The alternative financing landscape is undeniably in flux. As digital advancements continue to reshape our world, they are also redefining the boundaries of finance, ushering in a wave of novel opportunities and unique challenges. Let's delve into some of the most compelling and insightful statistical data on the subject:

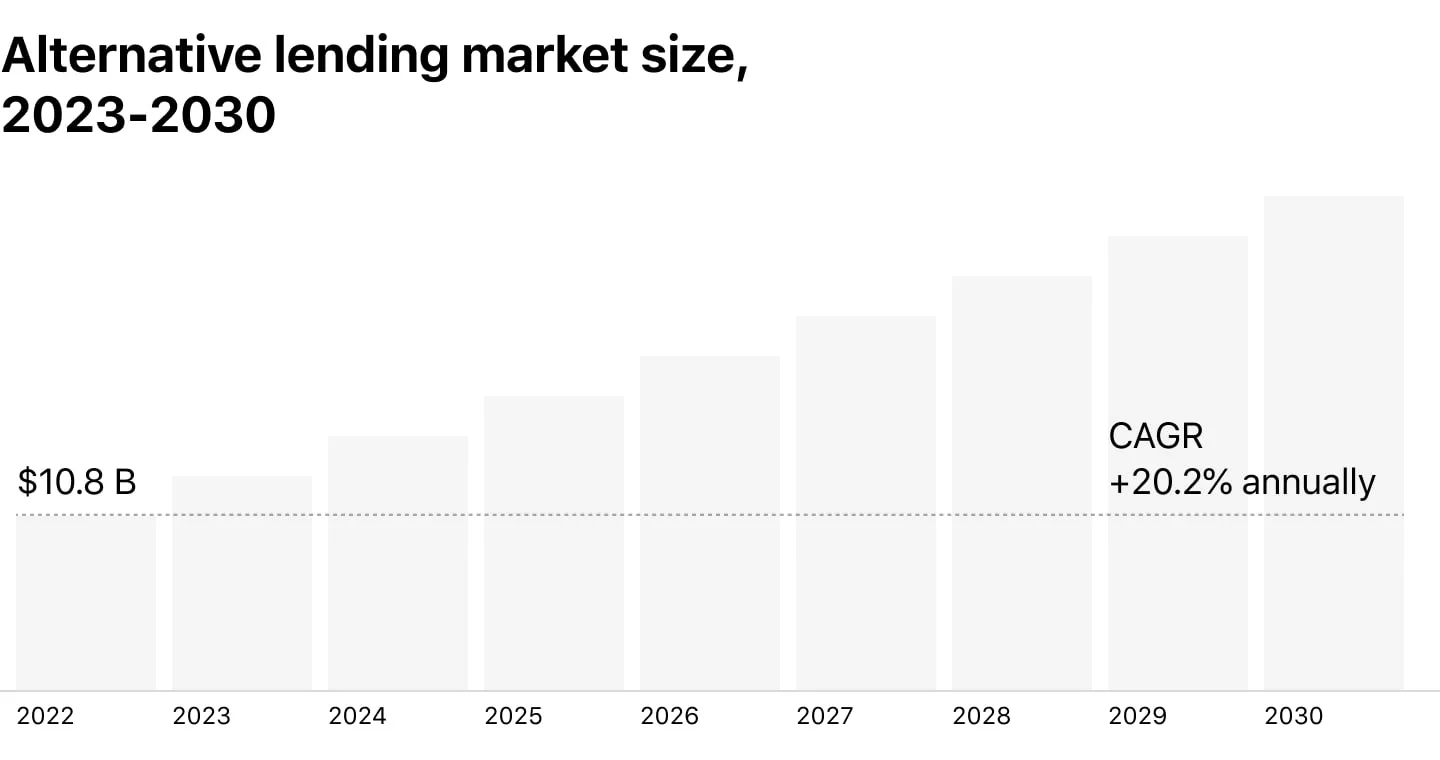

- Already in 2023, the global alternative financing market was expected to experience a compound annual growth rate (CAGR) of 20.2% by 2030.

- The share of small and medium enterprises (SMEs) presented at the alternative financing market accounts for about 55%, while individual consumers are forecast to grow at a 22.0% CAGR through 2030.

