do you need to reduce time-to-market and allow for easy tailoring without extensive developer resources? Low-code/no-code platforms might be a solution. Another option is implementing white-label tools that offer brands a seamless customer experience at a relatively low cost.

- Assess the scalability potential. Can the system grow with your loan volume and adapt to new products?

- Examine the integration possibilities. Does the new software connect with your existing systems (core banking, CRM, etc.)?

- Check the regulatory compliance and security measures. Does it have built-in compliance checks and robust data encryption to protect client data and eliminate breaches?

Here's the thing most vendors won't tell you: the "best" LOS isn't always the most feature-rich or the most expensive one. It's the one that actually fits how your team works.

What Are the Key Benefits of Using Loan Origination Software?

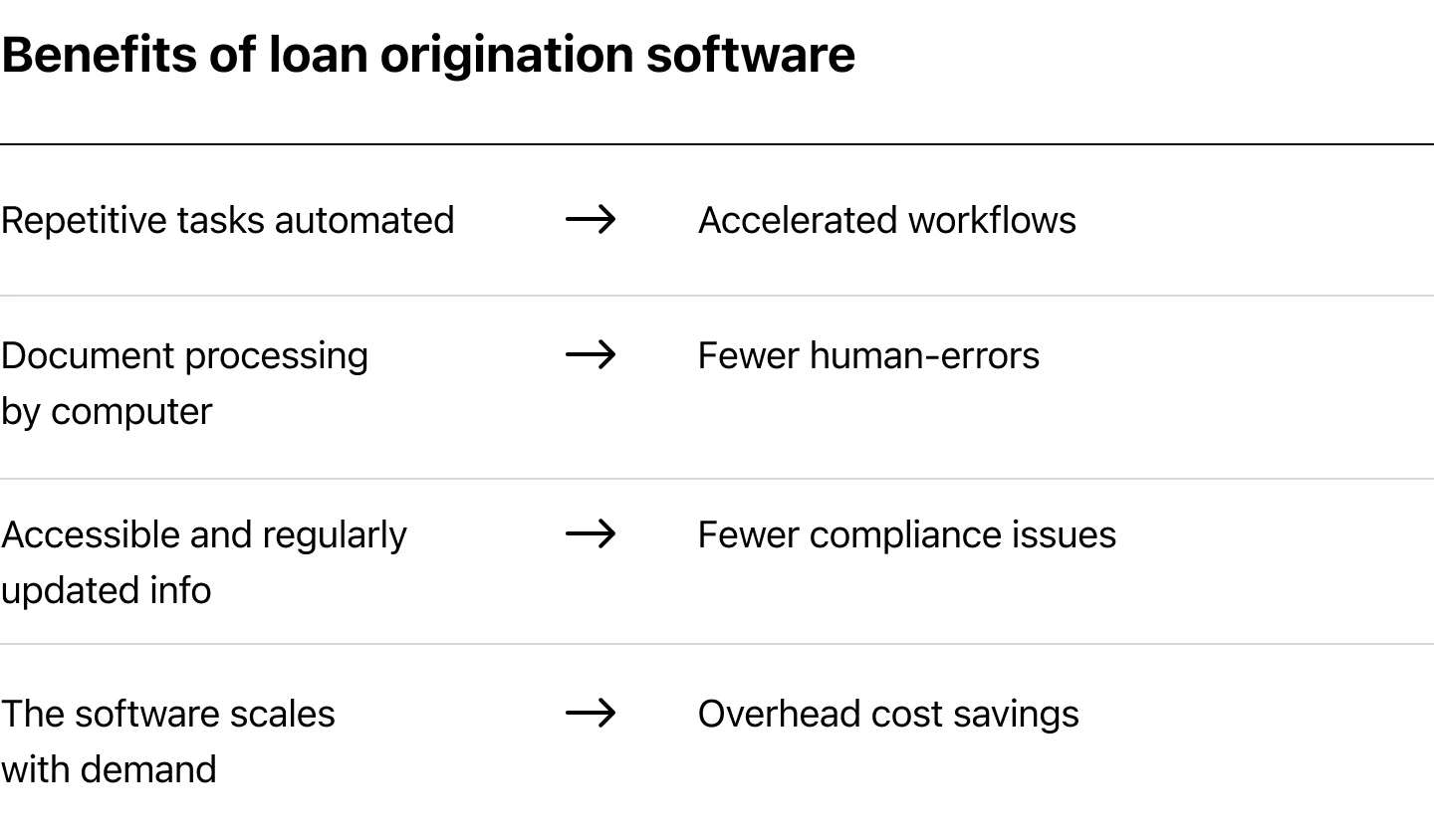

Lenders that implement LOS mention the following key improvements in their lending operations:

- Repetitive tasks are performed automatically, which results in accelerated workflows.

- A computer program deals with document processing, eliminating the human factor and reducing errors.

- All the information is easily accessible and regularly updated, which minimizes the risk of compliance issues.

- The software scales in accordance with the market demands, saving overhead costs.

How Do You Know It's The Best Loan Origination Platform for YOUR Company?

Run this quick test before making a decision:

The 30-day reality check.

Ask yourself: can your team realistically go live in 30-60-90 days? If the vendor is talking about 6-month implementations for a standard setup, that's a red flag. Modern platforms should get you up and running fast.

Now, let's be realistic here—if you're running a complex, multi-country operation with dozens of custom loan products and legacy system integrations, yes, you're looking at 6+ months of customization work. That's just the nature of enterprise complexity. But we're talking about standard lending needs here: basic loan origination, underwriting workflows, and servicing. For those core functions, a modern platform shouldn't need half a year to go live. If a vendor needs 6 months to set up a basic consumer lending flow, they're either over-engineering it or their platform isn't as flexible as they claim.

