Financial KPIs (Key Performance Indicators) are the important metrics that help the managers of the financial institution to analyze the growth of the business toward its end goals. The lending KPIs help them analyze the financial and operations strength of the business and get deep insights.

They offer a visualization of key data for the lending business and can give an immediate snapshot of its health. Moreover, they are highly beneficial when managers analyze and evaluate certain trends for the business over a given period of time. Let us go through some stats to understand the importance of tracking the critical KPIs for lending businesses.

Statistical Overview

According to the report, bank profitability reached a 14-year high in the previous year, with revenue growth of $345 billion for the bank. The sharp increase in the interest in the net margins helped the growth.

Moreover, the loan approval rate rose to 73% in 2021, and financial institutions experienced a rise in more returns, with 13.7% of loans returning back some portions by 2021.

Commercial Lending Trends 2024All these stats highlight the importance of KPI monitoring by the managers to strive for the business to better growth. In the next section, you will get the top lender KPIs that can help the management and stakeholders of the lending businesses to track the progress and deploy proper strategies to grow to the next level.

7 Major Lending KPIs

1. Loan Approval Rate

The loan approval rate (LAR) is an essential KPI for a loan provider. It is a metric that gives the visualization of loan application workflow for their lending business. The formula for the KPI is given below.

LAR = (Number of Loans Approved / Total Number of Applications) x 100

If the business is experiencing a low loan approval rate, then there may be an issue with the application review process. Moreover, the issue may tell that there are some gaps in the ideal customer profile of your lending business.

The KPI value will warn the owners and stakeholders that they are targeting the wrong customer profile, which will not reap good fruit.

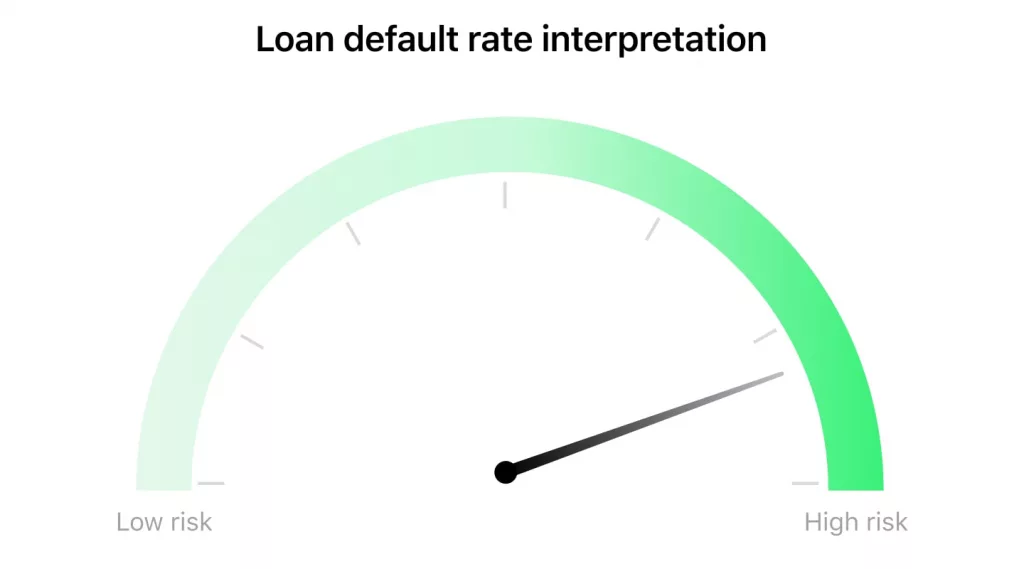

2. Loan Default Rate

The loan default rate (LDR) is a critical lender KPI and an essential component in KPI finance analysis. It helps the owners and stakeholders to evaluate the quality of the portfolio and the overall risk associated with their business’s lending activities. The formula to calculate the KPI is given below.

