KYC is a shorthand for Know Your Customer that refers to the collection, analysis, and verification of customer information to establish a person's true identity. This is a vital piece of information that generally includes personal, financial, and sometimes, biometric information. This information helps in assessing any potential risk and verifying the eligibility criteria for digital lending.

From fraud prevention and risk mitigation to meeting certain legal and regulatory requirements, KYC plays a pivotal role in building customer trust in digital lending. KYC safeguards all sensitive information for operational efficiency and ensures proper regulatory compliance in digital lending platforms. However, there are a plethora of roadblocks that hinder its path to improved customer experiences. So, let's dive deep into knowing the different challenges of KYC and its paramount role in digital lending.

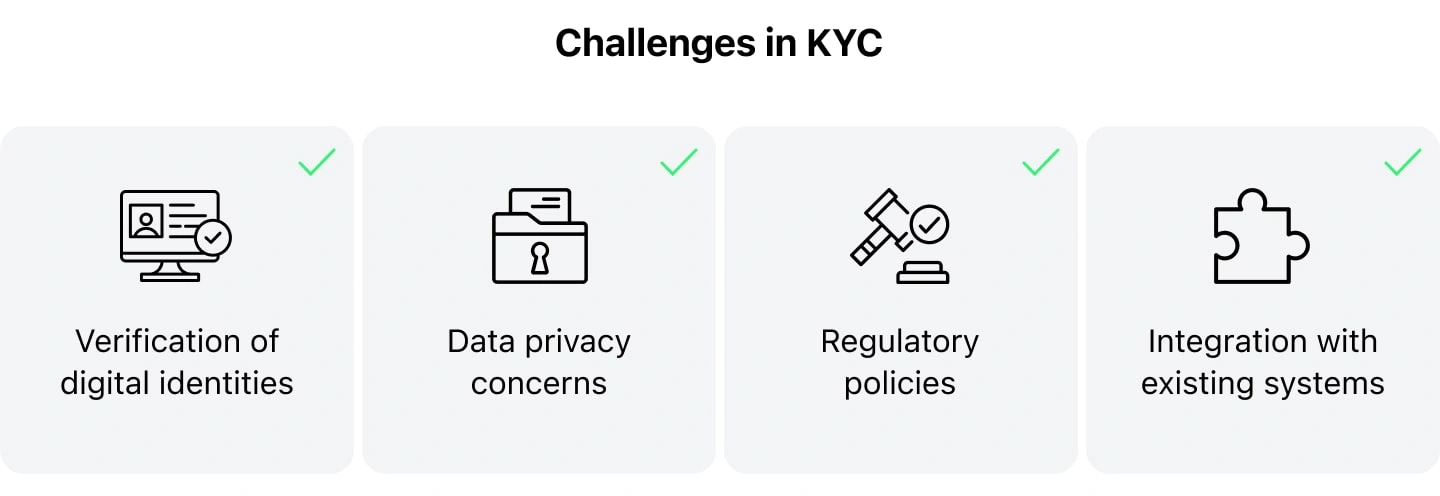

Challenges in KYC

The implementation and management of effective KYC strategies are fraught with challenges, each posing unique hurdles for financial institutions. As digital lending continues to grow, addressing these challenges becomes increasingly important to ensure not only regulatory compliance but also to maintain customer trust and operational integrity. In this section, we delve into some of the most pressing challenges that digital lenders face in implementing robust and efficient KYC processes.

Integration with Existing Systems

Integration with the existing systems poses a significant challenge in Know Your Customer (KYC) processes when it comes to digital lending. Generally, financial institutions rely on legacy systems, each with its own data formats and protocols. Bridging these technological gaps requires meticulous planning and execution. Compatibility issues, data migration complexities, and the need for real-time updates can hinder seamless integration. Moreover, stringent regulatory requirements demand airtight security and compliance, adding another layer of complexity.

Data Privacy Concerns

Address how digital lenders handle sensitive customer data while complying with privacy laws.

Another major concern is storing and processing sensitive data for digital lenders. Gathering and managing vast amounts of sensitive customer information require stringent safeguards to protect individuals' privacy. The digital lending landscape involves the collection, storage, and transmission of personal data, raising the stakes for potential breaches and unauthorized access. So, lenders must take care of the security and privacy of sensitive data and deploy all the strategies to protect the data from cyberattacks and breaches.

Regulatory Policies

Staying in compliance with the varying global KYC requirements is another major challenge for the digital lender in the field of KYC. The KYC lending regulation changes with different jurisdictions which keep on evolving with time and the financial institutions have to adhere to them. Failing to comply with the changing regulation can lead to several penalties and damage the overall reputation of the brand. So, strict vigilance is necessary to navigate through the maze of global regulations.

Besides all this, the interconnected nature of digital lending demands a robust system that ensures real-time compliance, adding complexity to the KYC process.

