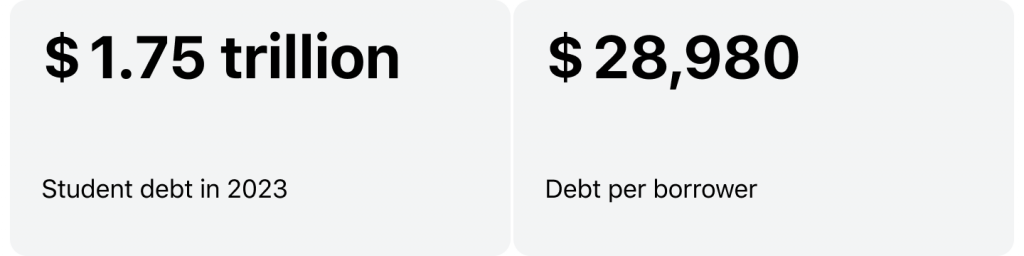

With student debt (federal and private) hitting a total of $1.75 trillion this year, or approximately $28,980 per borrower, the student loan industry is continuing to grow. However, since the beginning of the pandemic in 2020, instances of forbearance have been growing too—from 2.7 million in 2020 to 24 million in late 2021—indicating market changes are afoot. For companies seeking to enter the market and government bodies seeking to upgrade their services, there is no better time to relook at their student loan financing software options and adapt to the new market conditions.

Student loan financing software: top 5 features

As a fintech company, developing lending software, HES is at the forefront of market changes. That’s why we’ve collected the top five must-have features from our clients for you.

Application and document management tools

Innovative Student Loan Software Solutions: Where to Start Going off to college is a stressful process for both parents and their adult children, many find the loan experience stressful and confusing. Even more so if this is the first time the family is taking out a loan. By creating a seamless application process using the latest in UX (user experience) design and state-of-the-art document management tools, your company can reduce the level of stress, while ensuring you get the data you need to process the loan.

However, this experience isn’t just about the borrower’s comfort. At the same time, it’s about reducing application errors and cutting down confusion, which can lead to incorrect decision-making, and improving operational efficiency, as it’s likely you’ll be answering fewer questions on the customer service side of things too.

Automated eligibility determination

Approved, denied, or further information required? No one likes waiting for a decision to be made. That goes doubly so for students, who doubtless have already spent a significant amount of time waiting, for example, on exam results, college application feedback, and more. When designing your student loan processing software solution, it’s important to ensure that you can process applications as quickly and accurately as possible. This reduces the stress for the student and, as a result, they’ll be more able to accurately answer your questions and provide the correct documentation.

In terms of software, this often means getting the right software onboard, including UX, at the start, and seeking out the right tools that help analyze the information provided and seek out the right financial tools for this individual. By automating this process, you reduce the level of stress for the would-be student as well as improve your own time and cost savings as well.

Integrated financial aid processing

The bank of mom-and-pop is almost a long-lost daydream, and students aren’t always just financed by loans. In fact, the world of academic finance can be a melting pot of grants, scholarships, self-funding, and other forms of financial assistance—all of which needs to be taken into account for your student loan financing software to work to its fullest.

By including tools that allow the integration of this data, whether entered manually or automatically, you can seek to benefit from a more holistic approach to student financing. This makes it easier both for your company and for the student themselves to understand the complexity of their finances while studying.

Consider including software that allows third-party integrations, data exchange, real-time updates, and more to enhance any solution you’re thinking of developing.

Robust compliance and regulatory support

For many students, this may be the first time they are interacting with the big financial world, beyond a basic savings account. Occasionally, this may cause some complications for regulatory bodies, who generally issue loans based on set criteria. When designing your student loan origination software solution, it’s important to account for the specifics of your market. What this means is that you may have to consider alternative credit checks and methodologies, as well as traditional strategies.

At the same time, to ensure the legitimacy of your solution, you must follow the regulatory requirements and ensure data security. This means that any solution you create must contain a variety of features, such as built-in compliance modules, data encryption tools, and audit trails that protect sensitive student information and help maintain regulatory compliance. Similarly, you keep your company on the right side by ensuring a student’s creditworthiness and can comply with KYC regulations too.

Effective loan disbursement and servicing

Nearly all of us remember our student days waiting for the payments to come in to pay for the course and purchase the necessary materials. Any delays in this area can be critical, especially if the student is staying in accommodation away from home. That’s why it’s essential that alongside your student loan origination software, you have the tools in place for loan disbursement and consider adopting a servicing module that automates fund distribution over the long term.

At the same time, the student also needs the agency to manage their loan, ideally from the touch of a button, and that’s where borrow self-servicing comes into play. Having tools on hand to manage payments and see current updates on the loan account means the student is more likely to take responsibility for their payments rather than leave it to chance. Not only does this enhance the borrower experience, but also helps increase the likelihood of loan repayments.

Ready to kickstart your student loan financing software journey? Start here!

Armed with these five helpful features, you can now proceed to the next step and consider designing or upgrading your current student loan financing software toolkit. However, not every solution is cookie-cutter, and while some software solutions may work for most, others require a bit of tweaking to get it right. That’s why it’s important to get in touch with industry experts, such as HES, at the get-go. Our team of loan software specialists can guide you on your journey to creating the perfect software solution for your market.