LDR = (Number of Loans Defaulted / Total Number of Loans Issued) x 100

The number of loans defaulted refers to the borrowers that were not able to make proper payments for the loan in the given timeframe. The total number of loans issued refers to the number of loans that are active for the company in the same timeframe. A higher rate for the KPI will refer to the high risk of the customer portfolio, while a lower value will indicate a good credit quality for the lending business.

3. Loan Portfolio Yield

Next on the list is loan portfolio yield (LPY), a crucial aspect of consumer lending KPIs and an important metric in evaluating the effectiveness of a consumer lending solution. This KPI assists lending businesses in measuring the yield of their consumer lending portfolios. The formula to calculate the KPI is given below.

LPY = (Interest and Fees Earned / Average Loan Portfolio) x 100

The KPI helps the management to track the performance of the business’s portfolio and identify the areas of improvement in it. Then it can deploy proper strategies to improve the overall profitability of the loan portfolio.

4. Cost of Funds

Cost of funds (CoF) refers to interest paid by the financial business for its assets that are utilized by it. It includes the total interest paid by the financial institution on the borrowings, deposits, and other sources of funds. The formula for the KPI is given below.

CoF = (Total Interest Expense / Average Borrowed Funds) x 100

A lower value will indicate the business is enjoying better returns due to reduced cost generation for long-term loans. Moreover, it says that the funds are used for short-term expenses incurred by the business.

5. Operational Efficiency Ratio

The operational efficiency ratio (OER) is one of the key lending KPIs for the financial institution. It allows them to evaluate the performance and efficiency of their operations. The formula to calculate the KPI is given below.

OER = (Operating Expenses / Operating Income) x 100

It tells about the effectiveness of the lending business in managing its operational expenses with respect to the overall revenue generation. The lower value suggests that the business has proper strategies to manage the operational costs according to its overall revenue. The lower value of the metric is a positive sign for the lending business to maximize revenue while controlling costs.

6. Loan-To-Deposit Ratio

Loan-To-Deposit Ratio (LDR) is another important lender KPI for financial institutions as it evaluates its liquidity by taking into account the total number of loans disbursed by it to the total number of deposits in the same timeframe. The loan-to-deposit ratio formula is given below.

LDR = (Total Loans / Total Deposits) x 100

A high value of the KPI suggests that the lending business does not possess enough liquid funds to cover any immediate fund requirement by the investor. It also helps the stakeholders to assess the performance of the lending business. If the deposits are increasing, that means that new funds are coming into the business, and it can lend more funds to new or existing customers. However, a pretty low value will indicate that the institution is not earning according to its potential.

7. Net Interest Margin (NIM)

How Fintech is Transforming the Lending IndustryNet Interest Margin (NIM) refers to the profitability ratio of the lending business. It refers to the net profit by the business on its assets that earn interest which includes loans and other investment securities. The formula to calculate the KPI is given below.

NIM = (Interest Income – Interest Expense) / Average Earning Assets

The positive ratio will indicate that the business is making the correct investment decisions that yield good overall profit. However, a negative ratio will indicate that there is a need for improvement in the investment decision to pave the way for the lending business toward higher profits.

