Over the past decade, digital transformation still stays on top of people’s minds. According to projections, the global DX market is anticipated to reach $1,009.8 billion by 2025, exhibiting substantial growth from its 2020 value of $469.8 billion. This represents a CAGR of 16.5% throughout the specified period.

IDG projects the second largest industry to adopt the digital-first approach in 2023 is finance. Technology evolves fast, and following the innovations was never easy both for small and large financial institutions. Let’s take a look at the latest trends on the way to digital finance strategy development.

Get a digital transformation roadmap for your finance business

Want to get a ready-made roadmap for the digital transformation of your finance business? Take a 5-minute quiz. Select the option that most accurately represents your situation. Once you complete the quiz, you will receive a finance digital transformation strategy tailored specifically for your lending company. Your answers are totally confidential.

How to develop a finance digital transformation roadmap

About 70% of companies have a finance digital transformation roadmap or elaborate one. It is clear that to stay at the competitive edge, both alternative lenders and banks should embrace technological advancements. However, there is a lack of actionable insights on how to develop a custom digital transformation strategy. Here is a guide on how to create one.

Prioritise areas for automation

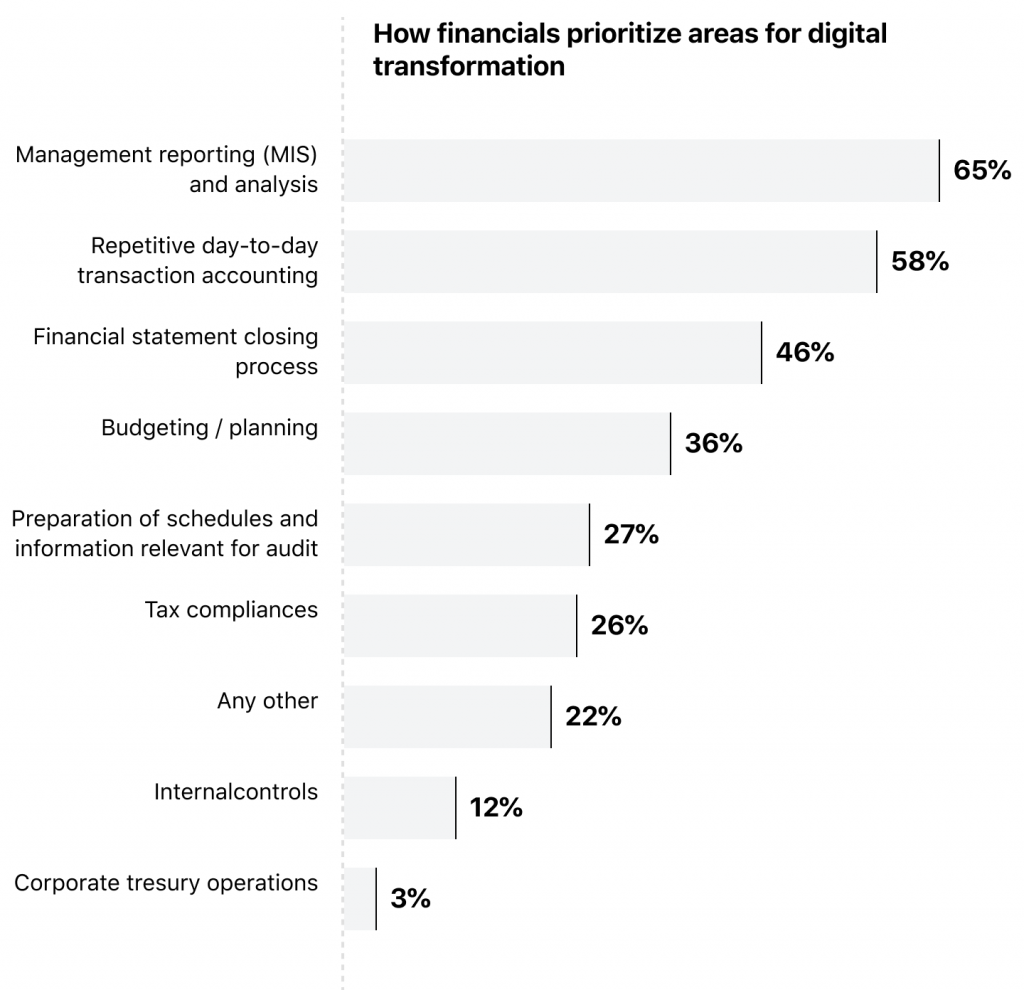

In a survey conducted by Ernst & Young, it was found that 83% of the respondents identified day-to-day transaction processing, monthly management reporting, and financial statement closing process as their three highest-priority areas for implementing digital intervention. Depending on your company size and finance industry specifics, these priorities may vary. Defining the parts of your finance business workflow that have to undergo digitalization in the first place will help you estimate the potential budget and time resources, needed for digital transformation of financial services.

