Unpaid bills and debt can add up. According to research, on average, small businesses in the US accrue over $85,000 in unpaid invoices. Of these, over 81% are 30 days or more past due and this can have a significant effect on employee pay and overall sustainability. Some of the most-affected industries are unsurprisingly information technology, wholesale trade, construction, and logistics.

However, this effect isn’t limited to business. Financial industry players, such as banks and fintech firms, suffer too. Non-performing loan write-offs are a growing issue and can create long-reaching issues, such as increased rates and inflation. But how to tackle this issue? While there are no 100% iron-clad guarantees against unpaid loans, adding or upgrading your consumer debt collection management system can limit the damage and ensure you take the correct steps to debt recovery. Here’s how.

Read also

Industry Needs for Debt Management and Collections System

Default on credit and unpaid bills happen across all industries. While it’s never an ideal situation for a business, there are some steps you or, if you’re lucky enough to have one, the Accounts Receivable department (AR) can take. But before we look at the solutions. Let’s take a quick glance at how defaulting affects different business areas.

- Small and medium sized enterprises—unpaid invoices can add up for SMEs. Often operating on small margins and with less resources for debt recovery small and medium enterprises and suffer acutely from unpaid invoices. This affects sustainability and the ability to pay employees. According to the World Bank, SMEs account for 90% of all businesses worldwide and over 50% of employees, making them a powerful economical asset.

- Large corporations—although some unpaid invoices for large enterprises shouldn’t pose too much of a problem. These can add up over time, and this is particularly an issue if this continues for a long period of time. Unpaid invoices become harder to monitor and their cost of recouping the money or even the possibility to do so go down.

- Financial industry players—correctly predicting risk is a challenge for any financial provider. No matter how much you do, there will always be some circumstances where your clients fail to pay, for whatever reason—lost employment, forgot about payment dates, etc. Engaging debt management and collections systems help to monitor which debts should be collected and when and if it is financially viable to do so.

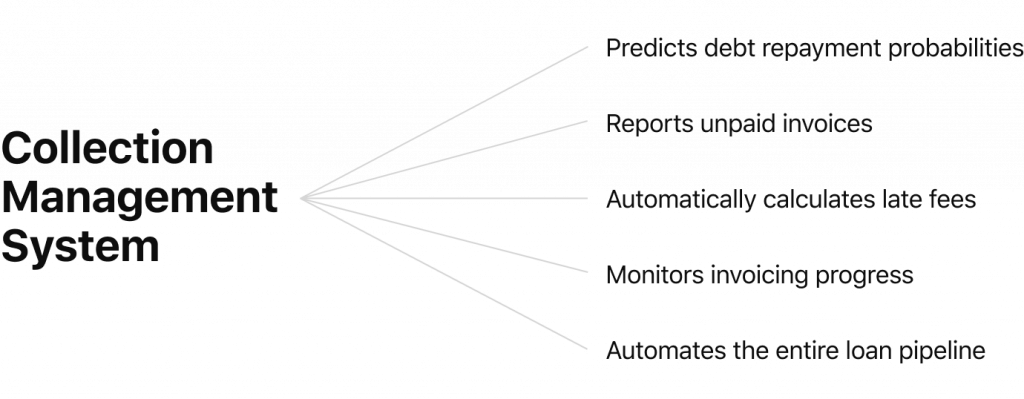

How Collection Manager Software Reduces Losses

Getting the right tools on hand early in the process can help reduce a backlog of unpaid invoices and overdue loans. Instead, your business or service provider will tell you who owns what and when. Here’s how collection management software can optimize your business and ensure losses are reduced.

1. Alerts you to unpaid invoices

Knowing is half the battle. While it can be tempting to bury your head in the sand over unpaid invoices or loans, this approach will not help anyone—especially not your team. By being aware of how many invoices remain unpaid or loans defaulted on, you can be equipped to make the next strategic steps for your business whether that be a loan freeze, increase in interest rates, or something else.

2. Automatically calculates late fees

Unfortunately, delayed payments are costly. Not only do they impact the cashflow through the company, but they can also have very real consequences for the team who may rely on such invoices being paid on time. By automatically calculating late fees you can remain fair to your employees and still ensure the viability of your business, without all the stress of thinking whether or not you’re overcharging.

3. Monitors invoicing progress

Depending on the size of your business or organization, you may be experiencing a different challenge in this area. For SME the lack of employees can prove to be a challenge when it comes to monitoring who paid and hasn’t. For larger firms, you may not yet have established practices and debt is building up. And for banks, the sheer scale can prove a challenging marker for optimizing the debt collection process. Having technology onboard from the beginning ensures you have the data you need to make decisions and follow them up throughout the loan processing.

4. Automates the entire loan pipeline

It’s likely that no matter the type of unpaid bill or defaulted debt, the process started with the best of intentions. In the future, we say, forget wishful thinking and instead, use the numbers and available data to back-up your decisions. But how? With so much data around, it can be hard to keep track, let alone process it and get useful insights. In this case, it’s essential to onboard smart tools and technology that help your business work with Big Data to set the rules for lending. Next, it’s time to automate your internal processes and keep track of all those documents and risk assessments, they will prove vital. Next, track your loans and detect any irregularities early. By utilizing the right tools, you can keep on top of who paid and who hasn’t while ensuring you’re in the best position possible for future planning.

5. Lets you know when to let it go or seek assistance

Sometimes collecting on a debt or unpaid invoice is more costly than the value of the bill or loan. But how can you calculate this ratio, so you know where an individual debt falls on this scale. Software solutions, such as GiniMachine, allow you to assess the likelihood of the debt being paid and the cost to the business to retrieve it—ensuring maximum probability of repayment.

Getting the Right Tools at the Right Time: Credit Management Collections Software

At HES, we create smart solutions for the entire loan process from origination to fulfillment. When things go wrong, and sometimes, they do, our team helps ensure you are prepared by having the right technology— consumer collection management software—in place to quickly manage the debt or unpaid bill collection process. This is vital no matter whether you are a small business or large company and putting these steps in place early makes sure you are in the best position to tackle the challenges of defaults on credit.

Interested in automated debt collection? Get in touch with HES to book a live demo tour.