With the digital lending market size projected to reach $20.5 billion by 2026 at a growth rate of 13.8% CAGR, the adoption of generative AI, ML, and blockchain-based technologies has surged. Studies have shown that such use of FinTech has led to a 20% faster loan application processing speed than other lenders without any inaccuracy. Thus, these technologies prove to be useful in making the entire process of credit risk management seamless, transparent, and scalable. In this comprehensive guide, you will understand all the top trends ruling in the digital lending and credit risk management sector. So, without any further ado, let’s get started!

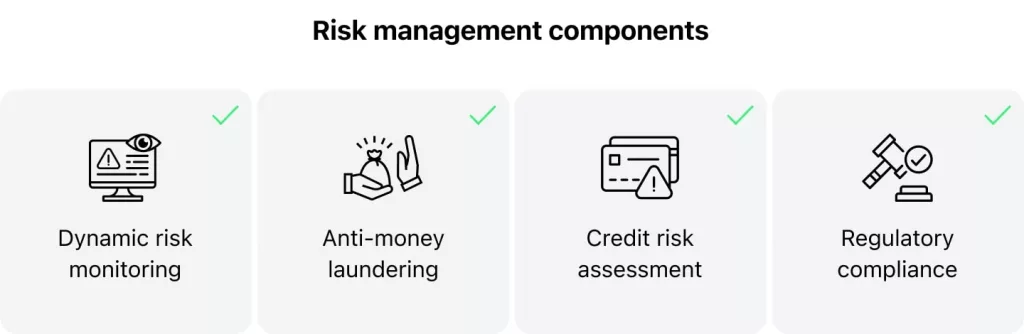

Risk Management Components in Digital Lending

Financial institutions, FinTechs, and private lenders incur losses when the people who have borrowed money from them default on their loans and fail to repay the borrowed money in the given time. So, proper credit risk management is necessary, which allows financial lenders to assess, monitor, and manage the risk while lending money so that it aligns with their overall risk tolerance.

Here, in the video below, Kuntal Sur (Risk Consulting & Leader, Partner, Financial Services & Treasury Risk Management at PwC India) discusses some new strategies for FinTech that will be beneficial to stand in the challenging digital lending space.

Now, we will go through some of the key components of risk management in digital lending.

Credit Risk Assessment

With a robust credit risk assessment approach, financial organizations can scrutinize the defaulters and make sure that they lend money to borrowers who fall into their credit risk limit. Having proper information about the borrower’s ability to repay the debt within the given timeframe helps the organization avoid losses, which makes credit risk assessment a crucial part of loan risk management.

The risk profile of the borrower includes details on security/collateral, credit background, capital needs, credit background, financial capability, and loan standard. When it comes to evaluating the credit risk of borrowers, the 3C method is one of the top credit risk management techniques. Let us get into its details.

- Credit Experience

It evaluates the borrower’s intent and capacity to repay the loan by analyzing his/her previous borrowing experience. However, if there is no credit history, it will not mark them as risky borrowers.

- Collateral

If the borrower puts a security or collateral, then the whole lending process speeds up. It acts as safety for the lenders who are lending money. They can sell the pledged collateral in case the borrower fails to repay the loan in the given timeframe.

- Cash Flow

It is a metric that tells about the ability of the borrower to pay back the debt balance. If there is consistent and ample cash flow, then the borrower will be able to pay back the debt without any difficulty.

Anti-Money Laundering

Anti-Money Laundering (AML) is a critical risk management component in digital lending aimed at preventing the illicit use of financial systems. In the digital realm, where transactions occur rapidly and across borders, AML measures become paramount. Digital lenders must employ robust customer due diligence processes, transaction monitoring systems, and enhanced identity verification tools to detect and deter money laundering activities.

Compliance with AML regulations is imperative to mitigate legal and reputational risks, ensuring the integrity of the lending platform. By implementing stringent AML protocols, digital lenders strengthen the security of their operations and contribute to a more resilient and trustworthy financial ecosystem.

Regulatory Compliance

Regulatory compliance is a pivotal risk management component in digital lending, ensuring adherence to laws and industry standards. In the dynamic landscape of online lending, compliance measures are crucial to mitigate legal risks and foster trust among stakeholders. Digital lenders must navigate a complex web of regulations governing data protection, consumer rights, and financial transactions. Maintaining compliance requires continuous monitoring of evolving regulatory frameworks, robust documentation, and the integration of compliance into digital platforms.

Non-compliance can lead to severe penalties and reputational damage. Therefore, a proactive approach to regulatory compliance is integral for the sustained success and legitimacy of digital lending operations.

Learn More About Regulatory Compliance

AI, Machine Learning, And Data Analytics In Risk Management

All of these offer advanced techniques to analyze large data sets, identify patterns for deep insights and make data-driven decisions, as well as ensure accurate and efficient lending for the financial organizations. In this section, we will see how these technologies are improving the digital lending space.

