This article aims to shed light on Banking-as-a-Service operational framework, key benefits, and the immense potential it holds for startups looking to disrupt traditional banking paradigms without the burden of regulatory and infrastructural constraints.

What Is Banking-as-a-Service?

The BaaS (Banking-as-a-Service) business model refers to a scenario in which banks that possess the necessary licenses for banking operations integrate their digital services into products developed by non-banking companies. Through this model, a non-banking institution can offer digital banking services such as loans, cards, and mobile banking to their customers without the hassle of obtaining a banking license.

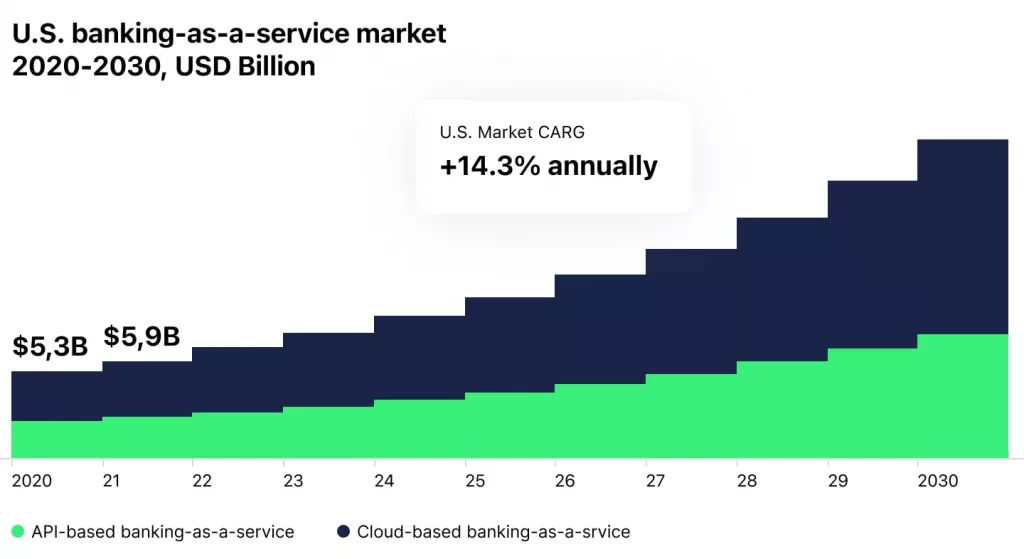

With the advent of online banking, businesses are exploring more customer-friendly and superior methods to deliver banking services and products. Gartner predicts that by the end of 2024, 30% of banks with assets exceeding $1 billion will adopt the BaaS model to seize new revenue opportunities. Furthermore, the market size for BaaS is expected to expand at a CAGR of 16.2% through to 2030.

Let us have a look at some top examples of the Banking-as-a-Service model.

Examples of Businesses Embracing BaaS Model

In this section, we explore several exemplary businesses that have embraced the BaaS model, highlighting how they leverage this approach to redefine banking services. From Solarisbank's comprehensive API-driven solutions across Europe to Synapse's facilitation of banking integration in products, and BBVA's Open Platform that aids financial startups in scaling innovative products, each case study showcases the potential and diversity of BaaS applications.

1. Solarisbank

Solarisbank, a pan-European leader in the Banking-as-a-Service (BaaS) business model, offers a versatile platform that enables businesses to seamlessly provide banking services. Through its APIs and modular solutions, Solarisbank allows companies to integrate banking functionalities into their products, fostering innovation in fintech, e-commerce, and beyond. With Solarisbank handling compliance and regulatory frameworks, partners can concentrate on delivering customized financial solutions and tapping into a robust infrastructure.

The rise of embedded finance is transforming how financial services interact with customers. Solarisbank, in collaboration with the Handelsblatt Research Institute, conducted a study revealing that 61.4% of respondents from a sample of two thousand were open to receiving financial services from online platforms. This integration of banking services with non-banking companies is poised to yield beneficial outcomes for all parties involved.

2. Synapse

Synapse is another banking-as-a-service business that enables companies to integrate several banking services into their products without any hassle. The platform empowers companies to develop premium products while navigating the complexities associated with banking relationships, compliance, identity management, licensing, and more. It offers customization of services tailored to the size and requirements of your business, providing the flexibility needed to scale and expand. Currently, Synapse supports 18 million end-users and manages 91 million transactions annually.

3. BBVA Open Platform

BBVA's Open Platform provides fintech startups with a suite of tools and APIs to build and scale innovative products. Rising financial startups can integrate banking functionalities into their solutions, ranging from payments and account management to lending and risk assessment by leveraging BBVA's infrastructure and expertise.