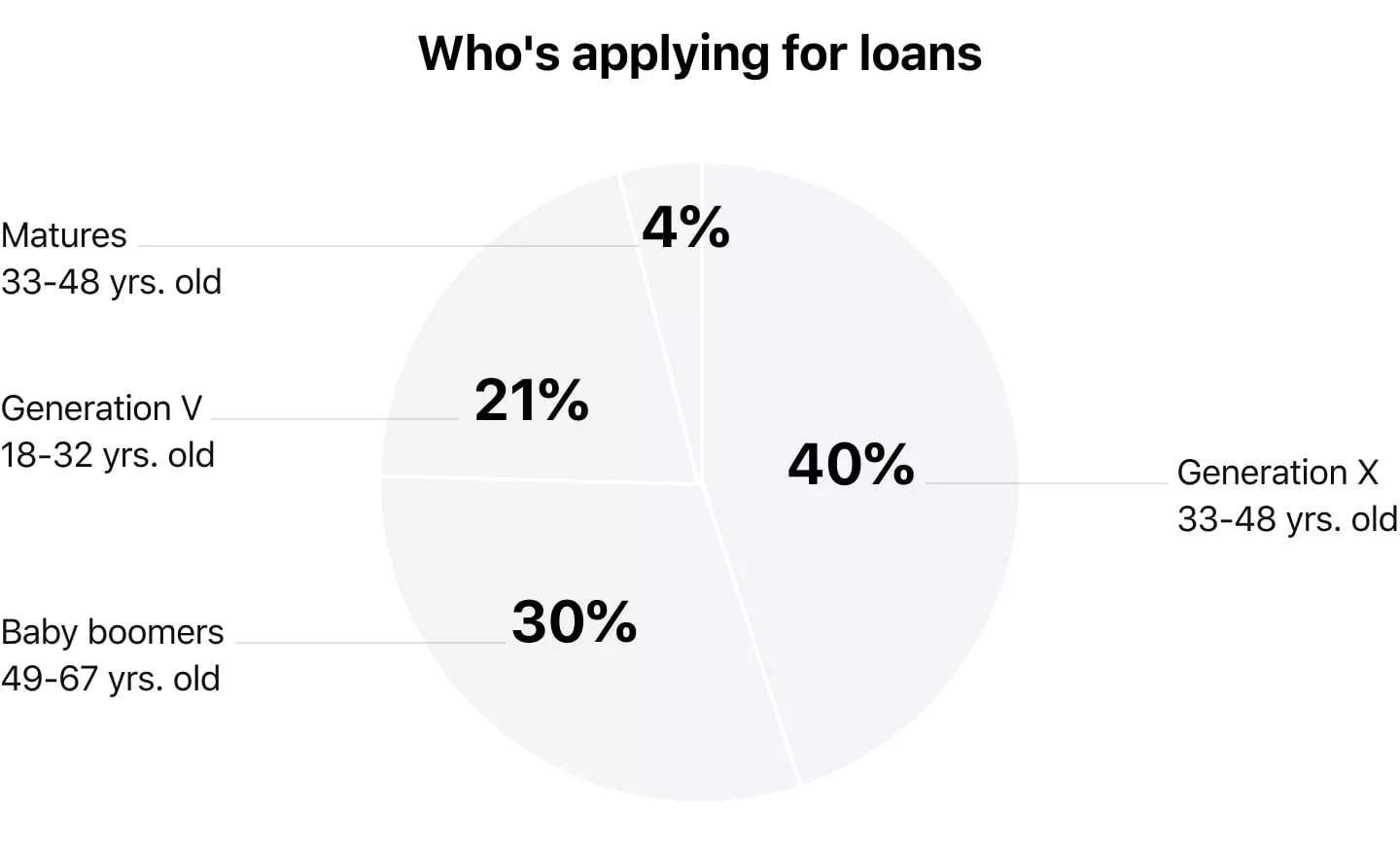

- Young investors participate actively in alternative lending; thus, in 2024, 61% of P2P lenders were under 40 years old.

To gain a deeper understanding of these shifts, especially in the domains of alternative lending, AI in finance, and emerging fintech trends, we sat down with Ivan Kovalenko, the co-founder of HES FinTech. With years of experience and an astute understanding of the industry, Ivan delves into the current landscape of alternative financing and what the future holds. Here's what he had to say.

