The banking and alternative lending sectors are increasingly turning towards technology for solutions, and this comes as no surprise. The transformative potential of software in these industries lies in its ability to significantly boost operational efficiency and drive cost savings. A striking example of this impact is illustrated in McKinsey's article, "The Transformative Power of Automation in Banking." The case study of the Australia and New Zealand Banking Group, as featured in the article, showcases how implementing robotic process automation (RPA) at scale led to annual cost savings of over 30% in certain functions. This example underscores the profound effects that automation and digital transformation can have on financial services, transforming the way traditional banking and lending operations function.

Building on this premise of technological advancement and its pivotal role in redefining operational strategies, this blog post delves into how specialized software solutions, such as HES LoanBox, can be instrumental for businesses in the financial sector. We will explore five key ways in which HES LoanBox assists businesses in saving operational costs and time, reflecting a new age of efficiency and financial management.

Enhancing Credit Processes – The Backbone of Lending and Banking

The importance of credit process automation for banking and alternative lenders stands at the core of operational efficiency and competitive edge in today's financial landscape. Automated systems can process loan applications with greater speed and accuracy, ensuring timely and reliable service delivery.

The Risks of Relying on Manual Credit Processes

Businesses that rely on manual credit processes are at a disadvantage for several reasons. Let’s look at them.

- Increased Processing Time and Costs

Manual processing is time-consuming and labor-intensive, leading to higher operational costs and slower response times. This can result in lost opportunities and decreased customer satisfaction.

- Error-Prone Operations

Human errors in manual processing can lead to inaccurate risk assessments, compliance issues, and unsatisfactory customer experiences. These errors not only have financial implications but can also damage the institution's reputation.

- Inability to Scale Efficiently

Manual processes can hinder an institution's ability to scale effectively in response to market demands. As the volume of applications increases, manual systems can become overwhelmed, leading to bottlenecks and delays.

- Reduced Competitive Edge

In an industry where speed and efficiency are key to staying competitive, reliance on manual processes can put businesses at a significant disadvantage. It limits their ability to respond quickly to market changes and customer needs.

- Compliance Risks

Keeping up with changing regulatory requirements is more challenging with manual processes, increasing the risk of non-compliance and associated penalties.

How Does HES LoanBox Help with Credit Processes Automation?

Financial Regulations in Thailand, Canada, Australia, and Saudi ArabiaPicture a tool specifically crafted to cater to the unique needs of alternative lending and banking. HES LoanBox is this tool, comprising three integral components: the Landing page, the Borrower portal, and the Back office, all designed to optimize the efficiency of the lending process at each stage. Now, let’s dive into how it revolutionizes credit processes.

First off, HES LoanBox automates numerous routine tasks, including managing loan agreements, processing payments, and overseeing debt collection activities. This automation not only saves valuable time but also allows managers to concentrate on more strategic aspects of their business.

Moreover, the tool offers customizable credit scoring models. Tailored to meet specific lending criteria, these models ensure that credit decisions are grounded in the most relevant and accurate data.

And here's an exciting teaser: We're currently working hard on integrating GiniMachine's enhanced functionality into HES LoanBox. This update promises to make credit processes even more precise, transparent, and efficient. Keep an eye out for this!

A Key to Reducing Loan Defaults is Data-Based Risk Management

The phrase 'Data is the new gold' might sound clichéd, but it rings especially true in our niche markets. Accurately assessing and mitigating risks is crucial for maintaining an institution's financial health and reputation.

A study by Deloitte highlights the significant role that AI and predictive analytics play in reducing loan defaults. By incorporating these technologies into their risk assessment strategies, institutions have seen a decrease in loan defaults by up to 25%. This impressive statistic underscores the powerful impact of technology in reducing financial risks.

That’s why AI and machine learning algorithms, HES LoanBox can analyze vast datasets, recognize patterns, and predict potential risks with greater accuracy. It employs a unique decision-making system for credit scoring, which includes a range of elements from critical stop factors to a comprehensive, matrix-based cumulative scoring system. This approach enables nuanced and sophisticated assessment of credit applications.

Maximizing Engagement in Seconds with User-Friendly Interface

How many seconds do you think your interface has to convince potential clients to continue to interact with it? 10 seconds or less! According to research from the Nielsen Norman Group, users often leave web pages within 10 seconds if they don't find a clear value proposition or can't figure out what to do next. To retain user attention for longer, it's crucial to effectively communicate the value of your interface within the first 10 seconds. This research is dated 2011, now we can surely say that having 10 seconds of their attention in 2024 is a priceless luxury, keeping in mind what social media and other cheap dopamine sources do to our ability to concentrate.

This is where the HES LoanBox Landing Page module shines. It's designed to capture user attention instantly with its streamlined and user-friendly interface, ensuring that the crucial value proposition is communicated effectively within those first critical seconds. With this module, businesses can significantly enhance their digital onboarding experience, making it intuitive, engaging, and efficient for potential clients.

