Welcome to our special Q&A session. Today, we have two industry experts who know all about the fast-evolving world of lending technology and compliance. Ivan Kovalenko, Co-Founder of HES FinTech, is here to talk about end-to-end lending innovations and how they can benefit both traditional and emerging markets. We’re also joined by Povilas Steikūnas, VP, Global Partnerships at Ondato, who will shed light on KYC/KYB, AML, and how automation is changing the game for financial institutions. Let’s jump right in.

What are the main challenges lenders face today in managing loans efficiently, and how does HES FinTech’s technology address these?

I’d say one of the main challenges lenders face today is complexity—particularly the ever-growing complexity of processes, data, and compliance requirements. Lenders often struggle to manage multiple disparate systems, which leads to inefficiencies and bottlenecks in loan origination and servicing. In addition, manual processes and siloed data sources can slow underwriting, raise operational costs, and increase the risk of human error.

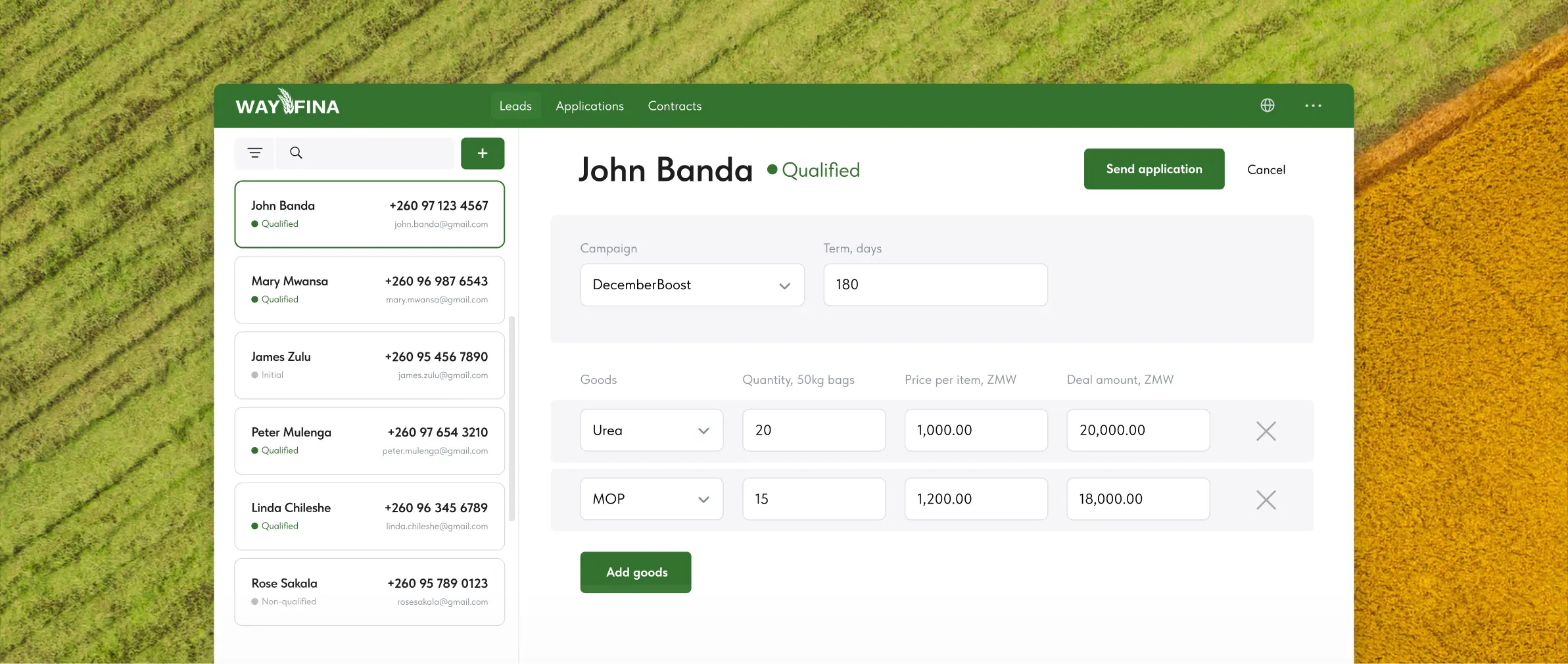

At HES FinTech, we tackle these obstacles head-on by offering HES LoanBox–end-to-end lending platform that is highly configurable and automated. From the initial application and identity verification to underwriting and servicing, our technology covers the full lending cycle. We leverage advanced analytics and integrations with partners like Ondato for seamless KYC/KYB and AML checks, ensuring compliance is streamlined and embedded into the workflow.

