For millions of people, a car is more than just a way to get around—it’s freedom, flexibility, and often a necessity. As demand for both new and used vehicles continues to rise, so does the need for financing solutions that make car ownership accessible. Auto loans remain the go-to option, with over 80% of new car purchases being financed—an industry trend that has remained strong year after year. And with today’s financing trends, lenders, investors and dealerships have a massive opportunity to capitalize on this growing demand.

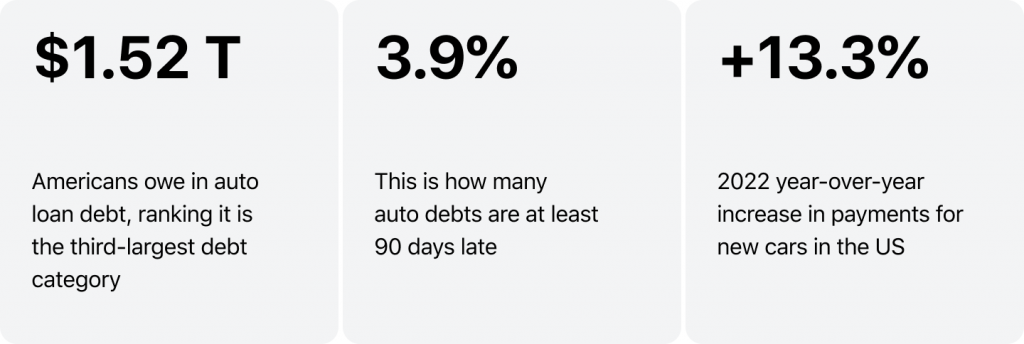

This ever-growing reliance on auto loans has made auto financing a $1.6 trillion industry, now the second-largest category of consumer debt, trailing only mortgages. Buyers are borrowing more than ever, with the average auto loan hitting a record $42,113. Monthly payments have also climbed, now averaging $754, up from $739 the previous year. As vehicle costs rise, so do loan amounts and repayment terms, creating a new reality where 1 in 5 drivers are committing to monthly payments exceeding $1,000, a figure that would have been unthinkable just a decade ago.

How to Start an Auto Finance Company: Where to Begin?

