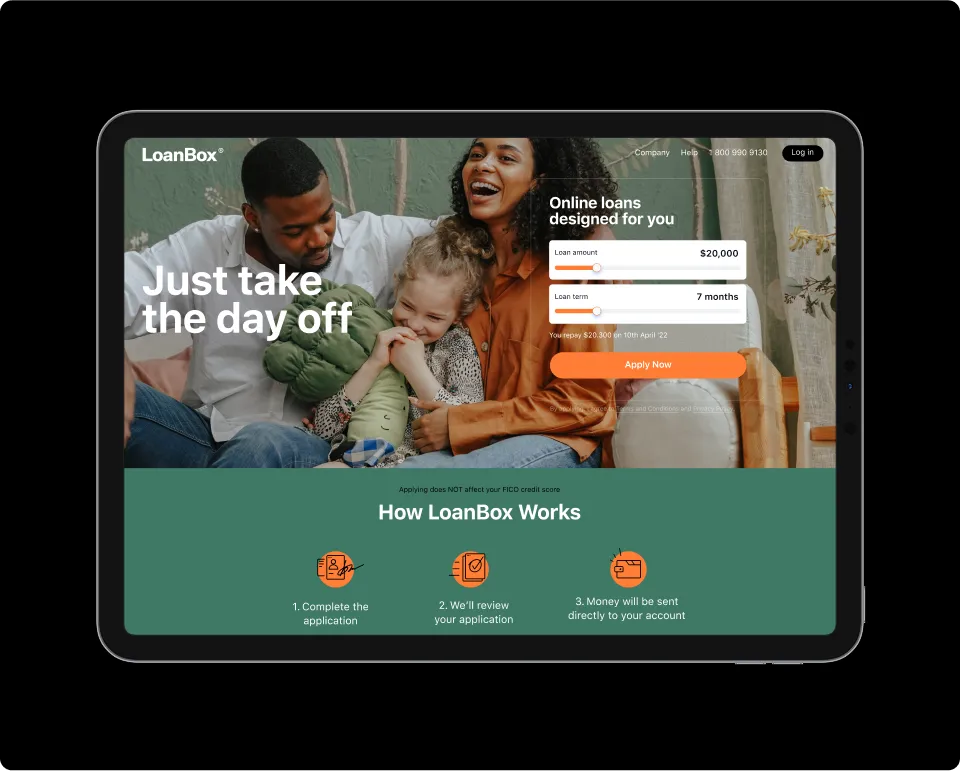

The core of your lending business

Simple and powerful

HES FinTech develops complete loan management software that

increases efficiency and drives comprehensive automation for financial service companies. To create

HES LoanBox, we combined our domain knowledge in lending software development for financial service

providers and created a comprehensive combo of modules meeting the business processes in full.

