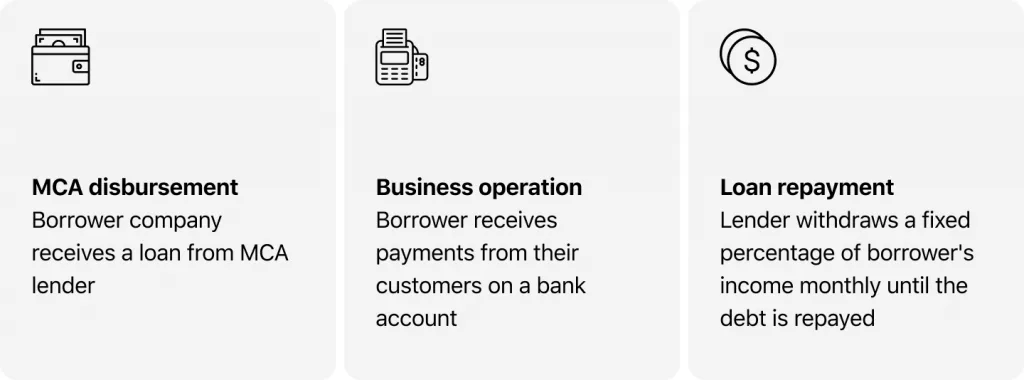

Since it was first launched in 2008, the merchant cash advance industry has been growing. Just a few years ago, the industry was estimated at having funded small businesses a sizeable sum of $8 billion. In the last years that amount has exceeded $19 billion. Merchant cash advance loan software allows businesses to get funding based on their estimated credit card sales — for every sale, the investor gets a percent until the debt has been paid off. Such arrangements can be beneficial to both lenders and borrowers, allowing businesses to grow with the necessary cash flow.

Of course, this has also lead to an uptick in demand for the technology to manage these processes effectively. Both business owners and investors are actively seeking out new tools to create the best cash advance loan management software that will help manage processes — especially when they’re large-scale — organize data, and ensure everything runs smoothly and securely.

Where to start with a merchant cash advance platform?

Let’s go back to basics and learn where is the best place to start when building a merchant cash advance platform. Most wonder what they need to include to ensure functional software that does exactly what they need it to do. Our advice? Choose your tools correctly at the beginning, and you’ll have way less to worry about later. The best practise is to consider your lending process and mark up the critical features you need to cover your business needs.

What features do you need in merchant cash advance platform

- Customer profile management — no manager the type of your loan platform, you’ll need a customer profile management tool to ensure you can input, update, and amend client data when you need to. Even better? Look for a tool that’s automated. This will save your business time and ensure your team has more time to focus on more demanding tasks.

- Document workflow management — security of your and your client’s documents is key to your business’ reputation. Having a dedicated, secure, and careful management document workflow means that whether you’re dealing with merchant cash advance underwriting software or a full-cycle loan process, you are capable of handling everything.

- Automated decision-making — don’t keep them waiting. Your clients are busy people and there’s no need to create an unnecessary hold-up anywhere. Instead, integrate automated decision-making at the beginning and save both you and your client time — without increasing the risk.

- Collection scoring — this is a must for any business. Leave this out, and you could put yourself in a risky situation and face bankruptcy (at worst). Ensure you have in-built tools in your merchant cash advance funding software to score and calculate the likelihood of repayment and which methods will work most effectively with this client.

- Sales performance tracking — it’s all about the data with this one. Sales is a high-pressure environment, and with good reason. Your team must constantly perform in order to get results. Higher up the ladder, it’s important to know these results to plan future activities. With the right merchant cash advance loan software, you can measure the success of your team, know the loans per manager, and detect small problems before they become big ones.

- Credit card analytics — being able to import data, have built-in analytics, automatic reporting, and more, means your technology can do its work more effectively, and so can your team. This will allow you to analyze and monitor usage and history before deciding on a path of action.

- API and customization — depending on the exact tools you want to build, you may consider the integration and customization options you need at the beginning. Consider your business needs and decide if you need to integrate marketing tools, analytics, accounting, or any other third-party systems. This is possible later on as well, but it’s much easier to do at the start.

Of course, this list to not limited and can be expanded (almost infinitely) to meet your precise goals and expectations.

Looking for unique MCA software?

Getting the best cash advance loan software: step by step

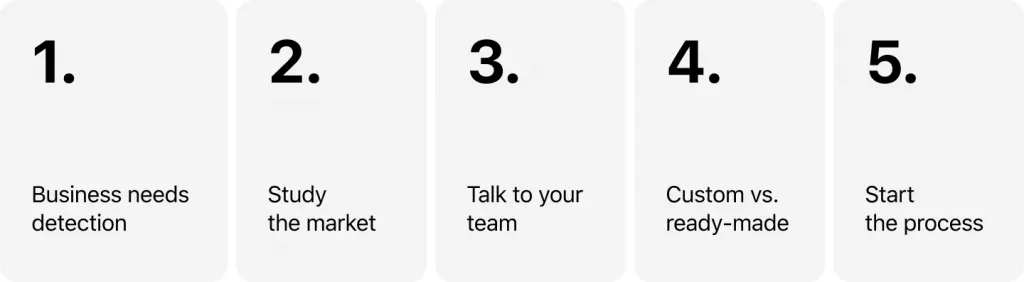

Now that you know some of the must-have tools for merchant cash advance loan software, here comes the hard part — building your own. We’ve designed this quick step-by-step guide to help you:

1. Know which problems your business is facing

Having a general idea that an MCA software system would be good for your business isn’t going to work. The system will end up too complex as you add more and more elements that you might not need. Plus, this will add up to your bill too. Instead, figure out the exact challenges you want to solve at the start and work from there.

2. Study the market

Know your competitor — the new KYC. You don’t have to copy them but knowing which systems they have in action will give you some idea to how they work, and what you would like to do to improve your own business. Of course, don’t forget to recheck these ideas through analysis so you can be sure they’re what you need.

3. Talk to your team

Who in your team will be dealing with the merchant cash advance loan software? Who needs it most? Talk to your frontline workers and figure out their needs and expectations in advance. This will help you when designing your software, as you’ll have feedback from the people who know the role best. In addition, by involving them at this stage of the process, you’re more likely to get employee buy-in later.

4. Choose between custom and ready-made solutions

Explore the tools that are on the market today. For some out-of-the-box solutions do the job perfectly well—so don’t feel the fear of missing out if this is your case. You can also get customizable tools that will help you adjust this software and personalize it to your needs without breaking the bank. At the same time, if you have a complex business, custom software may be more effective in the long-term. Although this is a longer process, it may well be worth it for your business.

5. Start the process

There’s no better time than the present. After all, the global digital transformation movement is set to grow to $1,009.8 billion by 2025, updated merchant cash advance funding software is definitely a part of this. That’s why, it’s important to start looking forward at how you can set your business up to be future-think now, not later.

Ready to kickstart your merchant cash advance funding? Let’s go!

Right now, it might be hard to grasp just how merchant cash advance funding software fits into your company plans. Take the time to sit back and analyze the findings and apply them to your business case. Having MCA software is an all-in-one solution that can help you manage your business lending platform, track deals, management leads, review the sales, funnel and more. The only decision left is to decide — what is the best way to build one?

In doubt? Why not get in touch with our team here at HES? We have years of experience building lending software, including merchant cash advance platform. So let us talk you through the ins and outs of how it can work for your business.