Moreover, our platform is designed for scalability and speed. Lenders can launch new loan products quickly, adjust risk models with ease, and tap into varied data sources for more accurate decision-making. By centralizing and automating these processes, we help lenders drastically cut costs, improve customer experiences, and maintain a competitive edge in an evolving market.

How has the evolution of KYC/KYB processes impacted lenders’ ability to onboard customers more efficiently and securely?

The evolution of KYC and KYB processes has greatly improved lenders' efficiency and security in onboarding customers. Digital transformation and automation have reduced manual work, speeding up verification processes while minimising human error. On top of this, it allows us to combine two main processes needed by lenders into one. With it, lenders can identify risks and get to know their clients easier. Enhanced data integration and AI tools allow for real-time identity checks and fraud detection, making the process more secure.

HES FinTech on AI, NPL Reduction, and Inclusive Lending

How does HES LoanBox help reduce non-performing loans (NPLs) while maintaining compliance with regional regulations like SAMA?

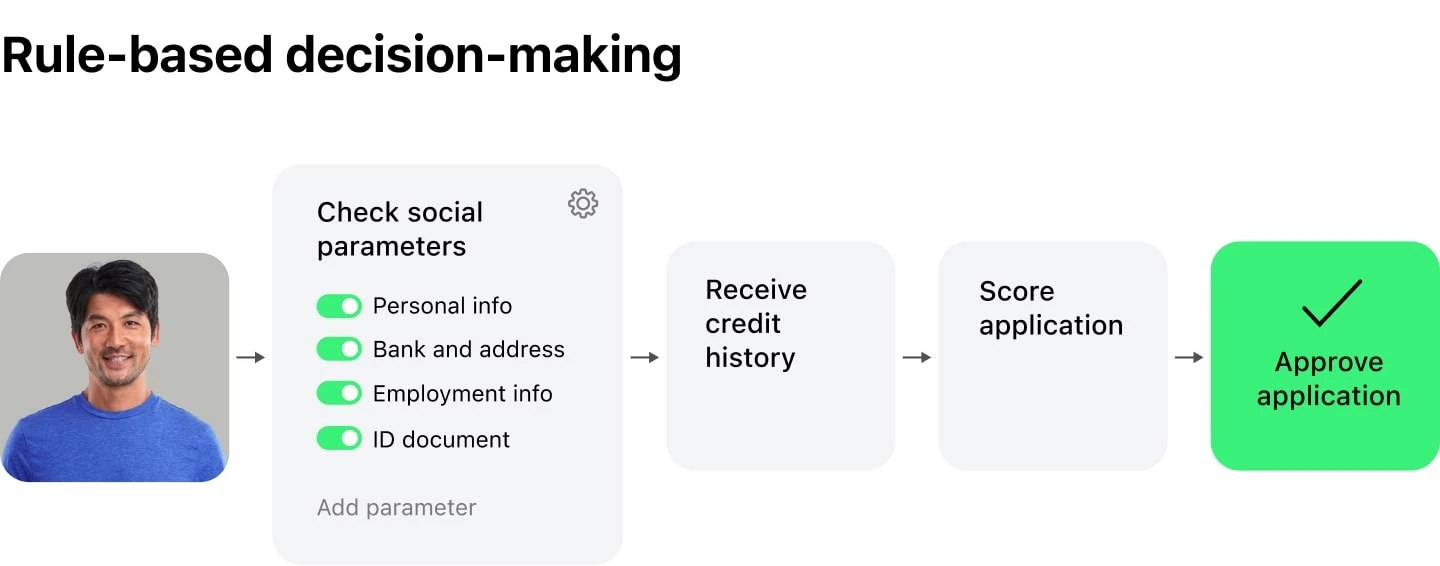

HES LoanBox is designed to reduce the risk of NPLs through its comprehensive, data-driven decisioning engine. The platform pulls information from multiple data sources—credit bureaus, alternative data providers, and our partners like Ondato for KYC/KYB and AML—to compile a holistic view of each applicant. This deep insight allows lenders to identify high-risk prospects early on and make more accurate underwriting decisions.

