Application Programming Interfaces (APIs) have become critical in connecting disparate systems and enabling digital transformation within various financial institutions. Central to maximizing the effectiveness of these APIs is API lifecycle management—a strategic process that guides APIs from creation to retirement, aligning them with business and technical needs. This article explores the essential stages of API lifecycle management and introduces digiRunner by TPIsoftware, a platform designed to streamline this process within the banking and lending sectors.

What API Lifecycle Management Is: Definition and Key Stages

APIs serve as the glue that integrates disparate systems, applications, and third-party services. Then, API lifecycle management is the systematic process of guiding them from conception through to retirement. It encompasses the planning, design, implementation, deployment, operation, and eventual sunsetting of APIs, ensuring they align with both business goals and technical requirements. The goal? Enabling financial institutions to optimize their APIs' performance, security, and utility throughout their operational lifespan, and address challenges that arise from integrating complex systems.

This process is broken down into several stages, each with its own set of activities that contribute to the API’s overall success and longevity. Let’s learn more about them.

Design Stage Activities

The design stage is the foundational phase where the conceptual groundwork for the API is laid out. It begins with identifying the necessary process and business requirements, followed by the creation of a logical data model. This model is then translated into logical services and API groupings. To test the feasibility and functionality of the design, API resources, operations/methods, and request/response payloads/codes are modeled, simulating how the API would function in a real-world scenario. An essential part of this stage is gathering feedback through mock-ups and interactive consoles, allowing developers to refine the API design based on real user feedback. The validation of these designs through continuous feedback loops ensures the API’s usability and functionality are optimized for end-user needs.

This phase highlights the criticality of repeatability and adherence to best practice patterns at both the structural and method levels of the API. It facilitates the discovery and sharing of repeatable patterns, enhancing the API’s design and integration capabilities.

Implementation Stage Activities

In the implementation stage, the API transitions from concept to reality. This stage involves the development and testing of the API, guided by the specifications established during the design phase. Architectural patterns play a significant role here, supporting essential functions such as orchestration, transformation, routing, data mapping, and system connectivity. Rigorous testing ensures that the API operates as expected, with multiple rounds of adjustments and the use of test automation tools integrating seamlessly into continuous delivery and deployment processes.

This stage underscores a systematic approach to building and testing, focusing on creating an API that is not only robust and secure but also prepared for deployment and integration into backend systems and other APIs.

Management Stage Activities

Once deployed, the API enters the management stage, where its performance, security, and reliability are continually monitored and maintained. This involves applying security policies to shield the API from potential threats and vulnerabilities, deploying the API into the production environment, and monitoring its traffic to quickly identify and address any operational issues. Troubleshooting and managing the API’s lifecycle, including version control and the decommissioning of outdated APIs, are also critical activities in this phase.

Through these stages, API lifecycle management ensures that APIs remain effective, secure, and aligned with the evolving needs of the organization, playing a pivotal role in the digital ecosystems of the lending and banking industries.