Verification of Digital Identities

Businesses have to verify the identity of the customers by collecting government-issued documents for identification. For customers who pose a higher risk of terrorist financing, money laundering, or other crimes related to the financial sector, the organizations have to conduct EDD(Enhanced Due Diligence). However, the virtual nature of digital identities introduces complexities in confirming the authenticity of individuals which is one of the KYC challenges in digital lending. Fraudulent activities, such as identity theft and deep fakes, pose threats, necessitating advanced verification methods. So, there is a need to balance rigorous authentication with a seamless user experience is crucial for digital lenders.

Explore the challenge of verifying identities in a digital space and combating the submission of fraudulent documents.

Learn More About KYC in Lending

HES LoanBox’s KYC Feature

HES LoanBox is an out-of-the-box solution for loan origination and management with several customizations and advanced technology-powered features. Even when it comes to addressing the KYC challenges, the product allows the companies and organizations to screen the customers properly. Here are the top features of the product.

KYC Check

With a tech-powered KYC module, HES LoanBox allows companies to identify borrowers with their documents and photo ID. The module enhances overall security which prevents fraud and money laundering attempts which further safeguards the reputation of the company in the market.

The whole KYC process can be completed in less than one minute with high security which expedites the whole underwriting process. This allows the borrowers to progress forward quickly in the loan process while lenders feel safe lending the money to verified borrowers without going through any manual hassle of verifying him/her.

Automated Decision-Making Support

The back-office module offers automated decision-making support, where the product screens the loan application by analyzing the credit history and approving/declining it on predefined criteria. This further optimizes the process by reducing human errors and saving funds.

The HES LoanBox is leveraging the power of Ondato and Jumio to offer better KYC compliance to further increase the efficacy of the onboarding process. The providers help combat the fraud by screening the application and offering a seamless KYC process.

Both Ondato and Jumio have deployed proper measures to elevate security and make it their number one priority. The data servers and information structure are protected by round-the-clock monitoring.

Both providers have achieved the ISO/IEC 27001:2013 certification which further elevates the trust level of customers when it comes to the security front. Jumio has even gained the PCI DSS and SOC2 Type 2 certifications.

Ondato is compliant with GDPR guidelines and uses only certified technology to avoid any security breach in the system.

HES LoanBox uses these secure partners to offer better KYC services to the customers so that they can feel safe while progressing forward in the whole process.

Case Studies

Here are some case studies of brands that have implemented KYC solutions to improve their performance, grow their profits, and prevent fraud.

Revolut

Revolut was facing a challenge to verify the identity of the customers at a global scale without compromising the accessibility and user experience of all the customers. The brand required a system that offered a seamless onboarding solution for all the customers while scrutinizing the fraud identities away.

KYC in online lending is necessary for digital banks like Revolut. However, they needed a system that would go beyond the traditional systems and company with the global KYC regulation to verify the identities and prevent identity fraud.

The bank created a solution that elevates the security level through face-to-face interactions through its excellent app. The solution allowed the bank to check the documents and perform facial checks while offering a smooth onboarding experience. This allowed Revolut to enjoy a higher degree of security in identifying customers without compromising on the user experience front.

With this new KYC system, Revolut Bank was able to spread its roots across different countries and expand its customer base. There is a 12% increase in overall onboards after the implementation of the new KYC system which reaps better fruit for the bank.

Square’s Cash App

When it comes to Square’ Cash app, the provider asks for details like legal name, DOB, and last 4 digits of the SSN for a full verification process. There are some cases when the app will ask for more details to complete the verification process. This removes the limitation and allows the provider to scrutinize the fraudulent applicants to avoid any fund loss and data breach.

Affirm

Affirm allows customers to pay for their purchases in several installments. It offers them the freedom to pay the amount of the purchase on their own terms. As they are working in the digital lending space, the risk of fraud always lingers. According to the report, merchants or financial services providers have to pay around 2.94 dollars in total costs for every dollar that is lost in the fraud.

So, to protect their resources and combat the issue of fraud, Affirm has implemented a KYC solution where they ask for partial SSN details from their customers. The SSN details allow them to perform a verification check on the identity and conduct a quick credit check. These checks allow them to determine the creditworthiness of the customers and there is no impact on the credit score of the applicant.

The whole verification and KYC in online lending allows the brand’s ML-based system to approve more customers seamlessly. Moreover, it reduces the overall customer acquisition costs. In short, the small details help the brand in the longer run by increasing the overall approval rate and reducing the number of online frauds.

Final Verdict

KYC in online lending ensures thorough customer verification, mitigates fraud risks, and fosters compliance with financial regulations. Robust KYC processes build trust among stakeholders, enhance security, and contribute to the overall integrity and sustainability of digital lending ecosystems.

HES LoanBox offers an omnichannel client onboarding process with robust KYC. Besides this, digital lending software can optimize the whole loan origination and management process. So, stop looking here and there, contact our team to learn more about its features, and grab the product to enjoy them.