The Monday morning test. Imagine it's Monday. Your loan officer just got back from vacation and needs to process an application. If they need to open 5 different systems or call IT for help, the platform fails. Good LOS should feel intuitive, not like rocket science.

The growth test. You're processing 500 loans a month now. What happens when that becomes 5,000? Ask vendors point-blank: "What breaks first when volume spikes?" Their answer tells you everything about scalability.

The real cost test. Add up everything: licensing, implementation, training, maintenance, and those "small" customization fees that pop up later. Then divide by your monthly loan volume. If the math doesn't make sense, walk away.

The support test. Something breaks at 9 PM on a Friday (because of course it does). Can you actually reach someone who can help, or are you stuck until Monday? Test their support response during the sales process—it only gets worse after you sign.

The exit test. I know, you're just getting started. But ask anyway: "How easy is it to export our data if we leave?" If they get uncomfortable or vague, you're looking at vendor lock-in. Your data should always be portable.

Look, here's what I've seen work: Stop chasing features you'll never use. Instead, write down the 3 biggest pain points in your current process. Then ask each vendor: "Show me exactly how your platform solves THIS." If they start showing generic demos instead of addressing your specific problems, move on.

The right loan origination platform should feel like it was built for how you actually work, not how some product manager thought lending should work.

Conclusion

A fintech lender choosing the best loan origination software is like a head chef choosing a knife set. The right choice is an extension of their skill and directly determines the quality of their services. The wrong choice, however, leads to wasted effort, complicated processes, and ultimately, higher costs.

An appropriate LOS increases efficiency and ROI, saves operational time, and customizes workflows. The loan origination software comparison allows businesses to evaluate a diverse range of solutions, from full-scale, end-to-end platforms to customizable tools for specific tasks.

Key differentiators in 2026 include the rise of low-code customization, AI-powered underwriting, and the importance of seamless integration. By carefully assessing their specific needs against the features, pros, and cons of top providers, lenders can implement a system that not only streamlines operations but also drives growth, mitigates risk, and ensures long-term competitiveness in the financial landscape.