Over the past year, since the beginning of the global pandemic, we have observed fascinating shifts in consumer banking, borrowing, and spending patterns. Debt is increasing, but so too are deposits, and it’s all too clear that US consumers are seeking alternative ways of finance, stepping away from the traditional lending arena. But what do these trends indicate, and what could they mean for the future of the financial market and loan offerings? Let’s take a closer look.

Read also

How the US Banking and Lending Landscape Looks Today

Digital transformation in the financial services sector has created the never-before-seen potential for consumers to access services not only where they want and how they want, but also with whom.

In addition to traditional providers, brick-and-mortar banks that are advancing their digital infrastructure, new providers, such as the so-called alternative lenders, are entering the market and gaining ground. However, that does not mean traditional facilities have lost the battle and should give way to newer providers. Here’s how the US lending and spending landscape looks today.

Debt increases

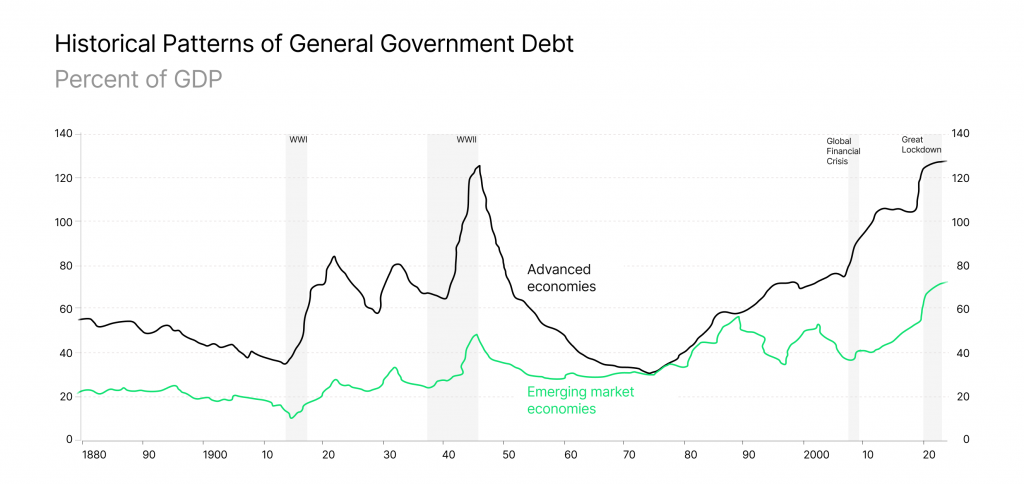

Since the beginning of the coronavirus crisis, we have seen massive increases in debt, not just in the US but around the globe—almost surpassing that of the post-World War II era. From July 2020 to July 2021 alone, debt in the US has climbed from $26.5 billion to over $28 billion. Both individuals and businesses felt the pinch of a receding economy, as governments took measures to stabilize the economy and introduced programs not only combating COVID-19 but also for individuals and businesses too, such as the PPP (Paycheck Protection Program) program.

Deposits grow

Yet, despite an increase in the overall level of debt, at the same time, we are also seeing something quite peculiar—a growth in deposits. While the economic dip as a result of COVID-19 may be considered similar to that of the 2008 financial crisis in terms of its economic effect, the market reaction is not. US financial consumers are saving now more than ever before. As of August 2021, the total in US deposit accounts is around $17.4 billion, a rise from $13.5 billion back in February 2020. However, in Q1 2021, this even hit an all-time high of $18.5 billion.

The US lending and banking turns to non-traditional FSPs

At the same time, we are almost observing another market trend. Alternative financial providers and services are entering the market at a fast-growing rate. Today, 14.2 million Americans use alternative banks exclusively, with peer-to-peer lending having an estimated value of $44 billion+ by 2024. As a market of acceptance to the era of digitization and to be able to retain their market share, even traditional providers are adapting their services to meet modern demand. For example, card giants Mastercard and Visa have invested heavily in acquiring fintech firms, and brick-and-mortar banks are focusing on upgrading their digital offerings to include a range of services from online banking, mobile banking, digital KYC, online loan approvals, and more.

