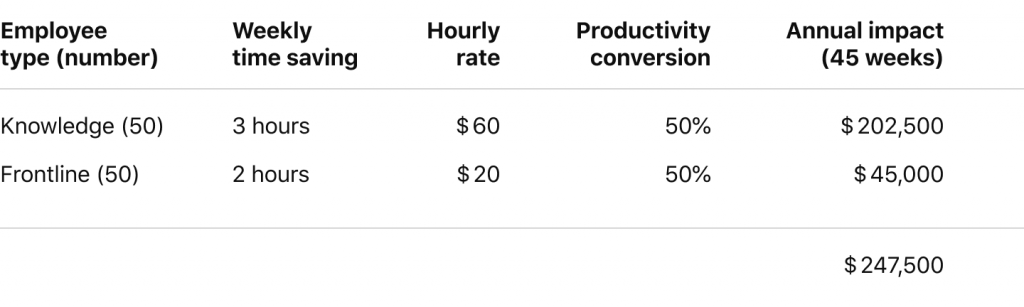

With the rise in AI usage, many may be wondering: “will a robot take my job?” The answer, luckily, is that this is far from the case. 70% of borrowers still prefer to go to a loan officer, meaning the human factor hasn’t lost its touch. However, that doesn’t mean there isn’t room for improvement. Software for loan officers’ collaboration can drive productivity increases of up to 10%, with Forrester estimating this could save organizations ~$250K per year. Although that is good news for lenders, for staff and clients there may be some hesitation to embrace new technology. So, let’s unwrap the mystery and look at how software solves the challenges of loan officers and how to get your team onboard.

Challenges of loan officer efficiency without the right software

Communication isn’t outdated, however, considering the amount of data and number of clients an organization needs to work with, there are ways of making client-company relationships more effective for both parties. Before we dive into the solutions let’s take a look at the challenges, software for loan officers hopes to solve:

- Inefficient communication—calls, emails, letters, these are all ways of keeping in touch with your clients. The only issue is that they require human action to make them happen. This means not only remembering to communicate, but to do so at the correct time. Instead, automation for loan officer communication tools help clients get the right communications at the right time. This can include emails, messages and more. Improving everything from loan processing time to repayment messaging.

- Limited access to information—with the amount of data being produced and stored, it’s no wonder loan officers aren’t just able to pull up the right data there and then. However, with the right tracking system for loan officers on hand, they should be able to find the data more efficiently than they need without a manual search.

- Lack of transparency—as everything is constantly evolving, it can be difficult for all parties to keep on track of the latest changes, leading to lack of transparency and miscommunication. Instead, by having automated tools in place, lending organizations can more easily inform clients of changes, increasing trust and transparency.

Benefits of collaboration software for loan officers

Often underrated, communication is often the key tool to a successful loan process. It can impact how well the client communicates with the lender, solve problems before they happen and reduce risk. Collaboration tools help in a number of ways, improving more than just communication, including:

- Accelerated decision-making—by utilizing smart tools in the decision-making process, lending decisions can be made quicker. CEB TowerGate suggests this could be by up to 50% faster. This means that lenders are able to communicate this decision to the client faster too, so they aren’t kept waiting.

- Smoother workflow—being able to collaborate between decision-makers, clients and other stakeholders more efficiently improves the workflow and leads to streamlined loan applications at all stages.

- Data-driven decisions—lenders have access to huge amounts of information. However, the trick is being able to use it. Software for loan officers helps increase loan decision accuracy by up to 50%, reducing the risk for the client and the business.

- Increased transparency—with loan workflow automation and tracking, all stakeholders can review the application at any stage, meaning clients are less likely to contract loan officers for follow-ups as they already have the information they require.

- Enhanced compliance—regulations are regularly changing and it’s almost impossible to manually monitor and apply changes in time. With the right tracking system for loan officers on hand, lenders can reduce compliance-related costs (including lawsuits) by up to 50%.

What are the must-have features of software for loan officers?

Back Office Automation in Digital Lending: Core Process Improvement IdeasSoftware for loan officers and lending organizations is a diverse field with an almost endless variety of potential solutions. Although just because you can build it, doesn’t mean you should, as unneeded software can cost an organization in more ways than one. That said, there are some common tools that many organizations find helpful. These include:

- Application scoring models

- Loan tracking tools

- Task management systems

- Role assignment capabilities

- Document management

- Relationship management systems for loan officers (CRM)

- Analytics dashboards and reports

Do you plan to automate loan officers work?

How to get your team onboard with your technology upgrade?

How Loan Automation Maximizes the Efficiency of LendingOften, organizational decision-makers are excited when implementing new tools but are surprised when they meet resistance from the team. There are a number of reasons for this, including fears of using new technology, the perceived risk of being replaced by AI, and reluctance to change. That said, it doesn’t have to be this way. Here are our tips for a seamless software integration journey:

- Involve loan officers from the get-go—to get buy-in from the team, they need to be involved from the start. Not only does this get them onboard with any new developments, but it also helps them get to know the new software too and even help find solutions more tailored to their needs. After all, they will work with this software directly.

- Provide training—not everyone will be able to deliver input into which solutions are needed, but once the tools are ready to go, your team will need to know how to use them. Specialized training reduces the fear element of new technology and helps the team learn how to use it from the experts.

- Communicate the benefits—technology for technology’s sake isn’t going to cut it with your team. Instead, it’s vital to highlight how it will streamline their workload and make it more efficient.

- Offer ongoing support—not everyone gets new loan management software the first time around. That’s ok. However, it’s important that you account for this event in your organization. Make sure ongoing support, such as the HES’ help desk, is available to your team to improve their technology usage.

- Deliver incentives—gamification is a real factor, and everyone likes to be rewarded. Having an incentives program allows your team to have that feel-good factor when engaging new tech and should help them embrace the chance.

Ready to kickstart your loan software upgrade?

Onboarding a new technology, whether it’s a new project management tool or loan workflow automation software is a challenge for any organization. This is only compacted when met with resistance from staff. That said, the secret to a successful integration is getting the team onboard from the get-go, which means making them see the benefits, delivering training, and getting staff buy-in.

If you’re ready for new technology or an upgrade, but are not sure your team are, now is the time to talk to HES. Our expert team will walk you through the process from A to Z, helping you get the solution you need and support you deserve throughout the process.