ALM Securities success story

An Icelandic securities company offering financial services to businesses

Learn how HES LoanBox helped ALM Securities to optimize lending workflow and accelerate loan processing.

We're extremely satisfied with how HES FinTech is currently serving us. In just 6 months, we went from

storing all our data in Excel to a fast, reliable, and user-friendly platform that caters to our

specific needs.

Hjortur H. Jonsson

Partner at ALM Securities

Challenge

Automation of securities management

Between 2009 and 2022, the client relied on Excel spreadsheets for handling their fixed-income

asset and liability transactions. However, with the expansion of their business, they

encountered a growing issue of escalating manual workload and an increasing number of human

errors. To address this challenge, the client sought the expertise of HES FinTech to implement a

cloud-based solution that would comprehensively automate intricate calculations and reduce the

need for manual data input.

Approach

Custom system for securities servicing

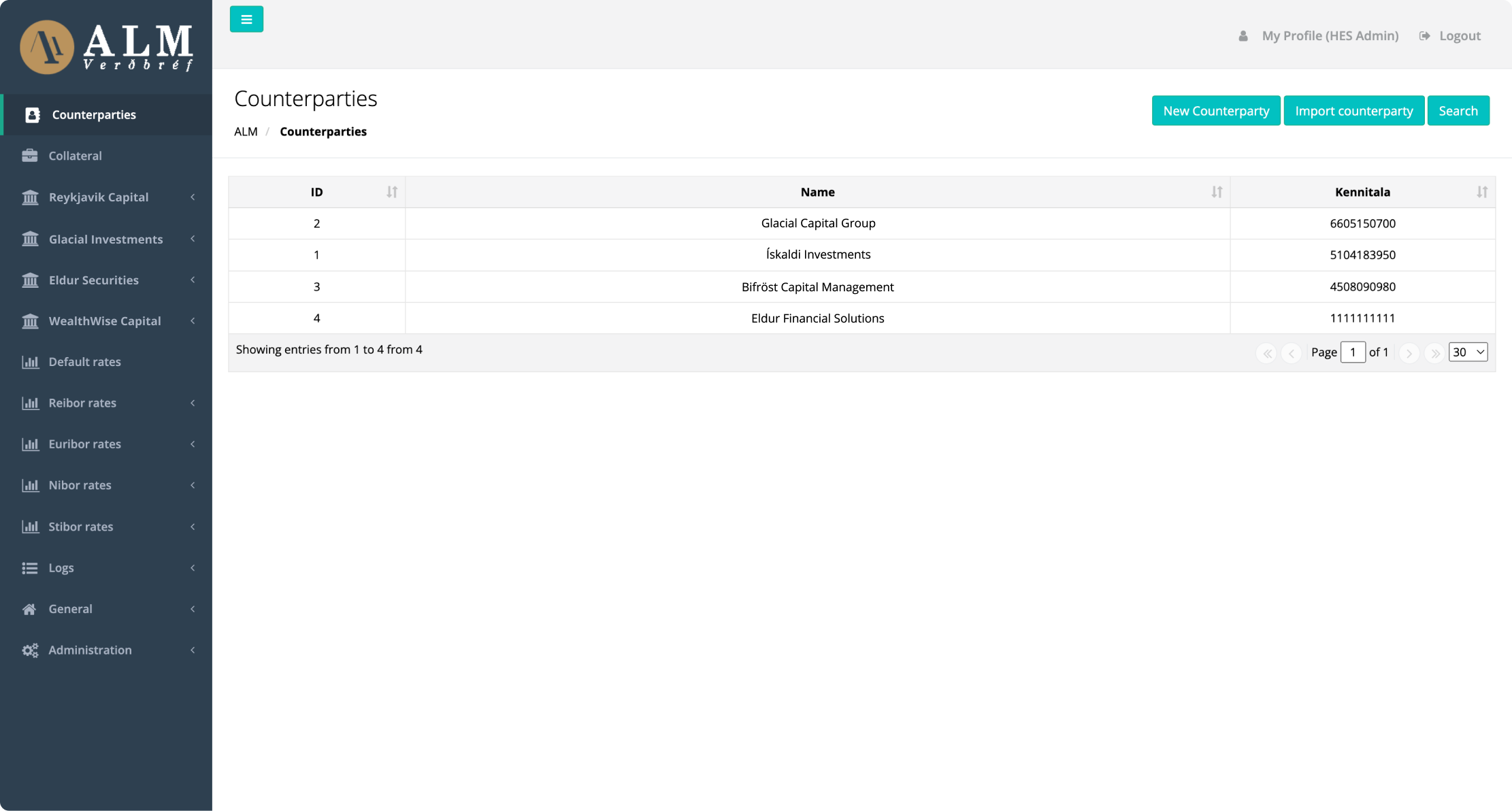

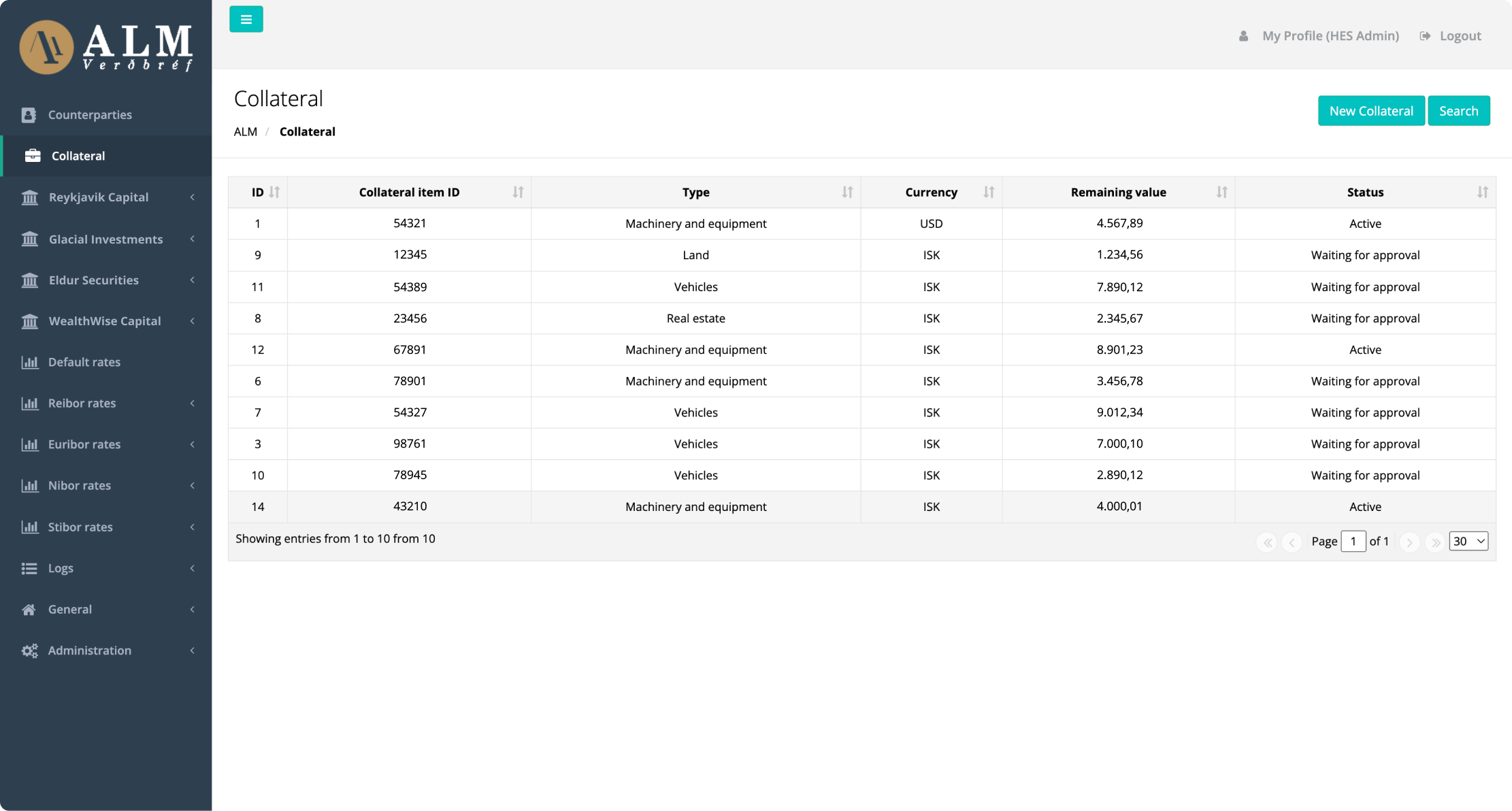

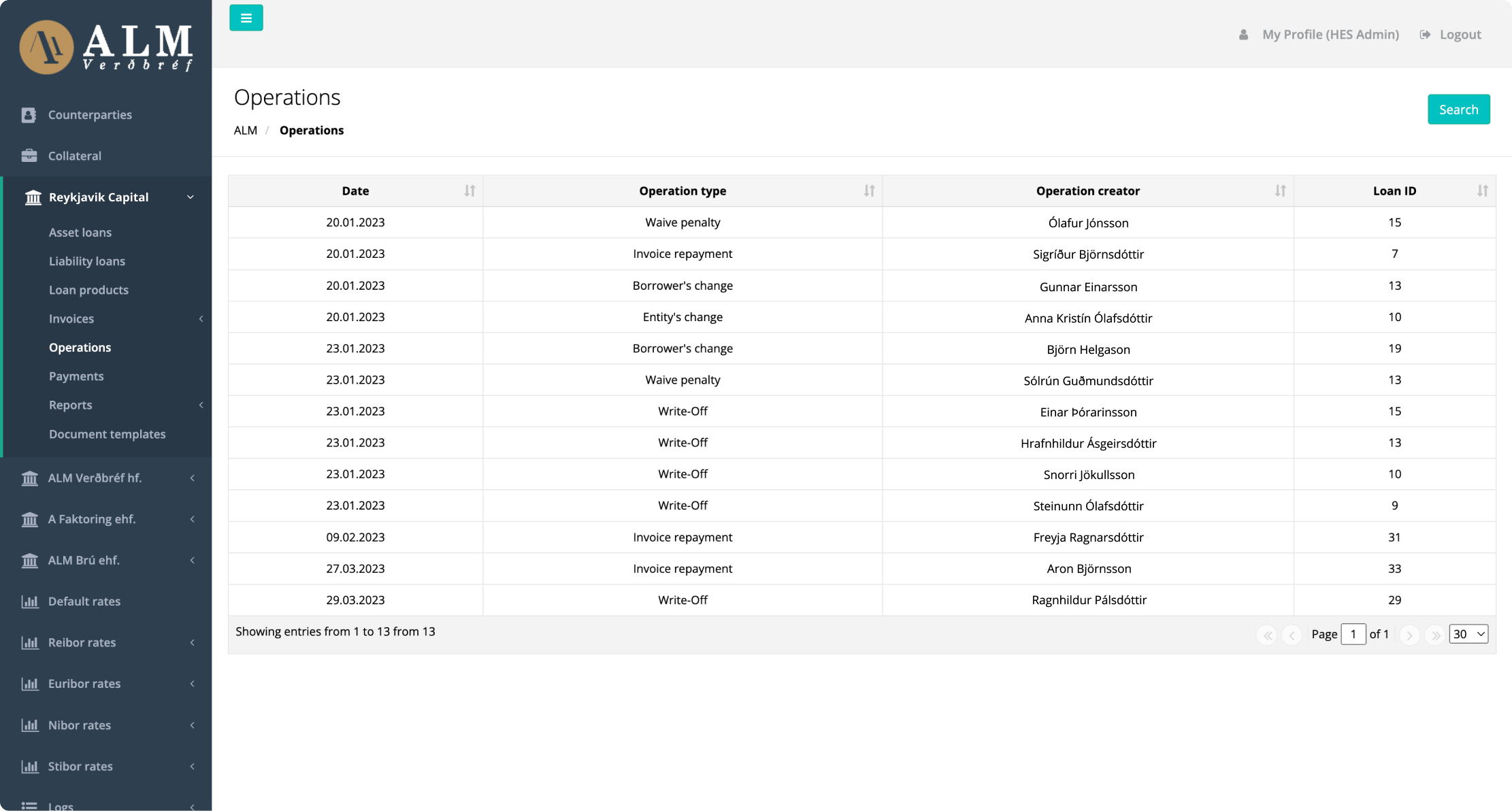

After a detailed assessment of the project's scope, the HES FinTech BA team identified the client’s need for a fully customized securities transaction management system.

The project presented four main challenges: automating comprehensive interest calculations, enabling automatic payment processing, generating real-time charts and reports, and ensuring continuous synchronization of interest rate adjustments based on the Central Bank of Iceland's indicators. Additionally, the system’s adaptability allows it to handle multiple currencies and scale seamlessly with the client's business growth.

To address these challenges, HES developers integrated the client's accounting system with services like CreditInfo and sourced EURIBOR, STIBOR, and NIBOR rates. Our team also successfully connected HES LoanBox to the Central Bank of Iceland and various commercial banks. For optimal performance and data security, the system is hosted on AWS cloud services.

8 minutes

to submit a loan application

6 months

time-to-market

100%

digital loan processing

Result

6 months from idea to a working business

ALM Securities received a fully functional and dependable system for overseeing

securities transactions. The intuitive user interface streamlines manual data input, resulting

in time savings for employees. Furthermore, the automated calculations have notably decreased

the occurrence of errors, reducing the impact of the human factor. The system has continued to

operate successfully, effectively optimizing the client's operational expenses.

After the launch, ALM Securities requested assistance with the onboarding phase. Our partnership

has since expanded, and the HES team now offers technical support and system enhancements.