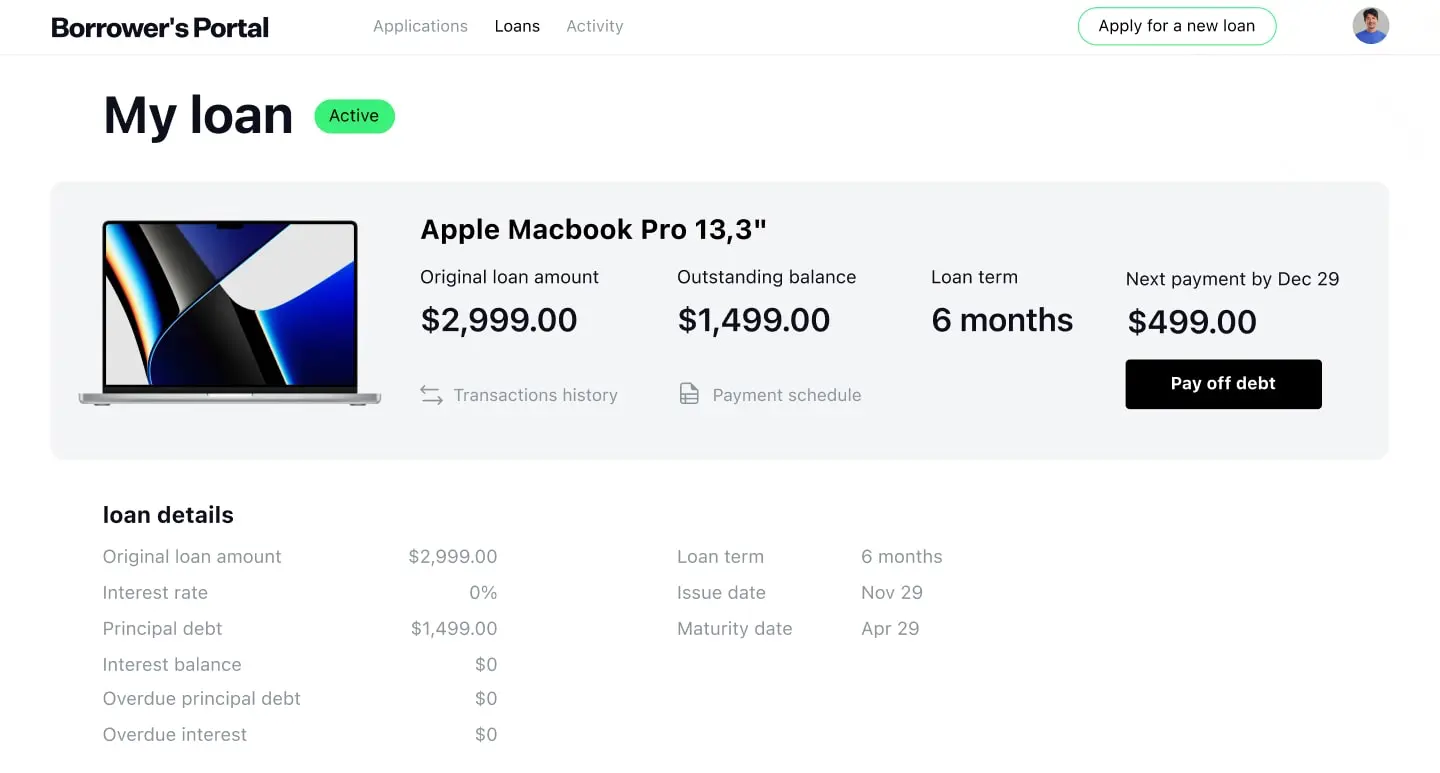

Once potential clients become actual clients, maintaining a user-friendly interface remains crucial for fostering loyalty and encouraging referrals. A smooth, pleasant interaction is key to turning borrowers into repeat customers who recommend your services. HES LoanBox consumer lending software understands this, which is why the Borrower portal has been meticulously crafted. It offers an intuitive, seamless experience, ensuring all interactions, from checking loan balances to making payments, are straightforward and hassle-free.

Unlock Growth By Adapting Offerings to Clients’ Needs, Fast

Last year, the UK alternative lending market experienced significant growth. The market is forecasted to grow by 20.2% annually, reaching a value of $72.48 billion by 2027.The key to staying ahead is swift adaptation and innovation in product offerings. This is especially true in response to evolving market demands and client data trends. Let's explore how being responsive to these changes can significantly benefit your lending business.

For instance, suppose your data indicates a growing number of clients from a certain professional sector or with specific income levels. This insight provides an invaluable opportunity to develop customized credit products that cater specifically to the needs and preferences of this emerging client base. By tailoring your offerings based on real-time market data and client information, you not only enhance customer satisfaction but also position your business as a forward-thinking, adaptable entity in a competitive market.

The HES LoanBox Product Engine enables you to swiftly create or modify credit products, adapting them to evolving market trends and client requirements. This is achieved through a user-friendly interface where you can easily configure the necessary fields.

Securing Your Financial Data

It's vital to recognize the importance of securing banking and alternative lending software. If you're not fully convinced, consider this: In 2023, the global cost of cyberattacks soared to $8 trillion, averaging $255,000 every second. By 2025, these costs are projected to escalate to $10.5 trillion annually. This alarming statistic underscores the necessity of taking cybersecurity seriously to protect your business and clients.

ISO/IEC 27001 certification is the international standard that specifies the requirements for establishing, implementing, maintaining, and continually improving an information security management system (ISMS). For financial institutions, this certification ensures a robust approach to managing sensitive company and customer information. It reassures clients that their data is protected against unauthorized access and cyber threats. By adhering to ISO/IEC 27001 standards, financial software can demonstrate compliance with top-tier security protocols, enhancing trust and credibility in a sector where data security is paramount.

HES LoanBox proudly holds the ISO/IEC 27001 certification, ensuring it's fully equipped to safeguard your business data against cyberattacks. This certification is a testament to the platform's commitment to top-tier data security, providing peace of mind in a world where digital safety is paramount.

Wrapping Up

In a surprising revelation, 66% of financial businesses reported still relying on spreadsheets in their operations. This figure is quite astonishing considering the myriad benefits that specialized software offers to banking and alternative lending businesses. If you're looking to elevate your business's efficiency with cutting-edge solutions like HES LoanBox, we encourage you to book a personal demo tour and experience the transformation firsthand.