Products

Solutions

Company

About us

Say Yes to HES

About us

Say Yes to HES

Our vision

In 2012, we launched HES to close the gap between legacy lending and modern technology. Our cloud-native platform equips banks, credit unions, and fintech unicorns with end-to-end lending software that modernizes operations without discarding the existing data.

HES FinTech unifies origination, underwriting, servicing, and analytics in one stack, so teams can roll out products in months, stay compliant, and scale worldwide.

Our belief is simple: lending software should cut costs and create value. We free your team to make faster credit decisions while focusing on growth.

Expertise

We combine deep lending expertise with advanced tech to

deliver secure, end-to-end loan-management solutions.

Innovation drives HES FinTech to solve the toughest lending

challenges while protecting your data and ensuring full

compliance at every step.

30+

countries

worldwide

worldwide

160

projects

completed

completed

Clients

Tier-one banks, high-growth fintechs, and regional specialists

alike rely on our solutions to launch new credit products in a

matter of months, scale confidently with bank-grade security,

and manage billions in loan volume.

Our history

Milestones in motion

2026

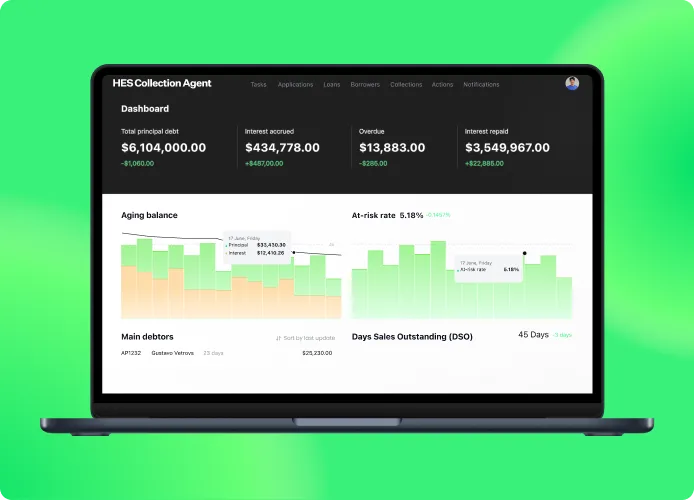

Launched HES Collection Agent, an AI-powered end-to-end platform for tailored debt collection strategies.

2025

Opened a US office and announced expansion plans for the UK.

Shortlisted for the FinTech Breakthrough Awards and the Cloud Awards for

excellence in digital lending and SaaS for FinTech.

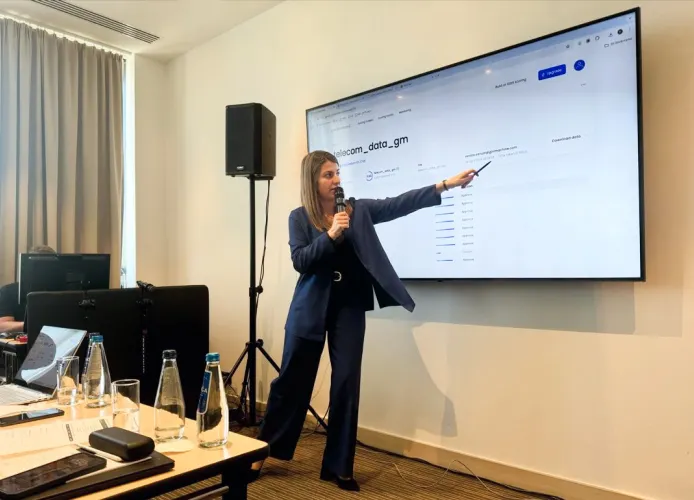

From LEAP 2025 to London Tech Week and Baltic Fintech Days 2025, we engaged the

industry firsthand, growing our ecosystem of partners and clients.

Integrates with over 100 APIs and external services, including VoPay, Ondato,

Jumio, Vector ML Analytics, PandaDoc, and GiniMachine.

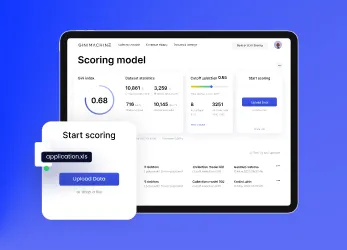

HES FinTech was recognized among the top 3 fintech companies. GiniMachine was

named one of the top 5 AI fintech solutions in Lithuania.

2024

Expanded strategic collaborations with EDGE and Alraedah Finance to drive open

banking analytics and digital lending in the Middle East.

Took part in key industry events including London Tech Week, Baltic Fintech

Days, Seamless Dubai, and LEAP 2024.

Contributed to conversations on the role of AI in inclusive finance at the MFC

Conference in Krakow.

2023

Showcased its solutions at LEAP 2023 in Riyadh and presented HES LoanBox at

Money20/20 Europe, receiving strong industry feedback.

Formed strategic partnerships with TPIsoftware, Credolab, Acquired.com, and

APLYiD to enhance automation, scoring, payments, and ID verification.

2022

Partnered with VoPay to bring real-time payments to Canadian lenders.

Joined forces with Nordigen to accelerate open banking adoption in Europe,

improving both payment flows and financial data integration.