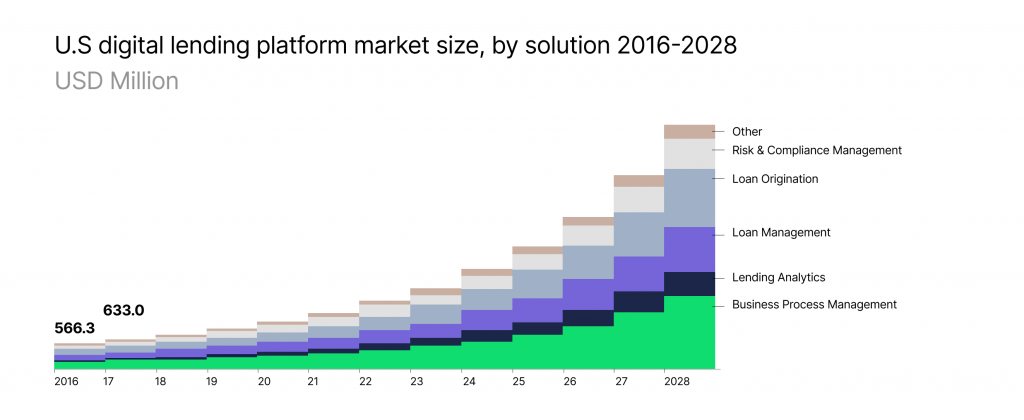

Analyzing the Grand View Research, the North American market segment exceeded the ⅓ market share of the global revenue, being home for large lenders. The financial institutions of the US aggressively invest in R&D and introduce innovations, new product launches, and mutual agreements as a vital part of differentiating themselves from competitors. Partnerships are an integral part of building a better customer experience: banks partner with lending platforms to cater to growing consumer demand for digital lending and mobile lending. The dynamics of the digital lending platform market size look the following way, with precise figures available in that report:

Digital Lending Industry Predictions for 2021 and Beyond

It’s clear that the financial market as we know it is changing and faster than ever before. The coronavirus crisis served as a catalyst for digital transformation. US financial services consumers, fueled by uncertainty, seeking security and financial freedom, are becoming more vigilant with their money and savvy about the lending services they access.

So, what does this mean for the future of lending and finance in the US? And where should providers focus their energy if they want to remain relevant in 2021 and beyond? These are our top predictions for Q4 2021 and further.

A more expansive range of financial products

Consumers want more. No longer can a bank or financial provider deliver a limited number of loans and expect that a one-rate-fits-all approach will work. Instead, clients are demanding a wider range of options available from online banking to digital onboarding, in-app trading to loan applications, and everything in between. Essentially, banking providers need to deliver a variety of services all-in-one place, and at a competitive rate. Otherwise, their clients may seek alternative providers that can deliver.

Personalization at every step

It’s all about that personal experience from the first time you walk in the door to the moment you close it behind you after a successful transaction. Or, in this case, from the moment you tap on the icon on your smartphone till the second you close the app, having completed what you need to do. No matter how you access the lending services, you want to feel valued as a customer, and so do your clients. That’s where personalization comes in.

Personalization is all about adding intelligent tools that help connect the user to the financial services, whether this is the first, “Hello, John,” to tailored customer services and personalized tools to help them get there. No matter the financial instrument or how your series is accessed, it needs to be personalized and meet the needs of your clients.

Digital transformation, flexibility, and trust required

Competition is out there, and it’s the new reality for traditional financial providers that they no longer stand unopposed as market leaders. Alternative financial providers, such as neobanks, peer-to-peer lenders, and alternative providers, are closing the market gap. But does that mean that brick-and-mortar stalwarts should give way to the new generation? No, not completely, but it is time to take the competition for what it is—competition. Traditional providers will need to deliver greater flexibility on the products they offer to keep clients on board.

Meanwhile, for newer service providers, this doesn’t mean that the race to the top is not without its hurdles. It will take some time before they gain the level of trust as traditional providers, which is indicated by the lowish number of neobank-only account holders—many still prefer a combined approach to their finances.

Smarter lending for all

If the coronavirus crisis has taught us anything, it’s that we need to be vigilant both when it comes to our health and our finances. Today’s financial consumers are specifically seeking new methods to manage their money smarter, and it’s up to the market to deliver. Tools such as artificial intelligence and machine learning can help both traditional and alternative providers to design systems that work for their clients. From setting up an intelligent chatbot that answers within sectors to an AI-based credit scoring system that lowers risk across the board, the opportunities are almost endless. However, it is up to companies to decide which one will work for their needs to meet market demand.

Automation creates efficiency

It’s not just the range of services that matter. It’s also how fast you can provide them. After all, as they say, “time is money.” Both for businesses and their clients, automating processes offers unlimited benefits. For example, clients save time, get the services they desire, and leave with positive customer service due to efficiency. For businesses, time really is money. Automating loan origination and loan management processes, such as document-making or account approvals, helps get clients to access services faster. Meanwhile, staff can concentrate on more important tasks, such as customer service.

Read also

What’s Next for Finance?

As we move into an exciting new era in US lending 2021-2025, the door is open for both traditional lenders to upgrade their offerings, making them suitable for a more modern world, and for alternative providers to access the market and deliver something a little different. For consumers, this means a greater range of flexibility, designed to suit their needs with speed and agility. Meanwhile, for business, it’s an opportunity to upgrade before it’s too late.

By looking at the current trends and market sentiment, we can see that the effects of coronavirus are here to stay for a while yet. Yet, still, there is an opportunity for providers to understand how the market is changing a move with it to seek new levels of success in our new normal.

Ready for digital transformation? Contact us to learn how the HES Lending Platform can augment your growth.