This article is aimed at discovering the Digital Lending strengths, weaknesses, and opportunities in Europe, provide valuable insights on regions, specific EU countries, loan products, and services. Also, we are going to talk about industry-specific prime challenges and forecast the lending industry development.

Before we narrow down the market analysis to the European countries, it is important to give an outline of the current global digital lending ecosystem and its expected dynamics in the upcoming 5 years.

Digital Lending Market Globally

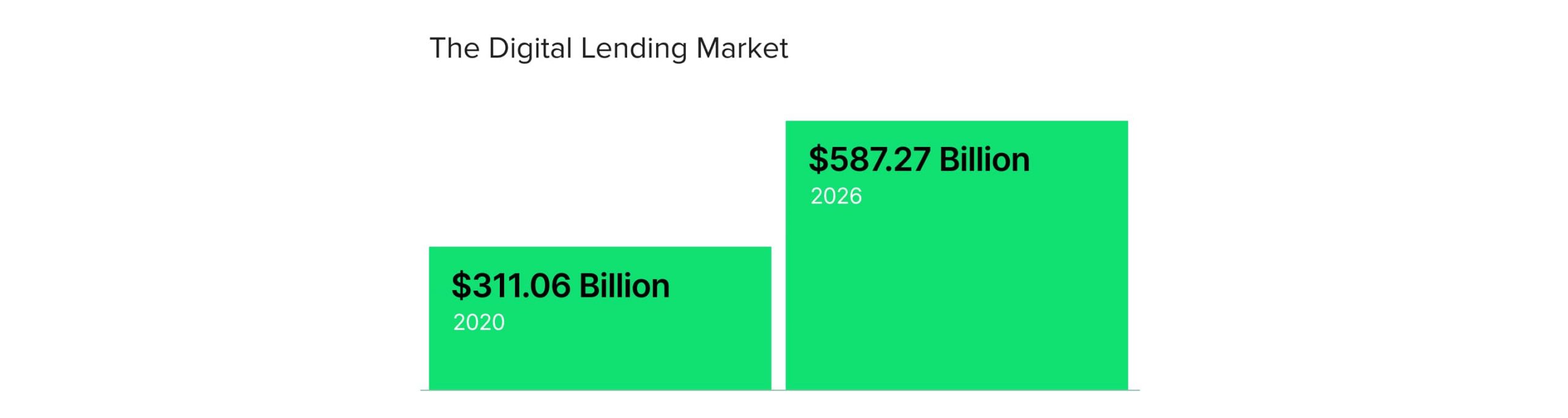

- The global Digital Lending Market is expected to register a CAGR of almost 12% in the upcoming 5 years (2021-2026). Because of the well-known pandemic events, SMEs and individuals worldwide faced challenges to obtain credit to keep their businesses operating and their households safe.

- According to the Mordor Intelligence market study, the digital lending market was $311.06 billion large in the unstable 2020 and is expected to demonstrate an almost two-fold growth by 2026, up to $587.27 billion.

- The regional digital lending growth rates in Europe and EU can be compared to those in the USA and Canada – medium-level. High growth rates are noticed in the Asia-Pacific region and Australia. Africa and South America develop digital lending at a slower pace.

Read also

Lending in Europe and European Union

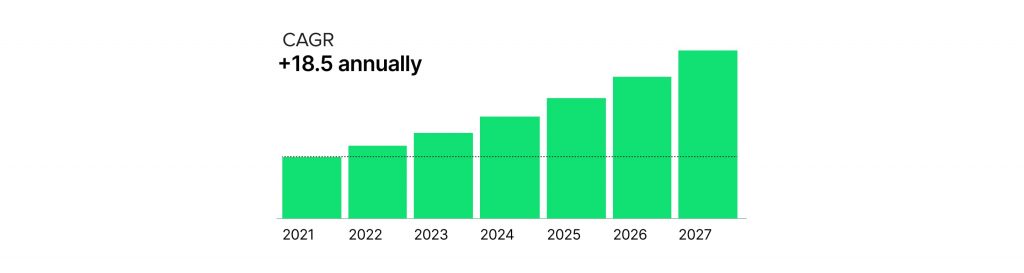

According to the Data Bridge Market Research, the European digital lending platform market in 2021-2027 is demonstrating planned growth with a CAGR of 18.5%. The figure is expected to exceed $3.518 million in the upcoming years. The most substantial contribution to the European market growth is likely to be provided by German, UK, French, and Belgium banks and fintechs. According to experts, the key driving factor is quite predictable – the high demand for digital lending services at the fingertips.

The loan application services will move towards a paperless and effortless trend with the impeccable customer experience on the pedestal – as far as the user-facing digital lending software is concerned. As for the most notable back-end challenges, cybersecurity issues are highly likely to remain in the focus area.

The post-pandemic economy recovery in European countries will also act as a favorable condition for lenders, and, subsequently, for digital lending platform providers. The trust in traditional financial institutions will remain high, but easier access to digital services will help alternative lenders compete with banks more actively.

This is what is going to be an additional opportunity for the digital lending platform market: whether integrated into the Core Banking, provided as embedded lending, or as a separate service.

European Digital Lending Platform Market: Insights and Trends

The digital lending platform market in Europe is segmented by loan types, verticals, subscription types, and deployment models. Analytics of segments can help reveal niches for growth, the target markets, and the right strategies to follow.