How to choose areas for automation in the finance business

In order to prioritize areas for automation, finance businesses should conduct thorough research on their business performance issues and pain points. Here’s how to do it effectively:

- Speak with employees, managers, and stakeholders to gather insights on areas that require improvement or modernization. The specialists can highlight some processes, that need to be optimized the most.

- Set measurable goals, that you want to achieve through digitalization. For example, it could be improving operational efficiency, enhancing customer experience, reducing costs, or ensuring regulatory compliance.

- Dive into the industry’s best practices. Seek digital expert advice or competent fintech guidance from a professional. Look at what successful competitors or industry leaders are doing to stay ahead.

- Assess the potential impact and feasibility of adopting digital solutions in different areas of your finance business. Some areas may have a higher priority and be easier to implement, while others may require more resources and time.

- Set a high priority to improving customer experience. Online customer portals, mobile banking apps, or personalized financial advice can enhance customer satisfaction and loyalty and boost your profit.

- Note the time-consuming manual processes, which can be automated using technology. This can free up employees' time to focus on more strategic tasks.

- Evaluate the ROI and conduct a cost-benefit analysis for each potential digital transformation initiative. Prioritize projects that offer the most significant benefits relative to their costs.

Choose the technology to adopt

While prioritizing your company goals drives cost awareness, picking the right technology to take on board helps to form a clear understanding of the technical requirements you have. Choose the technology stack that would bring maximum impact to optimizing your operations.