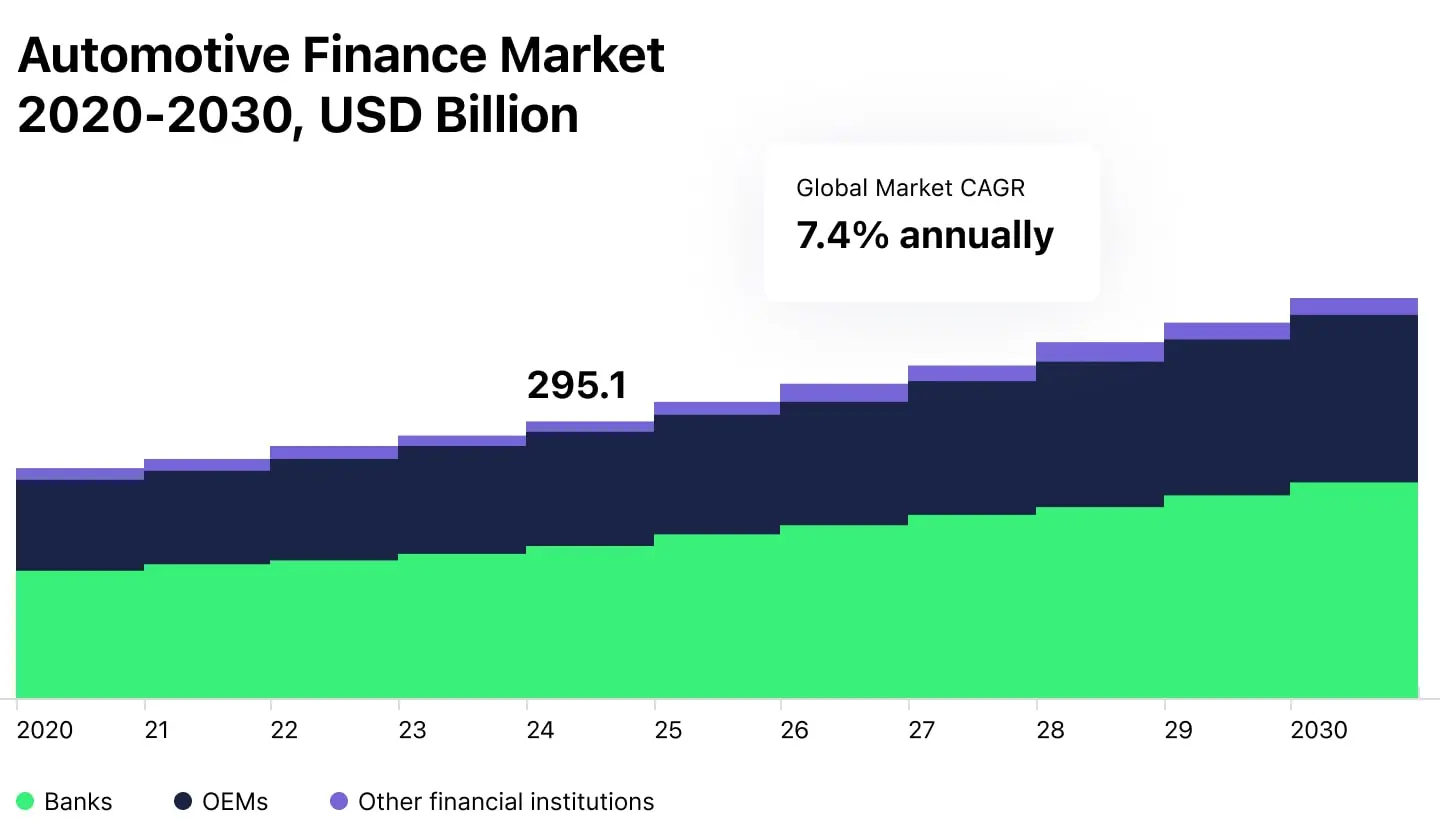

Data from Experian reveals that banks still dominate the auto financing landscape, holding 28.7% of the market, leveraging their scale and competitive rates for prime borrowers. Credit unions follow closely at 23.7%, capturing loyalty with lower fees and member-focused perks. Meanwhile, lenders—automakers' financing arms—control 21.9%, using exclusive incentives to keep buyers within their brand ecosystem. These numbers pinpoint that opportunity exists, but success depends on finding the gaps—whether in pricing, customer experience, or underwriting flexibility.

As consumer preferences evolve, so do opportunities for lenders — electric vehicles (EVs) are no longer niche purchases but mainstream investments. Financing for EVs has grown 30% from the previous year, driven by federal tax incentives and the introduction of more affordable models. The introduction of more affordable EVs is dismantling the perception that electric cars are only for high-end buyers. Federal incentives continue to be a critical driver. Buyers of qualifying new EVs can receive up to $7,500 in tax credits, while used EV buyers can access up to $4,000. Legacy automakers and emerging players alike are flooding the market with budget-friendly EVs. The 2024 Nissan Leaf ($28,140) remains one of the most accessible options, while Chinese manufacturers like Xpeng are pushing pricing even lower—their MONA M03 starts at just $16,813.

To remain competitive, lenders must also adopt auto financing software that streamlines loan origination, servicing, and risk assessment. Digital platforms improve efficiency and customer experience while ensuring regulatory compliance.

Exploring the Automotive Market Dynamics

Auto financing has long been a battleground of convenience versus cost, where consumers often trade long-term savings for immediate accessibility. The market is controlled by three key players—dealerships, traditional lenders, and digital disruptors—each competing for dominance in an increasingly debt-driven auto economy.

For most buyers, the dealership remains the default gateway to financing. With embedded lending partnerships, dealers make it seamless to secure a loan on the spot, eliminating the friction of shopping around. But that convenience comes at a price—higher interest rates, hidden fees, and financing structures that favor the lender, not the borrower. Many consumers accept these terms simply because they are baked into the car-buying experience.

Traditional banks and credit unions still set the benchmark for low-interest auto loans, particularly for prime and super-prime borrowers. Credit unions, in particular, offer some of the most competitive rates in the market, but their stricter underwriting standards limit accessibility. For younger buyers, gig workers, or those with subprime credit, these institutions remain out of reach, pushing them toward higher-cost alternatives.

The real disruptors are online lenders and fintech financing platforms, which have rewritten the rules of auto lending. These digital-first players emphasize speed, automation, and alternative credit assessments, expanding access to borrowers who would otherwise struggle to secure financing.

The takeaway? For lenders, differentiation comes down to three key factors: price, speed, and service. Staying ahead of market trends, such as lending trends in 2025, can help businesses refine their strategies and adapt to shifting consumer demands.

What Type of Lender Are You?

Lenders price loans based on risk, market conditions, and their own auto finance business goals. McKinsey has identified four recurrent archetypes in the market, as some prioritize stability, others chase market share, and a few offer premium financing for brand-loyal customers.