Compliance with regional regulations, including those set by SAMA, is seamlessly integrated into our workflow. HES LoanBox is modular and configurable, so we can quickly adapt to new guidelines or regulatory changes specific to Saudi Arabia (and other regions). Each workflow step captures and stores critical information for audit and reporting, helping lenders remain compliant without creating extra operational burdens.

With robust decisioning, automated rule checks, and continuous monitoring of loan performance, HES LoanBox reduces the likelihood of loan defaults and also ensures lenders can operate efficiently and confidently under SAMA and other international regulations.

Can you share insights into how digital lending can drive financial inclusion, especially for underbanked individuals and MSMEs in emerging markets?

From my perspective as a co-founder at HES FinTech, digital lending is one of the most powerful tools we have to drive financial inclusion—particularly for underbanked individuals and MSMEs in emerging markets. Traditional lending relies heavily on extensive credit histories and face-to-face interactions, which can exclude a lot of people who don’t have easy access to banking services.

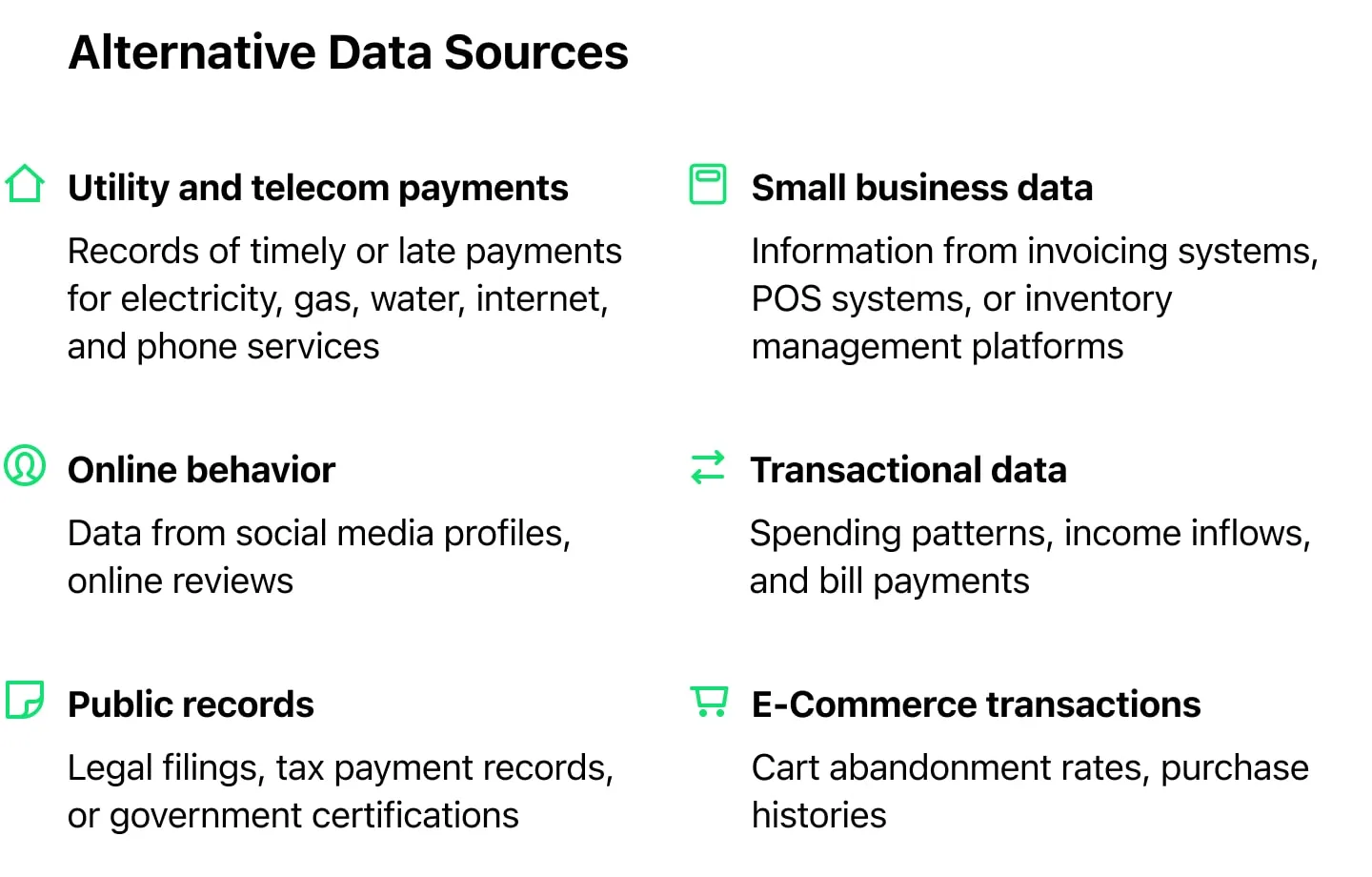

What’s so transformative about digital lending is how it leverages alternative data—like mobile phone usage or utility payments—and automates underwriting. This opens doors for those without a long credit track record. By using online platforms and integrated identity verification solutions like Ondato, we can streamline KYC/KYB processes and quickly confirm borrowers’ identities.

Another key factor is cost. When everything is online, lenders can reduce operational expenses and pass those savings on to borrowers in the form of lower interest rates. That’s a game-changer for underbanked populations, many of whom only need small loan amounts to stabilize or grow their businesses.

Finally, digital lending fosters a more inclusive environment by being accessible anywhere there’s an internet connection. In emerging markets, this can mean reaching rural or remote communities that might never have had a chance to receive funding through traditional channels. So, it’s not just about providing loans—it’s about building a framework that supports responsible lending and long-term financial well-being.

Learn More

What role does AI play in automating loan origination and servicing, and how can lenders ensure accuracy without sacrificing customer experience?