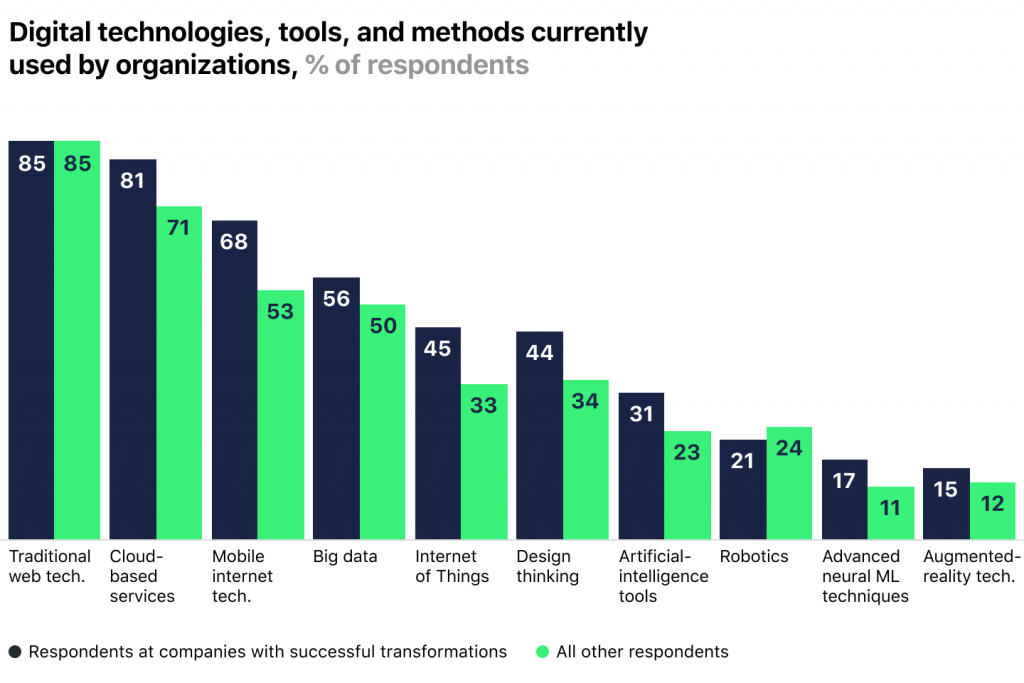

For example, Deloitte’s survey has shown, that 85% of companies that successfully completed digitalization took web technologies in place. This approach will help you to choose the qualified fintech partner or software vendor to trust your finance business digital transformation strategy implementation to. Additionally, a clear vision of features your business needs will facilitate communication with business analysts, ensuring better matching of the complete digital solution.

How to choose the right technology to adopt for finance business automation

Once the digital transformation objectives are set, it’s time to list your technology requirements. Evaluate your existing technology infrastructure, software systems, and tools. Next, identify gaps and limitations that need to be addressed to align with your digital transformation goals.

- Choose technologies that can scale with your business's growth and are flexible enough to adapt to changing market conditions and customer needs.

- Ensure that the chosen technologies can seamlessly integrate with your existing systems. A well-integrated tech stack reduces data silos and improves efficiency.

- Prioritize technologies that comply with industry regulations and security standards. The financial sector deals with sensitive customer data, so robust security measures are essential.

- Consider moving your systems and databases to the cloud. Cloud technologies offer cost-effectiveness, easy accessibility, automatic updates, and scalability.

- The back-office technology you adopt should have user-friendly interfaces and be easy to learn by your employees.

- Explore how artificial intelligence and automation can streamline processes, enhance decision-making, and provide personalized customer experiences.

- Technologies that enable robust data analytics and business intelligence capabilities must become a priority. Data-driven insights drive more precise decision-making and identify growth opportunities.

- Mobile-friendly front end and apps are moving the needle forward. Responsive design and mobile compatibility are crucial to providing your customers with an omnichannel experience, as today's customers prefer on-the-go access.

- Before fully committing to technology, consider running a proof of concept to assess its viability and suitability for your specific business needs.