Formulaic Pricing: Cost-Driven & Conservative

- Prices reflect external factors like interest rates and inflation, often passed directly to borrowers.

- Common among banks where auto loans are a secondary focus, particularly in super-prime lending.

- Prioritizes stable margins over aggressive market expansion.

Competition-Based Pricing: Balancing Risk & Growth

- Lenders adjust pricing based on competitive pressures, acting as either price leaders or followers.

- Popular among banks and finance companies seeking market share while managing risk.

- Often applied in prime and super-prime lending to attract reliable borrowers without excessive rate cutting.

Value-Centric Pricing: Focused on Long-Term Market Position

- Delays passing cost increases to customers, maximizing customer value and retention.

- Most effective for lenders with a low cost of funds, efficient operations, or strong dealer relationships.

- Competitive edge comes from scale, operational efficiency, or a full-service financing suite.

Premium Pricing: Niche & Brand-Driven

- Rare in auto lending but used by captive finance arms of automakers.

- Justified through exclusive services, dealer incentives, and brand perks.

- Targets luxury buyers willing to pay for convenience and brand alignment.

What Segment Will You Target?

Each borrower segment has distinct needs, requiring tailored loan structures and messaging to maximize conversions and retention.

- Subprime Borrowers - Usually excluded from traditional financing due to low credit scores, and need structured repayment plans with risk-adjusted terms. Lenders mitigate default risks by offering higher interest rates, extended loan durations, or alternative credit assessments such as income verification. Success in this segment depends on balancing accessibility with sustainable risk management.

- First-time Buyers - Often struggle with loan terms and approval processes. Providing educational tools, transparent pricing, and pre-approval options simplifies decision-making and builds confidence. Lenders that guide these borrowers through the financing process can foster long-term loyalty while capturing a growing market of younger consumers.

- Luxury Buyers - Prioritize exclusivity and convenience over cost. Concierge-style financing, extended credit lines, and loyalty-driven perks cater to their expectations. Captive lenders and premium financial institutions dominate this space by integrating financing with brand-driven incentives, ensuring a seamless and prestigious borrowing experience.

- Budget-Conscious Buyers - Focus on securing low interest rates, rebates, and clear loan terms. Competitive pricing, promotional financing, and transparent conditions appeal to this segment. Lenders that emphasize affordability and value-driven offers can attract and retain cost-conscious borrowers while maintaining healthy loan volumes.

Who Are Your Competitors?

Knowing your own loan offerings is just the baseline – the true market advantage comes from understanding how others play the game. Direct competitors reveal how similar lenders price, package, and market their financing, but the real insights come from looking beyond your immediate rivals.

Banks, fintech disruptors, and captive lenders all have different strengths; some leverage AI-powered risk models, others push instant digital approvals, and some use bundled incentives to lock in customers. Are competitors cutting rates to capture market share or focusing on high-margin premium financing? What’s working, and what’s missing? Altogether, these insights can reveal market gaps and areas for differentiation.

What is Your Unique Selling Point?

Blending in is a fast track to irrelevance… Car buyers have many options, so why should they choose you? Some lenders thrive on speed, offering instant approvals and frictionless digital experiences, while others focus on premium, concierge-style financing for high-end buyers. Competitive edge can also come from transparent pricing, flexible repayment structures, or embedded finance solutions that integrate seamlessly with dealerships and online auto marketplaces.

How to Start an Auto Finance Company: Next Steps

Develop a Strong Business Plan

Without a clear roadmap, even the most ambitious lenders risk getting lost in a sea of competitors. A sharp business plan outlines where your company fits in the market, how you’ll attract borrowers, and what strategies will drive long-term profitability. Below, we expand upon the most essential components that should be included in your business plan:

| Section | Key Components | Purpose |

|---|---|---|

| Executive Summary | Car financing business overview, market opportunity, financial highlights, funding needs. | Provides a high-level snapshot to engage investors and lenders. |

| Business Structure & Management | Legal structure, ownership breakdown, location strategy, management team. | Defines auto finance business framework and leadership credibility. |

| Products & Services | Lease types, vehicle fleet, value-added services (maintenance, insurance, roadside assistance), customer support. | Highlights service offerings and competitive edge. |

| Market Analysis | Target customers, competition, industry trends, and regulatory requirements. | Ensures market viability and strategic positioning. |

| Business Strategy | Unique selling proposition, pricing model, sales & marketing, key milestones, risk management. | Defines growth strategy and market differentiation. |

| Operations Plan | Staffing, fleet management, technology, supplier agreements, operating hours. | Ensures efficient business operations and service delivery. |

| Financial Plan | Revenue model, operating costs, profitability forecast, funding strategy. | Establishes financial viability and investment potential. |

Secure Stable Funding Streams

Auto finance is capital-intensive, requiring stable funding sources to scale, such as:

- Debt financing: Warehouse lines of credit from major banks.