The platform offers flexibility and customization, and empowers startups to create tailored experiences for their customers while adhering to regulatory standards. With BBVA's support, financial startups can accelerate their growth, enhance customer engagement, and navigate the complexities of the financial landscape with confidence.

4. Railsbank

As a fintech startup aiming to deliver high-quality banking services with an excellent user experience, handling the technical complexities of banking processes can be daunting. Railsbank simplifies this challenge with a suite of wallet and banking components that can be easily integrated to enhance your functionality.

Recently, Railsbank announced it has secured $37 million in equity funding to broaden its presence in the US market. With the launch of its API, the platform is positioned to enable banks to provide digital services to companies at a low cost, while minimizing compliance risk—a critical advantage for burgeoning startups.

Benefits of BaaS Business Model

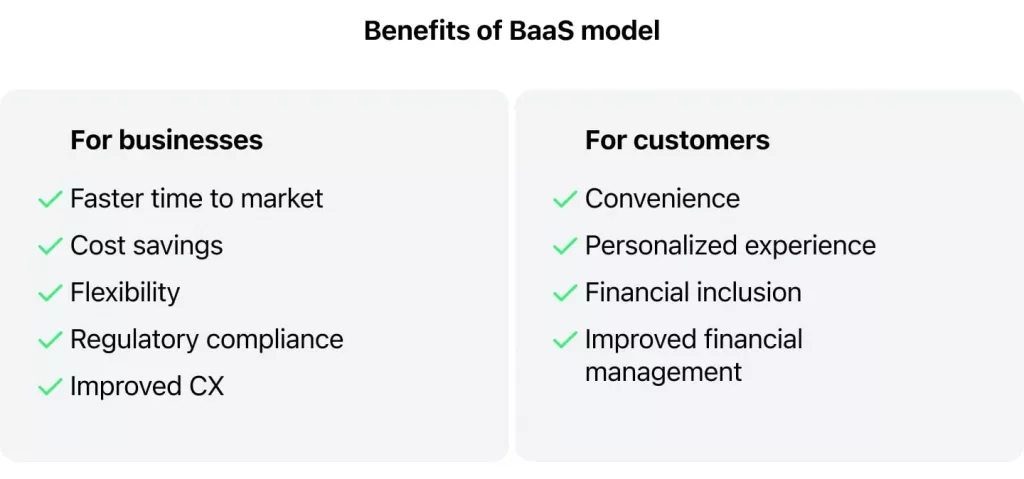

With its promise of speed, efficiency, and flexibility, BaaS has become the secret weapon for fintech entrepreneurs determined to disrupt traditional banking paradigms. In the sections that follow, we dive into the core advantages of adopting BaaS.

Revolutionizing Speed to Market with BaaS

In the race to disrupt financial markets, startups are leveraging Banking-as-a-Service to turbocharge their journey from concept to launch. Instead of the hefty task of starting from scratch, these companies are hooking into pre-built banking solutions, cutting down on both the time and expenses usually needed to get off the ground.

Unlocking Cost Efficiency for Fintech Innovators

For fintech startups, every dollar saved is a dollar that can fuel further innovation. BaaS eradicates the expenses tied to traditional banking infrastructures. By tapping into the power of BaaS platforms, startups are not just trimming down initial investments but are also optimizing operational costs, enabling them to pour resources into what truly matters—breaking new ground and scaling new heights.

Empowering Startups with Flexibility

The BaaS model is redefining agility in financial services. Offering a palette of modular and tailorable solutions, it allows startups to mix, match, and mold banking functionalities to their unique visions. This level of adaptability accelerates product development and fine-tunes market fit, giving startups the agility to navigate and thrive in a rapidly evolving financial landscape.

Navigating the Regulatory Maze with Ease

In a domain as tightly controlled as finance, navigating the labyrinth of regulations is a formidable challenge for startups. BaaS platforms step in as navigators, shouldering the complexities of regulatory compliance. This support system enables startups to launch boldly and scale wisely, minimizing legal hurdles and cementing trust among consumers and regulators alike.

Redefining CX in Fintech

Imagine banking services so seamless, customers can access them with the mere tap of a finger—no hoops, no hurdles. BaaS is turning this vision into reality, enabling fintech startups to offer streamlined, hassle-free banking experiences. This revolution in customer service not only deepens loyalty but also sets the stage for exponential growth, proving that in the world of fintech, a great user experience is the ultimate currency.

Conclusion

Till now, you’ll be familiar with the top examples of Banking-as-a-Service and the perks of the new model. If you’re looking to adopt the banking services into your existing structure without any complex hassle, you can opt for HES Fintech services. Reach out to us today for a complimentary demo, where you'll gain comprehensive insights and detailed information about our expertise.