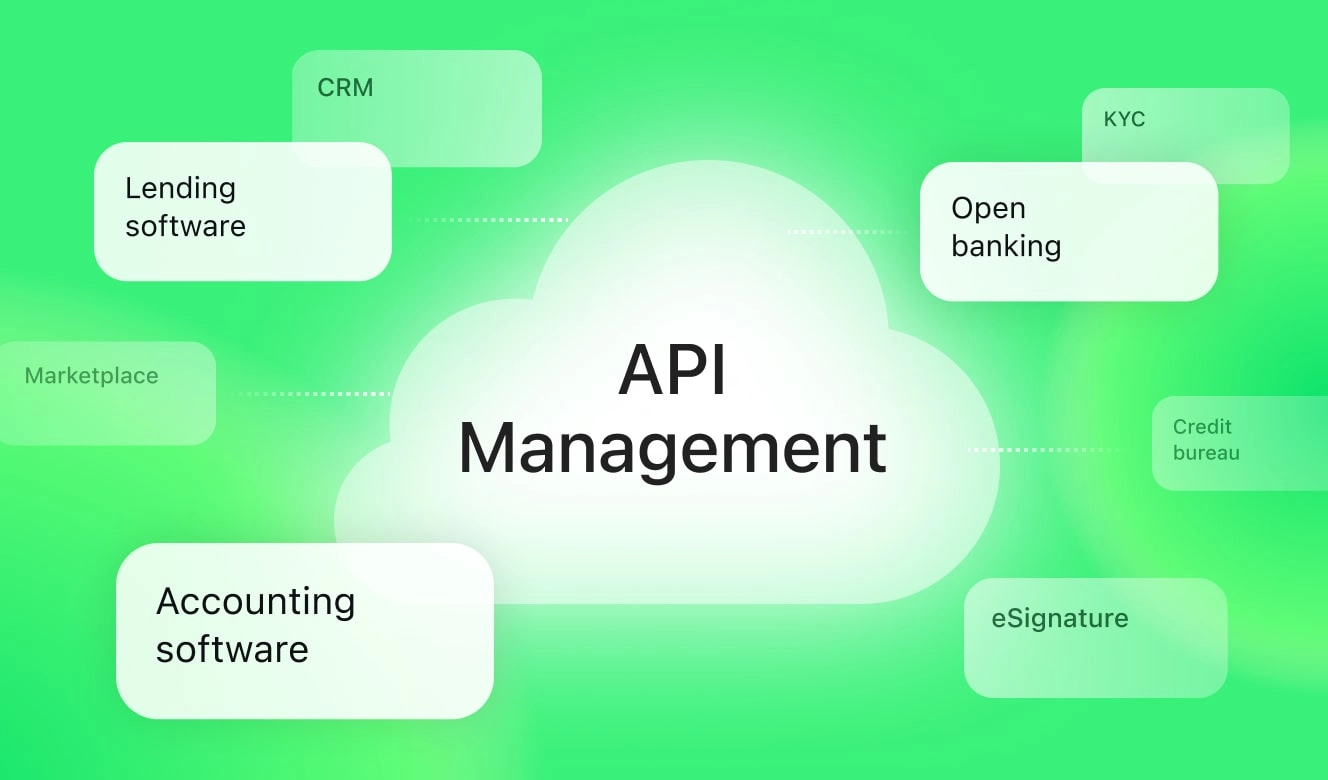

What API Lifecycle Management Is Used for in Lending?