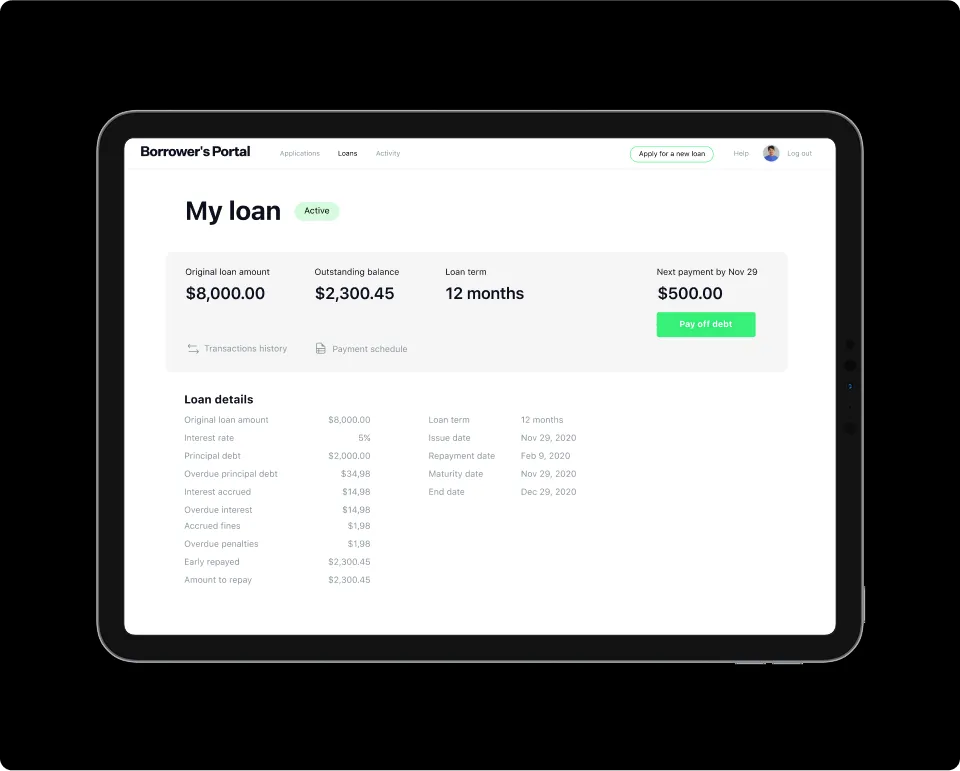

Task management dashboard

Comprehensive and intuitive dashboard with lists of tasks assigned to users according to

their roles.

Get your lending

product estimate

in 3 minutes

STEP:

/

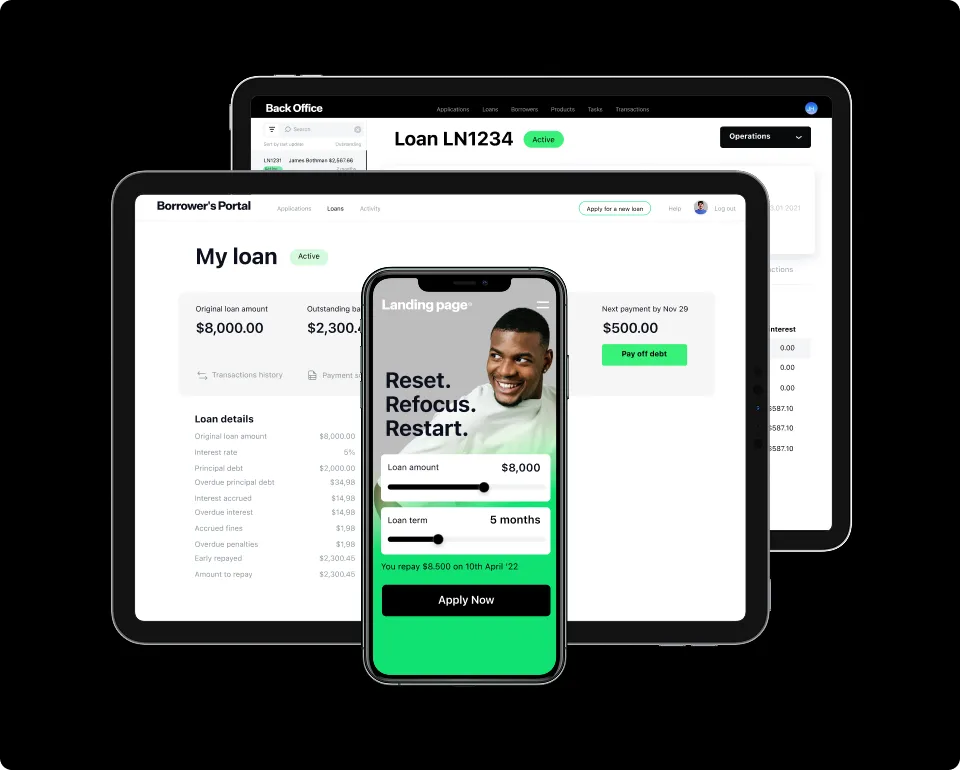

Digital lending from front to back

Integrated architecture

Automated calculations

Security updates

Automation of disbursements and payments

User-friendly interface

Lifetime customer support

Get a free demo

Issue consumer and commercial loans within 3 months

Get a free demoFAQ

Is back office finance software customizable to fit my specific business needs?

What kind of security measures does financial back office software offer?

What kind of support or training is provided for using back office finance software?

Is the software scalable? Can it handle the growth of my business?