With nearly 3 billion people worldwide excluded from formal credit systems, especially in emerging markets, the need for alternative approaches has never been greater. Millennials, Gen Z, immigrants, and gig workers often fall outside conventional models, despite being financially active. This landscape showcases solutions that tap into new forms of data—such as utility payments, device interactions, and social media behavior—to create a more inclusive, accurate, and dynamic picture of a borrower.

This global gap calls for a smarter, more inclusive approach. One that looks beyond bank statements and credit histories to tap into new, rich forms of data: utility payments, mobile device behavior, social media activity, online transaction patterns, and more. Together, these signals can create a fuller, more dynamic picture of a person’s financial identity.

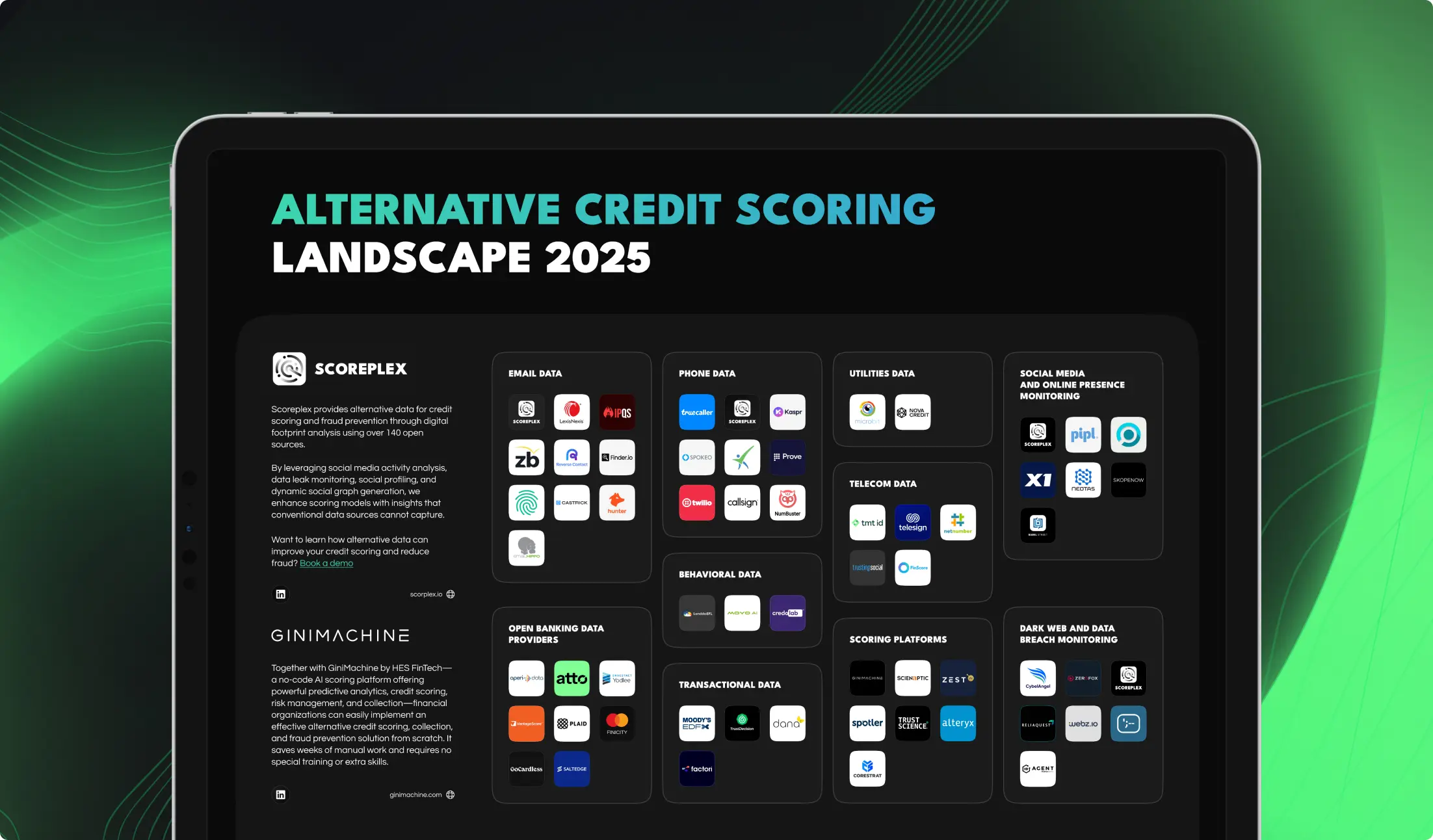

Alternative Data Sources

Together with Scoreplex, we’re helping lenders, fintech companies, and risk managers make sense of this changing landscape. The goal? To adopt smarter, data-driven tools that not only reduce risk but also bring more people into the financial system who've been unfairly excluded for too long.

About Scoreplex

Scoreplex is an Amsterdam-based fintech platform that empowers businesses to make smarter credit and fraud decisions through alternative data. By analyzing digital footprints from 140+ open sources—including social media, corporate registries, breached databases, and the Dark Web—Scoreplex helps companies build accurate, real-time risk profiles. Its core features include reverse email and phone lookups that verify identity, assess creditworthiness, and detect fraud before it happens.