- Equity financing: Investors specializing in fintech or alternative lending.

- Auto Loan Securitization (ABS): Packaging loans for sale to institutional investors.

- Government & ESG Programs: EV-specific financing backed by green bonds or tax incentives.

Asses Regulations & Specific Car Finance Company Requirements

Regulatory non-compliance has cost auto lenders millions in fines, with Wells Fargo paying $3.7 billion in penalties in 2022 for misconduct in auto lending. Lending is a heavily regulated industry, and missing compliance requirements can lead to lawsuits, fines, or shutdowns:

- State Auto Lending Licenses: Required in most states, processed via NMLS.

- Truth in Lending Act (TILA): Transparency in loan disclosures and fees.

- Fair Credit Reporting Act (FCRA): Governs credit checks and borrower data usage.

Build a Skilled Auto Financing Team

Auto lending requires expertise in risk assessment, compliance, tech infrastructure, and dealership relations, with some of the most important roles being:

- Chief Risk Officer: Designs credit scoring models and loss mitigation strategies.

- Compliance Officer: Ensures state and federal lending law adherence.

- Loan Underwriters: Manage borrower risk profiles.

- Tech & Product Managers: Develop loan origination platforms and digital underwriting tools.

Plan Marketing Activities

To really make your auto loan business stand out, your marketing approach should spark genuine interest and guide customers from curiosity to action. The moment someone types “How do I finance a car?” is the moment you want your business to appear, not just as an option, but as the obvious choice.

A strong digital presence puts you exactly where customers are looking. Invest in search-driven marketing so your brand ranks when financing questions arise. Make your website useful, clear, and interactive—loan calculators, side-by-side rate comparisons, and real customer stories turn passive visitors into engaged prospects. When information feels effortless, decisions follow.

But beyond the digital screen, real-world connections matter. Strengthen relationships with local dealerships to integrate financing directly into the car-buying process. Explore partnerships with insurance providers, repair shops, and gig economy platforms where financing plays a crucial role. These touchpoints position your business in the natural flow of car ownership.

Evaluate Adequate Auto Loan Structures

Lenders must offer loan structures that balance borrower affordability with profitability:

- Direct Auto Loans: Borrower applies directly (higher control, slower volume).

- Indirect Lending (Dealer Financing): Loan provided through dealerships.

- Lease & Balloon Financing: Alternative loan structures gaining traction in the EV and fleet markets.

How to Choose the Right Technology for Your Auto Loan Company

Traditional, paperwork-heavy processes are giving way to seamless, data-driven lending models, where loan approvals happen in minutes instead of days.

Choosing the Right Model: Build, Buy, or Integrate?

Lenders must determine their car loan business structure before selecting a technology solution. API-driven integrations work best for fintech firms or automakers expanding into lending, connecting with banks, credit bureaus, and dealership networks. Standalone platforms require a full-stack Loan Origination System (LOS) with automated underwriting to manage high loan volumes. For those building from scratch, modular, cloud-based systems offer flexibility but demand higher investment and compliance oversight.

Off-the-Shelf vs. Custom Tech Solutions

Any automobile finance company can choose between pre-built lending software, custom-built platforms, or hybrid approaches. Some solutions offer quick deployment but limit customization. Fully custom platforms provide maximum flexibility in underwriting and borrower experience but require high upfront costs. A hybrid model combines off-the-shelf infrastructure with custom AI and automation layers, balancing speed, scalability, and adaptability.

From Idea to Execution: Structuring Your Car Finance Business

Process automation can be the ultimate catalyst for accelerating the growth of an innovative auto loan business, but it requires a strategic approach. HES FinTech brings in-depth industry knowledge and 10+ years of experience, we focus on practical solutions that streamline operations, enhance risk management, and ultimately increase profitability.

Propel your car finance company

Expertise You Can Trust - 10+ Years of Industry Leadership

Our team’s decade-long expertise in the auto industry helps you navigate every phase of the process, ensuring that automation is much more than just a tool but the backbone of a future-proof car loan business model.

Ready, set, grow! With HES FinTech, you propel your car finance company into the fast lane.