The Future of Alternative Lending

As the CEO and co-founder of HES FinTech, how do you see the state of alternative lending and its trajectory by the end of 2025?

Ivan: Right now, the alternative lending market is pretty fragmented, and its growth varies by region. In some countries, regulatory forces and market dynamics are nudging alternative lenders toward becoming more like traditional banks. Kazakhstan is a prime example where many leading fintech firms are morphing into banks, largely due to centralized regulations and state subsidies. In developed countries, alternative lending is on a faster growth trajectory, often investing in emerging markets to expand their services to adjacent sectors.

Lately, banks are adopting the playbooks of fintechs, experimenting with what was once the exclusive domain of fintech: online lending, digital solutions, AI, and so forth. At the same time, fintechs are moving towards the scale and reliability traditionally associated with banks. The decentralized market, for instance, is gravitating towards a point of equilibrium, setting a level playing field with banks, driven by regulatory bodies. The primary legislative restrictions revolve around funding costs, card issuance plans, interest rate caps, reporting and capital reserve requirements, and limits on debt recovery channels.

In your opinion, what role does fintech play in expanding the capabilities of alternative lenders, and how has it changed over the last few years?

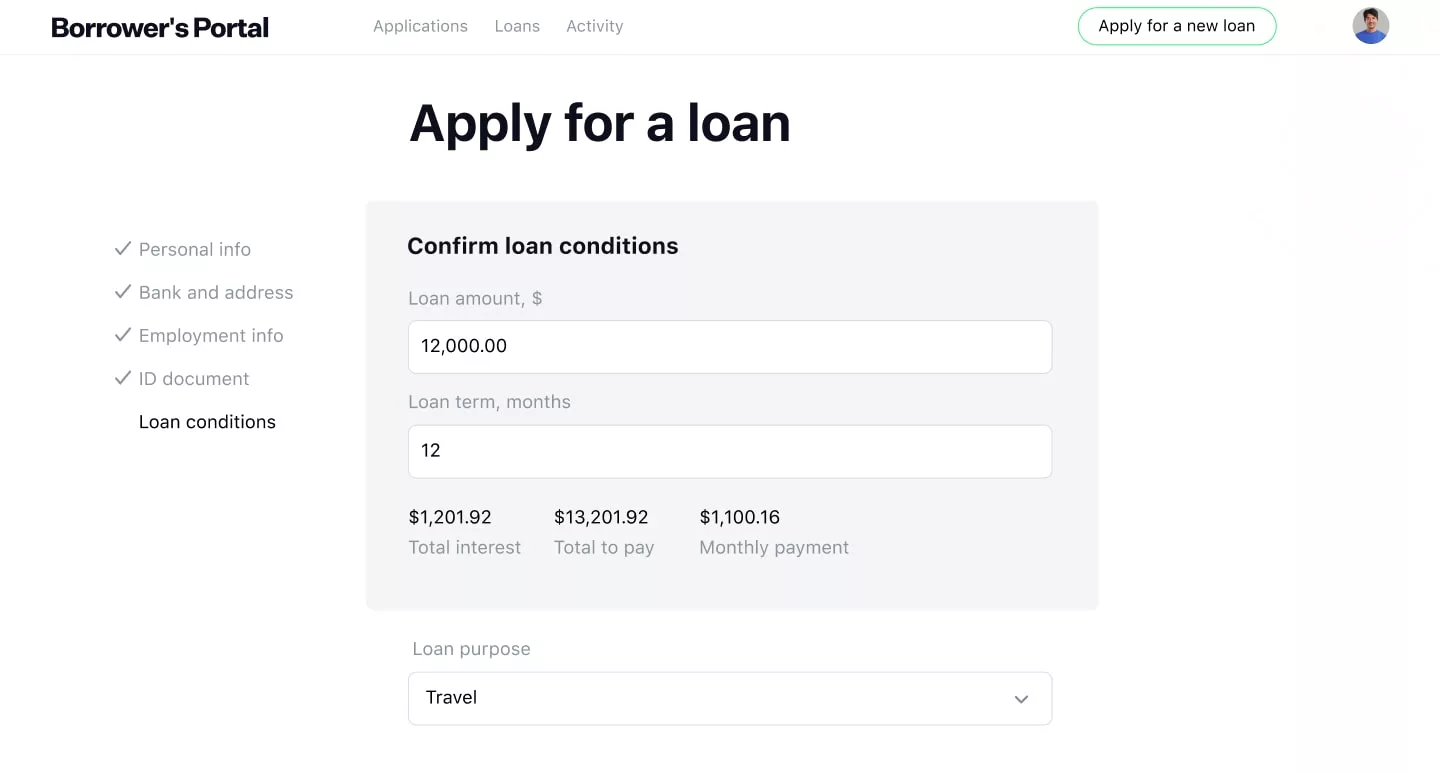

By their very nature, alternative lenders are more risk-tolerant and agile, making decisions swiftly and leveraging the flexibility in reserving and credit product offerings. Financial technologies enable them to fill niches that traditional banks might overlook. These include online lending without physical interaction with clients, cost-effective underwriting and credit management processes, combating defaults using technology, and the use of mobile applications.

Another realm where fintech is unlocking new opportunities for lenders is remote access to financial services. Thanks to fintech, alternative lenders can offer financing to residents of rural areas where access to traditional lending might be challenging or even unattainable. Through digitization, credit institutions can now easily interact with borrowers in remote regions, expanding their potential to acquire new clients.