On-premises VS cloud-based

The dynamics of deployment models in the 2020s are changing: the on-premises deployment model is still dominating the digital lending market, especially for large enterprises with pre-installed legacy software, but cloud-based solutions are growing at a significant rate.

OOTB vs custom

As for the lending platform type, the digital lending software market in Europe/EU is divided into out-of-the-box solutions and configurable software. Readymade solutions are more popular as out-of-the-box products are faster to deploy and more economically sound for startups. Custom software solutions require a higher initial investment but incur more scalability and opportunities for growth.

Loan amount size

If we classify lenders by the loan amount size, the dominating market segment is consumer lending, usually microlending, up to $7 thousand. The popularity of this segment category can be explained by more customers applying for such types of loans via digital channels. At the same time, it is worth mentioning that the largest category ($ 7,001 to $ 20,000) demonstrates significant growth at a higher CAGR.

Loan type

Based on the type of loans, the lending markets are segmented into mortgage loans, automotive loans, SME financing, personal loans, and more. As for the European lending market 2021-2025, auto loans hold the largest market share. This can be explained by the increasing vehicle sales in that region on an installment basis.

Verticals

The European lending market, like other regional markets, is segmented into banking, non-banking financial services, insurance organizations, P2P lending businesses, credit unions, as well as saving associations. It’s quite predictable that according to the research, the dominating vertical is banking that implements loan origination, loan management, and portfolio management digital solution from software vendors.

Regions

The UK is currently dominating in Europe for the digital lending platform market, and the trend is likely to remain in 2021-2025. The United Kingdom is investing a lot in financial technologies RDI and startup support. The growing economy and the technical literacy of the UK population are the supporting factors for the expanding digital infrastructure of financial services.

Partnerships

Partnerships, financial ecosystems, joint ventures, and other ‘collaboration instead of competition’ strategies improve the brand’s market share due to higher coverage and presence. This trend is noticeable in the European market as well.

Psss… Wanna start lending within 90 days?

Non-Bank Lending in Europe 2021-2025

We’ve noticed a rapid growth in finance due to the evolution of non-banking lenders in the European market. Turning from a niche offering to a recognized source of finance to reputable European business, alternative lending now serves SMEs and mid-market companies that previously relied on bank financing to a greater extent.

Neobank lenders are a valuable source of investment capital and are potent to meet the market needs in a more personalized offering. All that makes alternative lending a more serious market player than we could imagine 7-10 years ago. A favorable factor that contributed to this growth was the re-evaluation of the policymaker’s approach to the regulatory framework.

According to The Alternative Investment Management Association (AIMA), the points of improvement in the regulatory landscape should include:

- Removing barriers to the flow of capital markets to European businesses

- Facilitating knowledge exchange between stakeholders of alternative lending activities in the European region

- Ensuring that non-bank lending and the regulations benefit borrowers and improve the financing of businesses and innovations.

Alternative sources of finance improve market liquidity thus promoting financial stability and spreading risks among investors more evenly. Non-bank lending supports health competition: it motivates the banking sector to improve its offering and can help alleviate economic shocks in crisis times when banks tend to be more cautious or unwilling to lend. With all these advantages to the economy and the borrowers, there are no signs of alternative lending losing its current position. Quite on the contrary, it is like to reinforce its presence on the market and demonstrate impressive growth.

Lending is not banking

The most sufficient difference is that non-bank lending is based on investors’ capital rather than customer deposits. All that leads to a strong alignment of interests: investors and alternative lenders play for the same team and bear the same risks.

This is why any attempts to over-impose a banklike regulatory landscape on alternative lenders are highly likely to limit the potential benefits these market players bring.

European lending and regulations: necessary measures or unwanted obstacles?

The regulation of non-bank lenders in Europe ensures the following statements are true:

- Non-bank lenders in Europe are already authorized and supervised by NCAs – national competent authorities

- They support the liquidity profile of their lending activity and ensure the funds’ liquidity arrangements

- Alternative lending performs thorough due diligence and loan underwriting on any type of loan application they receive

- They identify and monitor risks associated with the lending activity via risk management systems

- The lending activity is followed by detailed reports to investors and NCAs.

At the same time, NCAs offer the needed tools to supervise non-bank lending in Europe. Additional regulatory measures for alternative lenders should only be considered when the existing risk management procedures and AIFMD approved regulatory oversight tools may lead to excess risks or are insufficient for non-bank lending activity management.

The policymakers need to adopt a proportionate approach towards non-bank lending regulation and supervision. As the market is growing, and the access to data is improving, further dialog between the industry and the regulatory authorities is dramatically required to support market sustainability.

Policymakers, supervisors, and lending businesses need to bring their efforts into synergy to enhance the growth of non-bank lending and drop the threshold for accessing finance. The authors of the research believe that we enter the first stage of the great lending market collaboration.

Read also

The Bottom Line

Despite regulation challenges and post-pandemic market turbulence, the digital lending ecosystem in Europe and European Union is intensively expanding and actively involving more banks and financial service providers.

Lending is likely to head to paperless and effortless procedures with exceptional attention to customer needs and convenience. Cybersecurity will still dominate as one of the key issues to be addressed in the digital lending growth.

Going to scale your lending business in Europe? We are ready to help, contact our business development team to learn more.