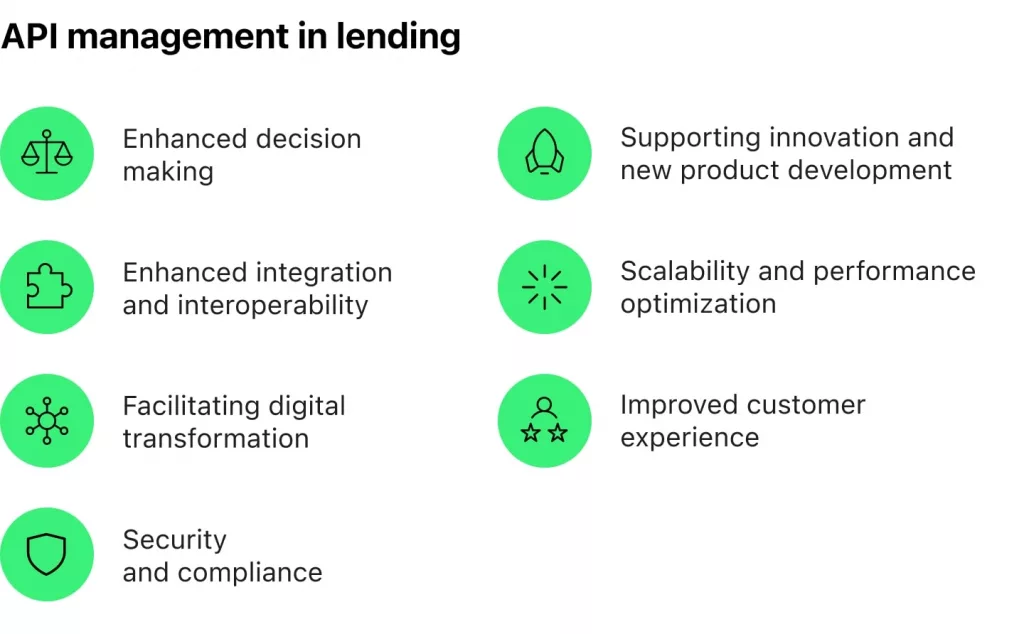

API lifecycle management in the lending and banking sector is a critical practice used to enhance financial services, drive digital transformation, and meet the evolving needs of consumers and businesses. Below, we’ll examine 7 key applications and benefits of API lifecycle management in lending and banking in more detail.

1. Facilitating Digital Transformation

API lifecycle management is foundational to the digital transformation efforts of banks and lending institutions. By managing APIs effectively, these institutions can rapidly introduce new digital services, such as online banking, mobile lending apps, and automated investment platforms. This enables them to stay competitive, meet regulatory requirements, and exceed customer expectations in a digital-first world.

2. Enhancing Integration and Interoperability

API lifecycle management ensures that these integrations are seamless, secure, and efficient, facilitating interoperability among banking systems, fintech solutions, payment gateways, and other financial services. This interoperability is crucial for offering a unified and cohesive customer experience across all digital touchpoints.

3. Improving Customer Experience

When managed through a meticulous lifecycle approach, APIs enable banks and lenders to offer personalized and convenient services to their customers. Businesses can gain insights into customer behavior, preferences, and needs, allowing them to tailor their products and enhancing customer satisfaction and loyalty.

4. Ensuring Security and Compliance

The lending and banking sector is subject to stringent regulatory requirements aimed at protecting consumer data and ensuring financial stability. API lifecycle management includes robust security practices, such as authentication, authorization, encryption, and regular security audits. These practices help prevent data breaches, fraud, and other cyber threats, ensuring that financial institutions comply with regulations like GDPR, PSD2, and CCPA.

5. Enabling Scalability and Performance Optimization

As financial institutions grow and the demand for their digital services increases, the ability to scale APIs without compromising performance becomes essential. API lifecycle management allows for efficient traffic management, load balancing, and resource allocation, ensuring that APIs can handle high volumes of requests while maintaining optimal performance. This scalability is crucial for supporting peak usage periods and expanding services to new markets.

6. Supporting Innovation and New Product Development

API lifecycle management fosters an environment of innovation within financial institutions by streamlining the process of developing, testing, and deploying new APIs. This agility enables banks and lenders to quickly experiment with new ideas, integrate emerging technologies (such as blockchain and artificial intelligence), and launch innovative financial products and services that meet the changing needs of the market.

7. Enhancing Analytical Insights and Decision Making

Through comprehensive monitoring and analytics, API lifecycle management provides valuable insights into API usage, performance, and user behavior. These insights enable financial institutions to make data-driven decisions, optimize their services, and identify new opportunities for growth and improvement.

However, with the increasing reliance on APIs comes the complex challenge of managing them effectively—a task underscored by the broader financial sector's recognition of APIs' pivotal role. A global survey highlighted by McKinsey found that 81% of respondents are viewing API management as a critical priority for both business and IT functions. This growing acknowledgment underlines the necessity of robust API management in ensuring secure, efficient, and scalable digital services.

Wrapping Up

As we've explored throughout this guide, your API strategy directly impacts your bottom line and market position. To be effective, your API lifecycle management should touch every aspect of your FinTech operation, including business value, security, compliance, and scalability. For lenders, this would mean faster product launches, smoother third-party integrations, and the ability to scale with confidence.