The lending landscape is changing in a big way. Significant market expansion, coupled with evolving consumer demands and requirements, is causing organizations to seek out solutions to help them better understand and work with their target markets. The use of Big Data in banking and lending is one such approach.

What is Big Data?

The Big Data definition is analyzing large data sets of a vast variety at a fast pace. Data scientists call this the 3 Vs—variety, volume, and velocity.

- Variety—processes structured and unstructured data, images and videos, texts, and readings.

- Volume—covers kilobytes, terabytes, and beyond, online and offline, from records, files, and other sources, in large amounts.

- Velocity—works at high speeds to generate data in almost real-time and, depending on functionality, can give data in streams, batches, or bits in online or offline formats.

Essentially, Big Data gives companies the power to harness the information they have and collect to turn it into data-driven insights for business growth. But what about Big Data for banks and other financial institutions?

Why is Big Data in banking needed?

Alongside technologies such as AI, machine learning, and other tools, Big Data is presented as a possible solution to the current challenges of the finance industry. But what are the industry pain points they’re set to solve?

Rapid market growth

In the last year, the lending market grew at a CAGR of 10.1% from $7,887.89 billion in 2022 to $8,682.26 billion. With an expected growth of a further 8.8% CAGR over the next five years to a value of $12,176.98 billion, its trajectory shows little sign of changing course.

Growth is good, but it does present unique challenges for lending organizations, naming how to keep up with market demand and remain competitive, especially considering the rise of Big Data lending startups in fintech and other industry innovators.

Changing types of borrowers

Traditional credit scoring systems have been around for a while and utilized data such as payment history, amounts owed, types of credit, and more to deliver a credit score. These have been stable since the introduction of FICO in 1989, but the market is changing.

The traditional borrowers, the so-called Boomer and Gen X generations are being joined by Millennials and Gen Z, who have a differing approach to finances. These generations have atypical credit histories, may participate in the gig economy, and often work abroad, resulting in challenges for traditional lending practices.

Increased automation and personalization requirements

Lending Automation for Banks and FintechsAs these generations have alternative financial backgrounds, they also have different needs when dealing with financial providers. For example, modern borrowers may expect enhanced flexibility, personalization, and automation, such as those delivered by fintech providers.

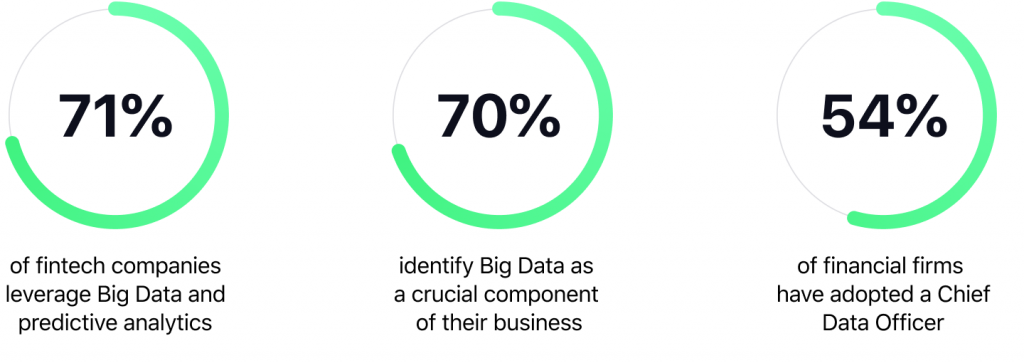

Big Data management in the finance sector

How can Big Data analytics improve lending?

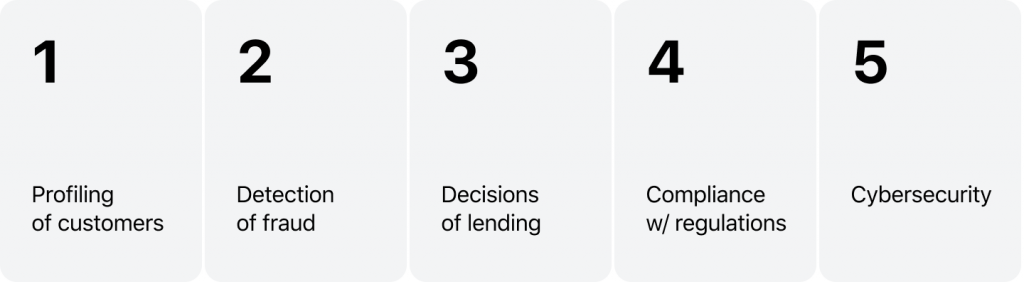

Of course, Big Data in banking is not a solve-all. Instead, it is a helpful tool that can be utilized effectively to get tangible results. Here are some of the top five solutions we see Big Data analytics impacting today.

1. Credit risk assessment

As we mentioned earlier, the borrower market is changing, impacting how credit scoring needs to be done. Traditional scoring methods only account for traditional borrowers, and sometimes, they don’t do that very well.

Big data can be utilized to expand credit risk analysis capabilities and account for various data, such as income, employment history, payment history, and even social media activity, to determine a client’s creditworthiness. This helps the organization expand its lending profile while lowering the risk to itself.

2. Customer segmentation and targeting

Diversity is critical in today’s market, with great respect and acceptance to alternatives. Banking is no exception, and today’s consumers, inspired by fintech startups, demand this as standard. So, what is the role of Big Data here?

Large and SME lending organizations can use Big Data to personalize their market offerings and target their services to specific groups. For instance, this may mean offering micro-loans to encourage business in less economically developed areas, or even car loans to new drivers, and everything in between.

3. Fraud detection and prevention

How to Avoid Fraud in Digital LendingAt the same time, greater personalization shouldn’t always mean more risk. Instead, traditional and online lending organizations can use Big Data to identify risks or suspicious behavior patterns in their customer and potential base. For example, this can be highlighting multiple loan applications simultaneously or checking personal information at a higher speed, mitigating financial loss.

You could start lending in 3 months

4. Loan underwriting and approval

The loan underwriting and approval process is quite complex and relies on various factors to get it right. With Big Data and other tools, lenders can optimize this process and speed up loan approval (or decline). This will delight consumers seeking almost instantaneous answers to their loan requests. At the same time, once the technology is up and running, this can have additional cost reductions for businesses due to increased operational efficiency.

5. Loan servicing and collections

Issuing loans is one thing while servicing and collecting on unpaid debt is another. Big Data can help detect and identify clients at risk of loan default to tackle an issue before it occurs. It can help inform loan repayment strategies to minimize the loss to the lender and help ensure the client repays on time. This helps lenders maintain healthier portfolios and minimizes the risk of defaults overall.

Uses of Big Data in the finance industry

SME lending and Big Data Onboarding

Depending on your financial organization’s strategy plans, it may be time to think about onboarding Big Data solutions if you haven’t already. To put things in perspective, by 2025, it’s estimated that 181 zettabytes of data will be created, so now is the time to start harnessing yours and stand out from your competitors.

Not sure where to start? Don’t hesitate to get in touch with HES experts who will guide you through potential Big Data solutions for your business.