AI is a real game-changer in the lending landscape. From my perspective at HES FinTech, AI-driven analytics significantly streamline both loan origination and servicing by automating the data-intensive processes that used to be purely manual. For instance, AI models can analyze credit bureau data, alternative data sources, and even behavioral signals in real time. This not only shortens decision times but also helps us identify risks and opportunities more accurately.

However, accuracy is just one side of the coin. Lenders also have to keep the customer experience front and center. We’ve taken a two-pronged approach. First, we integrate AI models with robust KYC/KYB and AML checks through our partner solutions like Ondato to ensure compliance. Second, we build our workflows to be intuitive. The customer or borrower sees a seamless, streamlined interface, even though there’s complex AI-powered decisioning happening behind the scenes.

A key point is that AI isn’t a ‘set it and forget it’ tool. Continuous model monitoring and periodic human reviews help maintain accuracy, catch outliers, and allow for quick tweaks. That human touch goes a long way toward ensuring we don’t lose the personal element of lending. Ultimately, combining advanced AI capabilities with a user-friendly design and oversight mechanisms lets lenders boost efficiency without compromising on either accuracy or the borrower’s experience.

How do cloud-based loan management systems enhance security and data integrity for financial institutions operating in highly regulated environments?

Operating in a highly regulated environment demands top-notch security and unshakeable data integrity. At HES FinTech, we’ve found that cloud-based loan management systems can actually exceed on-premise setups in meeting these standards. For starters, leading cloud providers invest heavily in robust security protocols—think encryption both at rest and in transit, advanced threat detection, and regular vulnerability testing.

Equally important is the compliance aspect. Cloud platforms typically adhere to strict international certifications such as ISO 27001, PCI DSS, and SOC 2, which gives lenders a head start on meeting industry and regional regulatory requirements. Additionally, the cloud makes it simpler to implement continuous monitoring and instant scaling—so if there’s a sudden spike in loan applications or a regulatory update, the system adapts automatically without sacrificing performance or security.