Find your technology provider

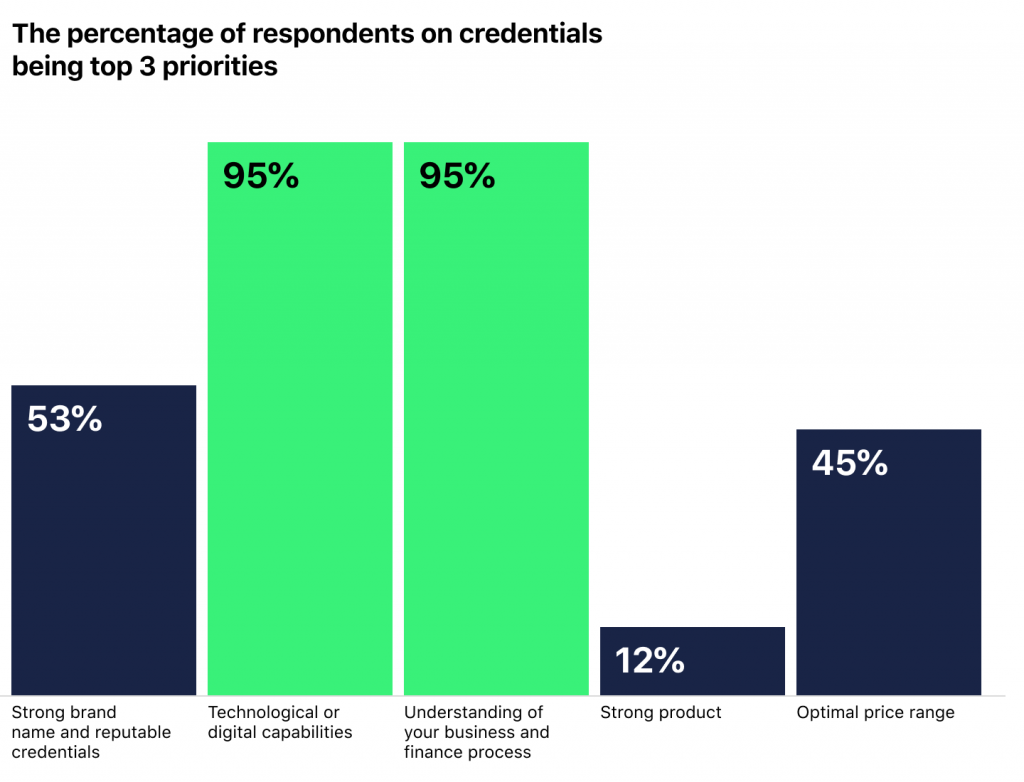

According to Ernst & Young survey, 72% of respondents have well acknowledged the challenge to select the right implementation partner. The key factor for successful digital transformation in the finance industry lies in the creation of a highly detailed, clearly articulated, and comprehensive document outlining the business requirements. This document should encompass both current and future scenarios, providing a solid foundation for the DX process.

Aligning expectations among the finance team, IT team, and implementation partner is crucial. This alignment serves as the initial critical step towards achieving optimal outcomes during the finance digital transformation journey.

Equally important is the need for the technology partner to demonstrate rationality in their commitments and deliver on their agreed-upon responsibilities. The digital solution provider, in addition to their technological expertise, should possess a deep understanding of finance processes and sector knowledge.

How to choose a fintech provider for digital transformation

Proceed to the next stage of your finance business's digital transformation after outlining the business requirements. Find the right technology provider to implement your roadmap. Before you select, outline the desired outcomes, scope of the project, and the necessary technologies and solutions to avoid any potential issues.

- A track record of successful digital transformation projects and experience in the financial industry are important factors to consider when researching the fintech market for potential technology providers that offer relevant solutions to your needs.

- To evaluate the trustworthiness and standing of each technology supplier, it is vital to examine their customer feedback, testimonials, awards, and case studies. Browse through independent platforms like Software Suggest, Capterra, Clutch, Gartner, etc. rather than the company website to find sincere and unbiased testimonials.

- Consider the scale and reliability of the tech suppliers. Bigger, well-established businesses can present wider-ranging solutions and better assistance. Alternatively, smaller firms may deliver a more tailored approach and affordable rates.

- Make sure that the technology provider's solutions are compatible with your existing systems and can seamlessly integrate into your current technology stack.

- Inquire about the technology provider's security measures, data protection policies, and compliance with industry regulations.

- Choose a technology provider that can offer scalable solutions and future-proof your digital transformation roadmap to accommodate your business's growth and changing needs.

- Request detailed proposals and cost estimates from the shortlisted technology providers. This may require the work of business analysts to reveal your current demands. Compare the offerings and pricing to determine the best fit for your budget.

- Find out whether the fintech company provides the support and training. Ensure they provide sufficient training to your team members to effectively use and manage the implemented solutions.

- Clarify the project timeline and milestones with the technology provider. Make sure they can deliver within your desired timeframe.

- Involve relevant stakeholders from your finance business, such as IT professionals, finance leaders, and end-users, in the decision-making process to gather diverse perspectives and ensure buy-in.

Support a digital-savvy mindset among your team

As per McKinsey, a significant 70% of digital transformations end up failing, and one of the most common reasons for these failures is resistance from employees. The reluctance or opposition from the workforce to adapt to and embrace the changes brought about by digital transformation strategies can hinder successful implementation and lead to suboptimal outcomes. Overcoming this resistance and ensuring employee buy-in is crucial for achieving successful digital transformations.

For large financial enterprises, it may be a good idea to have a digital-savvy leader in place. Less than one-third of all respondents to McKinsey’s survey say their organizations have engaged a chief digital officer (CDO) to support their transformations. But those that do are 1.6 times more likely than others to report a successful digital transformation.

Ways to cultivate a digitally adept mindset within a finance business team

Digital mindset starts with the leaders. Demonstrate a digital-savvy mindset by embracing technology, being open to change, and continuously learning about digital trends and innovations. Then proceed to creating an environment, that would encourage early adoption and tech curiosity.