Fraud Detection

It is expected that cybercrimes will cost $10.5 trillion in the world economy by 2025. So, it is necessary to use AI, ML, and data analysis to prevent attacks, especially in the digital lending space. ML algorithms identify patterns indicative of fraudulent activities, enhancing the ability to detect and prevent fraud in real-time. Data analytics helps identify unusual patterns or outliers, signaling potential fraudulent transactions or applications.

Customer Segmentation

According to Gartner’s report, 63% of digital lenders struggle when it comes to offering personalized experience to their customers. AI and data analytics segment customers based on various factors, enabling personalized marketing strategies and product offerings. Tailoring risk assessments based on customer segments allows for a more nuanced approach to lending.

Regulatory Compliance

AI facilitates automated checks to ensure adherence to evolving regulatory requirements, reducing compliance-related risks. Data analytics assists in organizing and processing data for regulatory reporting, ensuring accuracy and timeliness.

Dynamic Risk Monitoring

AI continuously monitors transactions and borrower behavior, enabling real-time risk assessment and prompt response to emerging risks. For lenders involved in secondary markets, AI can optimize trading strategies based on market conditions and risk profiles.

Looking forward to improving your processes with AI?

2024 Trends in Digital Lending

Many top industry specialists have discussed the various digital lending trends that will rule in 2024. From automation and AI/ML to embedded and sustainable lending, there are so many aspects in the risk management, lending, and credit management domain.

Prioritizing Lending Risk Standards And Sustainability

With the increased regulatory shifts in risk management lending, financial institutions also include different social and environmental considerations. Opting for various Environmental, Social, and Governance (ESG) factors in robust risk models allows banks and other financial institutions to keep consumer trust intact. Accenture’s sustainable lending action plan is best suited for higher loan volumes, lower funding costs, and effective risk mitigation.

Digitalization and Automation With AI and ML Models

The generative AI is useful in automating the entire lending life-cycle and will prove useful in high-level financial analysis. AI-based underwriting and anomaly analyzer will simplify loan risk management and impart superb personalized banking solutions. This will impart noteworthy growth opportunities to banks and other financial institutions for strategizing digital assets.

Incorporating these innovations, HES LoanBox stands at the forefront of this evolution. Its AI-driven features are designed to streamline various aspects of the lending process:

- Advanced credit scoring: Leveraging machine learning algorithms, HES LoanBox offers sophisticated credit scoring models that provide more accurate and nuanced risk assessments.

- Automated decision making: The platform’s AI capabilities include automated decision-making tools that can process applications faster, reducing the time and cost associated with loan approvals.

- Fraud detection and prevention: Utilizing AI, HES LoanBox enhances the security of transactions by identifying and mitigating potential fraud risks.

- Personalized financial solutions: AI in HES LoanBox allows for the creation of personalized loan offerings, aligning with individual borrower profiles and needs, thereby improving customer experience and satisfaction.

- Data-driven insights: The platform’s AI algorithms analyze vast amounts of data to provide valuable insights, enabling lenders to make informed decisions and identify emerging market trends.

Credit Score and Investment Assessment

The latest ML-based credit score and real-time risk analysis enables customers with reliable assessments in just a few clicks. With advancements in tagging, document classification, and processing, banks can offer the fast and smooth customer experience that users seek.

AI Implementation and Regulatory Policies Across Various Regions

As AI technologies rapidly evolve, countries are recognizing the need to establish clear guidelines and regulations to ensure their safe and responsible use. This section delves into how different regions, specifically the UK, the USA, and Canada, are approaching the task of integrating AI into their societal and economic infrastructures while also addressing the inherent risks and challenges posed by these advanced technologies.

UK

According to The Bletchley Declaration, which was signed by 28 countries, including the UK, EU, China, and the US, a collaboration was established between all the signing countries to take a common approach to AI and address the risks associated with it. It focuses on identifying the AI safety risks and creating risk-based policies for a harmonized approach to regulating the technology.

USA

White House gave an Executive Order (EO) on 30th October 2023 that will focus on the safe and responsible use of AI in the US. With this EO, all the key departments have to develop proper standards and practices within 3 to 12 months that will cover the whole AI cycle.

Canada

Canada’s proposed AIDA (Artificial Intelligence and Data Act) provides guidelines for responsible and safe design, development, and end deployment of AI systems in the country. However, the act has been under tight scrutiny for several reasons, and there is a need for certain changes in the act so that it can be enacted properly.

The Bottom Line

With the digital lending industry thriving with AI implementation in 2024, the global digital lending market will converge into one single unit. All the latest trends and credit risk management techniques will help in fostering sustainable growth that ensures proper regulations, collaborations, and proactive adaptation. This will bring new laurels to the lending landscape and help in building a responsible, consumer-focused, and resilient financial ecosystem.

Staying ahead with future-proof, secure, and compliant lending software becomes indispensable for any financial institution. If you are looking to navigate these changes with cutting-edge technology, HES FinTech offers the solutions you need. Our expertise in providing state-of-the-art lending software ensures that your business remains at the forefront of the digital lending revolution. Contact us today to learn more.