Continuing on this topic, could you share specific examples of how HES's lending solutions have helped alternative lenders achieve success?

Ivan: Certainly, we have many compelling client success stories. One notable case is our solution for the consumer lending platform, MoneyMan. This client successfully transitioned their services to the online lending sphere in the European market. For them, we provided our ready-made software product, HES LoanBox, which contributed to a 30% growth in net profit for the project within a year.

Read also MoneyMan Success Story

Another fine example underscoring that fintech is beneficial not only for alternative lenders but also for the optimization of traditional lending is IdeaBank. At a certain point, the company recognized that the future lies in digitization. Partnering with HES as a fintech provider allowed them to experiment with the rapid deployment of products based on the SaaS lending platform. This enabled the bank to launch an entire suite of online lending products, which continue to successfully operate on the HES LoanBox platform. It's gratifying to see that our client's application processing speed within online lending has increased fivefold.

We believe that AI will revolutionize the approach to credit decision-making not in the distant future, but right now. A significant part of this confidence comes from our successful collaboration with Mobicom. The company has implemented AI scoring based on our GiniMachine platform, speeding up the approval process for loan applications. This has had a direct impact on the volume of loans granted, which has doubled. The lender also observed an improvement in decision-making accuracy: as a result, the NPL rate dropped by 4 times: from 18.9% to just 4.4%. Mobicom Finance now also employs GiniMachine for the ongoing debt recovery processes. The optimal balance between risky applications and performing loans in a large portfolio over the long term has contributed to an increase in net profit. As of today, 100% of the company's decisions on applications are made using GiniMachine.

The Transformative Role of Automation and AI Technologies

You've touched on the subject of lending efficiency. From your experience, how do technology and automation enhance the efficiency and scalability of alternative lending operations?

Ivan: To summarize our experience, the most significant impact is observed in the acceleration and cost reduction of loan application processing, as was the case with the previously mentioned NEO Finance.