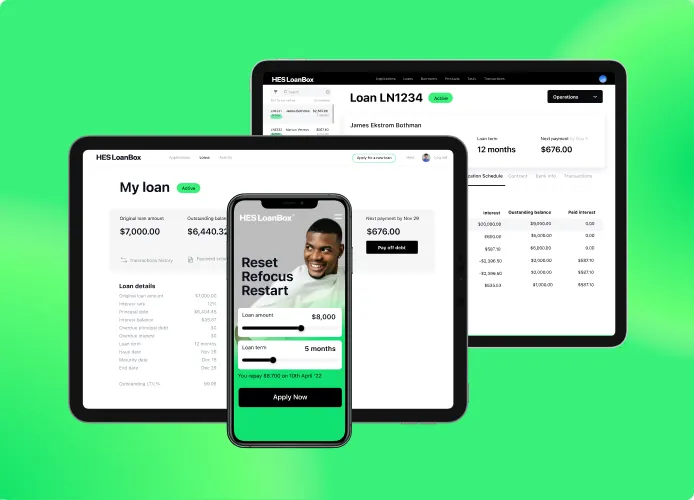

Launched HES LoanBox, a ready-to-use digital lending platform with 3–4 month

time-to-market, AI credit scoring, and flexible integrations.

2021

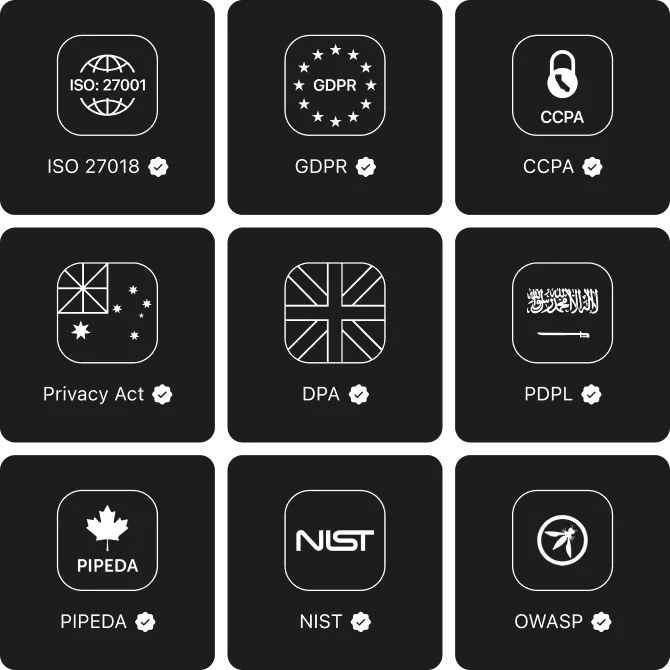

Earned ISO/IEC 27001 certification, confirming compliance with international

data security standards.

2020

Expanded across Europe, Asia, and the Middle East, with clients like ATM

Online, Fintruity, Wa’ed, Tavan Bogd Finance, CashU, and Ta Meri Finance.

Joined the Canadian Lenders Association to support digital lending

transformation in Canada.

2017

Selected for the Elevator Lab accelerator by Raiffeisen Bank International, a

nod to its innovation and future potential in digital finance.

2016

Launched GiniMachine, an AI platform for automated credit scoring and

decision-making for financial institutions and fintechs.

Nominated for Innovative Banking Software at the European FinTech Awards,

recognizing its impact and innovation in the industry.

2012

Secured its first major international client, ID Finance (MoneyMan), marking

the start of its global presence.

Founded in Lithuania to modernize lending through automation and process

optimization technologies.

Leadership team

Visionaries

driving growth

Our partners

Backed by the best

Our partner ecosystem unites category-leading platforms in data, compliance, workflow automation, and

customer engagement.

Our clients

Where lenders level up

Wa’ed, Aramco’s $500M VC arm, chose HES FinTech to automate SME lending with

a

full-cycle platform featuring AI and integrated payments.

Commercial lending

Saudi Arabia

Fintuity, the UK’s first digital FCA-regulated IFA, partnered with HES

FinTech to

build a hybrid AI-powered advisory platform in five months.

Investment advisory services

the UK

ID Finance partnered with HES FinTech to launch a custom HES LoanBox

platform in

three months for rapid expansion in emerging markets.

Consumer lending

Spain and 10 more countries

Consumer lending

Spain

Idea Bank, a Polish SME-focused bank, partnered with HES FinTech to

automate

POS

lending, cutting application processing time fivefold.

Bank POS lending

Poland

ATM Online, with 500,000 users and $14M disbursed in Vietnam, partnered

with

HES

FinTech to launch an automated lending platform in four months.

Consumer lending

Saudi Arabia

Tavan Bogd Finance serves 280,000+ customers with diverse loans, using

HES

FinTech’s

system for fast, flexible credit. They manage a $63M portfolio

efficiently.

Consumer & Commercial lending

Mongolia

Consumer

Mongolia

ALM Securities replaced manual spreadsheets with a cloud-based HES

LoanBox

platform,

going live in 6 months and achieving 100% digital processing.

Commercial lending

Iceland

Recent press

Media resources about us

The company’s flagship product is an all-in-one modular platform that brings

automation powered by AI to financial institutions of all sizes.

Read

more

HES FinTech is a full-fledged technology partner with vast experience in the

fintech

domain and a talented team ready to share valuable insights.

Read more

HES FinTech lending software is a great fit for traditional and alternative

lenders.

The platform has a potential to bring benefits both to lenders and borrowers.

Read

more

Security

Built-in security

HES LoanBox is designed using industry-recognized security practices and frameworks that support

compliance and audits. Encryption, access control, secure APIs, and audit logs protect every

lending operations.

Learn more

ISO 27001

GDPR

CCPA

PIPEDA

DPA

PDPL

NIST

OWASP

Start lending

in just 3 months

HES LoanBox end-to-end solution absorbs

the workload across onboarding,

underwriting, servicing, and reporting,

so you can scale revenue—not overhead.