How HES FinTech can help in achieving the lending KPIs

Reducing Cost Of Loan Acquisition

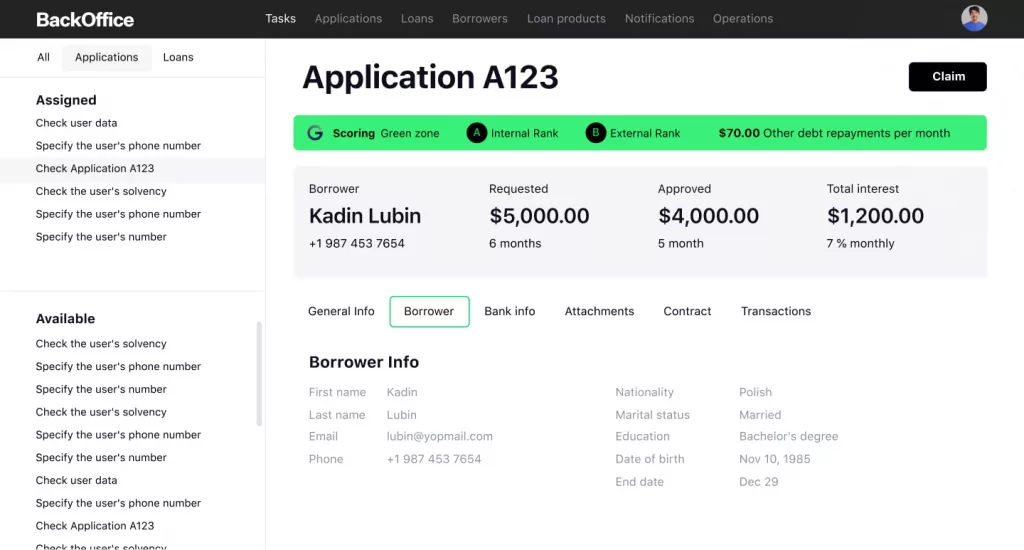

How to Choose Affordable SME Lending SoftwareHES FinTech helps lending businesses reduce the overall cost of loan acquisition. It offers a 3-in-1 digital lending platform to businesses that features a landing page where the business enjoys higher visibility and client reach by gathering all the applications online.

The borrower portal gives all your customers a safe space to check the status of all the loans in one place. Moreover, with the back portal, the managers can leverage the power of AI and machine learning to create new product lines and offer the right product to the right customer at the right time. Moreover, you can collaborate with your team under one roof without any interruptions or confusion, which elevates overall productivity.

Improving Operational Efficiency

With HES FinTech, managers can enjoy using deep insights by analyzing historical data to identify patterns in assets and make accurate loan decisions for financial institutions. With the help of AI-powered tools, they can decrease the NLPs. Moreover, the solution helps in reducing human error with its end-to-end automation of the lending process, which further elevates operational efficiency.

The HES FinTech comes with an easy-to-understand interface that further elevates the workflow speed and boosts the overall performance.

HES Lending Platform provides multiple modules that manage different phases of our customer journey, from the onboarding process to the automatic underwriting process, to the manual underwriting process, and finally to credit calculation. Highly valuable for us!

Hai DoCFO at ATM Online

Boosting Customer Retention Rates

HES FinTech offers a borrower portal where all the customers of your lending business can enjoy personal space to apply for new loans in an instant and manage the existing ones all under one roof. This improves the overall user experience of the customers, which elevates their loyalty factor in the business and thus stays with it in the longer run.

Moreover, the loan calculator helps them to make informed decisions as it automatically accounts for the loan amount, interest rate, and loan terms for the loan products.

Risk Management

The managers can use the AI-powered tools of HES FinTech to analyze high-delinquent assets and reduce the NPLs by making accurate decisions. They can set the criteria with the smart tools, and the system will automatically reject or accept the application according to those criteria. Moreover, you will get all the details on the borrower data and loan history under one roof.

Besides this, you can make deeper connections with the leads by offering the correct product to them with the help of HES FinTech.

Are risk management tools useful for your lending business?

Powerful Integrations to Boost Lending Metrics

The HES FinTech is capable of integrating with several payment providers, credit bureaus, and other relevant platforms that broaden its reach and allows it to cater to the regional needs of the customers. With 100 APIs, the HES FinTech platform follows a versatile and user-centric approach to fulfill the needs of its customers and facilitates easier tracking and improvement of finance KPIs. With the automated system, lending businesses can manage all their operations at a single point which can save them a lot of time and resources.

Conclusion

Here are some of the important loan origination system KPIs and loan servicing KPIs that will allow financial analysts to track the progress and growth of the lending business. HES FinTech offers custom solutions for the lending businesses to ameliorate their services with the power of AI and ML. You can contact the HES FinTech in-house team for a free demo of the solutions to understand all the perks properly.