- Request free training for your employees from a technology provider. Fintech product managers can highlight new features and communicate the most effective ways to utilize them.

- Organize workshops, seminars, and training sessions to educate your team about the importance of digital transformation in the finance industry. Success stories and case studies will help you to showcase the benefits of being digitally adept.

- Help your team understand the significance of delivering a personalized customer experience through digital channels. Focus on how technology can better serve customers and meet their needs.

- Allow team members to experiment and gain hands-on experience with small pilot projects and software demos to understand digital tools.

- Create a feedback loop where team members can share their experiences and suggest improvements regarding digital adoption. Be open to adapting strategies based on feedback.

- Acknowledge team members who demonstrate a proactive approach to digital transformation. Recognize and reward innovative ideas and successful implementations.

- Encourage your team to stay updated on the latest trends and innovations in the finance and technology sectors. This knowledge will help them identify opportunities for digital improvement.

Digital transformation in finance and lending: 2023 industry trends

To complete your understanding of the finance digital transformation roadmap, take a look at the current market insights.

The digital transformation adoption rate in finance

- Financial institutions are notably slow to begin their digital transformation process. 27% of senior executives believe digital transformation is a matter of survival, and 59% of companies are afraid it might be too late for them to adjust.

- A Forbes study states that 75% of banks and credit unions have started a digital transformation program.

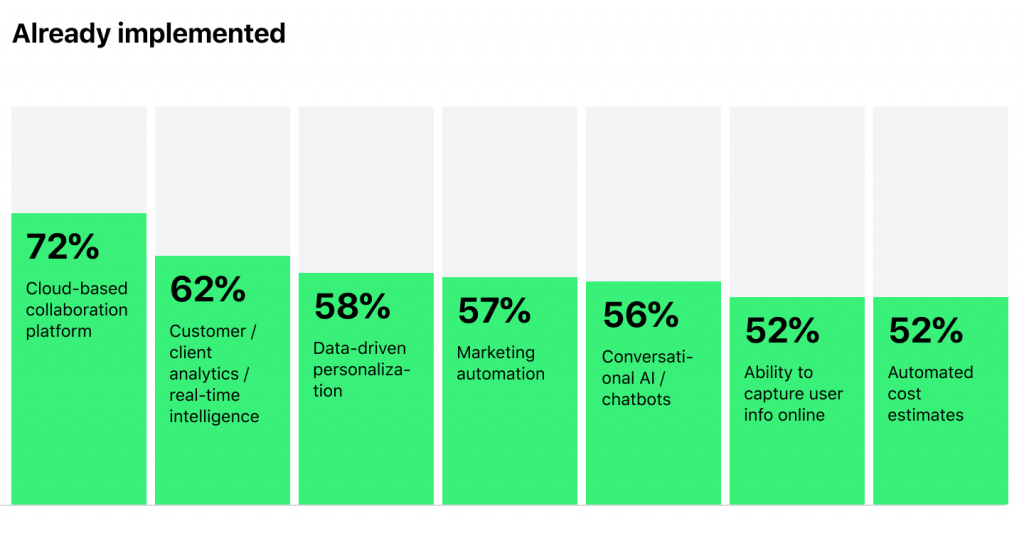

- BDO USA reports that by 2021 most financials have already shifted their finance business strategy towards cloud-based digital solutions and successfully automated their business intelligence:

Digital transformation impact

- 45% of higher digital maturity companies reported that their net revenue growth was significantly above their industry average.

- A study by McKinsey found that organizations that have embraced digital transformation are 26% more profitable than their peers

- In 2023, the digital transformation market in the US will generate an estimated revenue of $350 billion.

Future predictions for digital transformation in finance

- The Global Digital Lending Platform Market is forecasted to grow at a CAGR of 25.34%, to reach a staggering USD 104.74 billion by 2030.

- By 2025, around 75% of business leaders are expected to utilize digital platforms and ecosystem capabilities to enhance adaptability and future-proof their platforms.

- According to research by Altimeter, ~54% of DX efforts are dedicated to modernizing customer touchpoints, while 45% of efforts are focused on developing customer-centric solutions.