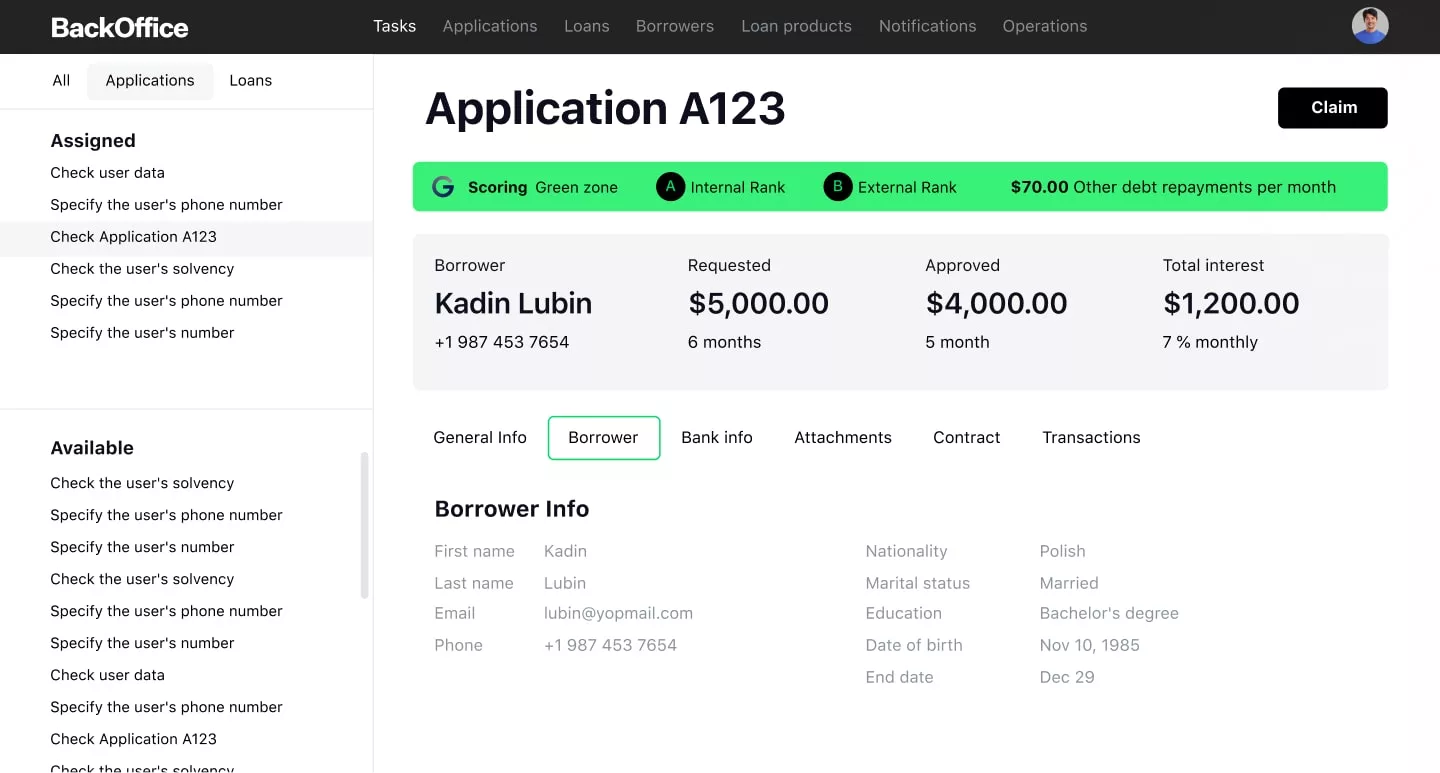

Automation in debt recovery processes generally allows for reduced collection costs through automated strategies, early detection of problematic loans, and the application of AI technology to identify those loans most likely to be recovered.

With automation, our clients expand their borrower reach, as seen with unbanked and subprime customers. This extends not only to economic segments but also to enlarging regional presence overall – exemplified by clients from rural areas with limited access to financial services.

What are the primary challenges alternative lenders will face in 2026, and how can fintech solutions address these issues?

Ivan: In my opinion, the primary challenge for alternative lenders is the rapid growth of competition in the micro-lending market. To address this, companies need to invest in marketing and develop competitive advantages. For instance, user experience, swift loan approvals, and tailored credit products can significantly influence a borrower's choice of lender. To free up resources for promoting financial services, one can optimize funding costs and automate internal processes. Automation helps reduce the need to hire new specialists and cuts operational expenses. AI-based scoring and fintech solutions overall can diminish debt recovery costs. The saved time and financial resources can then be directed towards developing marketing campaigns and attracting new clients.

Another significant trend is the tightening regulatory requirements for Non-Bank Financial Institutions (NBFI) in many regions. Restrictions are emerging around types of credit products, and there are stringent requirements for equity and reserves. It's clear that the state regulation of alternative lending is moving towards that of banking, with demands for more rigorous reporting on a regular basis. Given this, expectations from software solutions are rising. At HES, we continually work to refine our reporting and ensure it aligns with contemporary standards. That’s why HES LoanBox is a practical solution for alternative lenders.

How do data analytics and artificial intelligence contribute to risk assessment and the decision-making process for alternative lenders?