Another advantage is automated backups and disaster recovery. In our own deployments, we configure geo-redundant backups and real-time failover options, meaning financial institutions can trust that data is both backed up and quickly recoverable. With the right identity management layers and thorough KYC/KYB/AML integrations from partners like Ondato, we ensure that only authorized entities can access the data, closing the loop on a secure, compliant ecosystem.

In the end, it’s about building a system that’s not just powerful and scalable, but also certifiably safe for the sensitive information that financial institutions handle every day.

Ondato’s Approach to AI-Driven AML and Identity Verification

What are the key AML (Anti-Money Laundering) challenges for lenders today, and how does Ondato help tackle these challenges with automation and AI?

Lenders face many AML challenges. Identifying complex money-laundering schemes, cross-border fraud, staying updated on changing regulations. Fraud methods have gotten much more sophisticated over the years. And getting all the relevant information about clients gets more and more complicated. Ondato tackles these challenges with automated KYC/KYB verification, AI-driven identity checks, fraud prevention, and real-time monitoring, ensuring compliance while reducing human intervention and errors. With it, lenders can find all required data in place without any additional hassle, enabling them to quickly make informed decisions.

How can lenders ensure that their KYC/KYB procedures remain compliant with global and local regulations without causing friction in the customer experience?

It’s important to adopt scalable KYC/KYB solutions that incorporate automated checks, AI, and regular updates to regulatory databases. It’s also essential to ensure the tools you use have people behind them who react quickly to new regulations. Ondato achieves this balance by offering seamless, low-friction customer experiences while maintaining strong compliance standards. In addition, it allows companies to monitor any changes in their clients’ data without having to continuously bother the client.

What are the risks of failing to implement a strong AML strategy, and how does Ondato’s solution mitigate these risks?

Failing to implement strong AML strategies can lead to heavy fines, reputational damage, and exposure to financial crime. Ondato mitigates these risks through real-time fraud detection, continuous risk assessment, and automated compliance with evolving AML regulations.

How do AI-driven KYC and AML solutions improve the accuracy of risk assessments compared to traditional methods?

AI-driven KYC and AML solutions improve risk assessment accuracy by analysing vast data sets in real-time, reducing false positives and negatives compared to traditional manual reviews. Ondato’s AI tools allow for quicker, more precise risk profiling. As well as use less resources to achieve this result.

How does Ondato integrate with a lender’s existing tech stack to provide seamless identity verification and AML checks?

Ondato integrates with existing tech stacks through APIs, allowing lenders to seamlessly embed identity verification and AML checks into their platforms without overhauling current systems. This ensures a smooth, scalable solution for identity management and compliance with little to no additional IT resources. With the flexibility we offer, any company can easily implement our tools into their systems while maintaining full control of the existing processes.

What Lies Ahead for KYC/KYB, AML, and Lending Innovation

What trends do you foresee in the future of KYC/KYB and AML compliance, particularly in the digital lending space?

Future trends in KYC/KYB and AML compliance definitely include greater use of AI, machine learning, and blockchain to improve the accuracy and speed of identity verification and risk assessments, particularly in digital lending. RegTech will also play a bigger role in automating compliance updates.

What trends in lending technology do you believe will have the most significant impact on financial inclusion in the next five years?

The number of lending platforms that implement KYC, KYB and AML processes has grown exponentially and will only continue to become more and more commonplace. We predict that this trend will continue and soon allow companies to implement all relevant tools such as loaner generation, transaction monitoring and AML processes in one go, relying on just one provider.

Conclusion

Throughout this conversation, it became clear that the future of finance hinges on streamlined automation, robust compliance, and a commitment to inclusive growth. By deploying AI for faster underwriting and leveraging integrated KYC/KYB/AML solutions, lenders can craft experiences that are secure, efficient, and accessible to a broader audience. The synergy between HES FinTech and Ondato exemplifies how collaboration and innovation will guide us toward a new era of smarter, safer, and more inclusive lending.