Ivan: Data is often dubbed the new gold. With the advent of AI scoring technology, accumulating vast amounts of data has become an objective in itself. Beyond the traditional credit history derived from credit unions, alternative data about the borrower can now be considered. This aids in a more precise evaluation of incoming applications. For instance, a borrower's payment history for utilities, rent, telecommunications, and other bills can be taken into account. The historical data from applications serve as a foundation for machine learning-based analysis. By identifying non-obvious correlations in historical data, AI constructs a predictive model. Lenders can then apply this model to new, yet-to-be-processed applications to forecast their likelihood of default.

The analysis of alternative data not only serves as a robust indicator of application quality but also assists in targeted marketing towards specific demographics. Leveraging AI data analysis, for example, allows for rapid A/B testing of new credit products and business hypotheses. It also facilitates more accurate decisions regarding the structure of a credit portfolio and risk forecasting.

DeFi and Alternative Lending: What the Relationship Will Look Like?

With the rise of decentralized finance (DeFi), how do you believe alternative lenders are adapting to this new paradigm, and what opportunities does it present to them?

Ivan: Undoubtedly, DeFi is a promising sector that I watch with keen interest. Based on my observations, even within the realm of cryptocurrencies, decentralization is somewhat conditional, as there is still some form of governmental regulation, albeit to a lesser extent. Certainly, the rise of cryptocurrencies has unlocked avenues for alternative financing, but for many lenders, the risks double. In addition to counterparty risks, there's the added volatility of cryptocurrencies.

Currently, the paradigm is shifting towards P2P lending, another sphere that intrigues me. We're seeing a gradual uptick in demand for peer-to-peer lending, although it's still not mainstream. For alternative lenders, it poses a 'chicken or the egg' dilemma: should they proactively shape demand or simply respond to it? Startups are actively launching P2P marketplaces, but other forms of alternative lending still hold sway.

From the perspective of customer experience, how does fintech enable alternative lenders to provide borrowers with personalized and optimized services?

Ivan: Identifying segments overlooked by traditional models is the aim of alternative lending. By targeting these gaps and enhancing the user experience, lenders might clinch small deals, but the accumulated volume of such transactions yields substantial gains. Automation aids in catering to a vast array of niche segments with unique products, as the operational costs for processing are minimal when automated.

Focusing on the unbanked and expediting loan application processes yields impressive results, especially in the Buy Now, Pay Later (BNPL) sphere. A prime example is marketplaces where alternative lenders can compete for financing a purchase. The rapid assessment of the quality of an application based on limited borrower data is crucial here, as customers tend to accept the first financing offer they receive. On a multitude of such deals, lenders employing swift AI-driven application processing secure substantial profits, while those still relying on manual assessments miss out on potential transactions.

Are there any regulatory or normative requirements that alternative lenders should be aware of when implementing fintech solutions?

Ivan: Now, HES is actively expanding its partner network globally to assist clients in achieving technological compliance with local regulations. Of course, regulations vary significantly from one country to another, making it challenging to detail every region. Primarily, lenders should focus on the regulations pertaining to specific types of lending and financial services they are interested in. While some countries may offer a flexible regulatory environment for these services, others might have outright prohibitions. Therefore, our software solutions are designed with customization in mind, ensuring that they can be modified in the future to meet both the demands of the lending business and to remain compliant with evolving legislation.

Read also

Looking ahead, what future trends in fintech do you expect to benefit alternative lenders the most?

Ivan: Summarizing the latest trends, there's an anticipated surge in the adoption of artificial intelligence and digitalization in the industry, as the influence of these technologies has steadily grown over the past few years.

I believe that in the next 5 years, we'll witness a convergence between alternative finance and traditional banks. Alternative lenders will face increased regulatory scrutiny, with expectations aligning more closely to those of mainstream banks. Conversely, banks will be looking to emulate the technological prowess, flexibility, and personalized customer experiences offered by alternative lenders.

Regarding borrower assessment and overall credit risk, there will be a notable shift from relying on traditional data and credit bureaus towards utilizing supplementary, alternative data. This approach has proven to be more effective.

As for DeFi, I see it as a promising avenue for the future of finance, albeit still a distant reality. Nonetheless, I'd advise keeping a close watch on the developments in this sector.