At the end of March, we presented to you our new product – HES LoanBox. But we never stopped working on our products, adding new features and improving the quality of the technology. So today, we want to share with you the top 8 features we have added to the HES LoanBox during these six months.

#1. KYC verification

KYC stands for Know Your Customer and is a process of customer identification and verification. Here is how it works:

- Step #1. First of all, customers need to fill in a form with their personal details. Normally the KYC system asks about the name, date of birth, address, identification number, and selfie. But these requirements may vary depending on what system you use.

- Step #2. Next, the user should upload a document that proves their identity. It can be an ID card, passport, driving license, etc.

- Step #3. Then, the program runs several checks to confirm the identity and authenticity of uploaded documents.

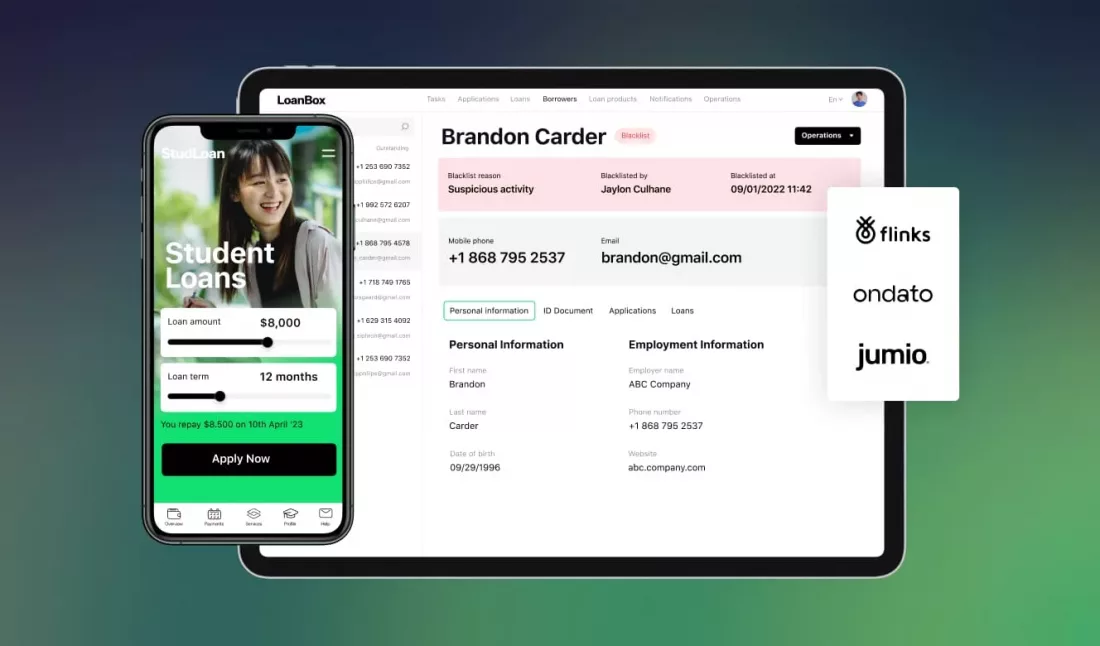

As you can see, a KYC check is just another level of security that allows you to ensure your customers are real and monitor risks. And we are happy to say that now, our LoanBox is fully compatible with not one but two KYC providers:

- OnDato – provides solutions for identity verification, data monitoring, screening, due diligence, risk scoring, and case management – all in one place.

- Jumio – pioneered the ID and selfie approach to identity verification, leveraging ten years of real-world production data and hundreds of millions of domain-specific.

#2. French and Spanish user interface

Saudi Aramco and Customers from Africa – the Footprint of HES is in 30+ Countries Now When we first released HES LoanBox, it was available in English only. But now, the user interface can be set up for French or Spanish languages depending on your business needs. So now, it will be easier to use HES LoanBox by non-native English speakers.

Also, we implemented a mechanism that allows us to make translations into any language by your request.

#3. Integrations with open banking

Open banking is a technology that allows you to get easy access to customers’ bank information, including their account number, history of transactions, etc. Here is how it works:

- Step #1. During the application process, your customer gives consent to use their banking data.

- Step #2. Next, they enter their bank system login and password, and all the needed information is filled in automatically, eliminating human mistakes.

- Step #3. Then, you get access to this information and can use it for risk management and better credit scoring. For example, you can check how much they already spend on different credits or verify that they have enough money in their bank account before starting an auto-debit transaction.

The new version of HES LoanBox supports integrations with two open banking providers:

- Flinks – the most popular open banking solution in North America that provides safe and reliable access to your users’ financial data and aims to enable the open, consent-based exchange of financial data.

- Nordigen – an open banking platform serving fintech and developers in 31 European countries. Its free API is connected to more than 2,300 banks.

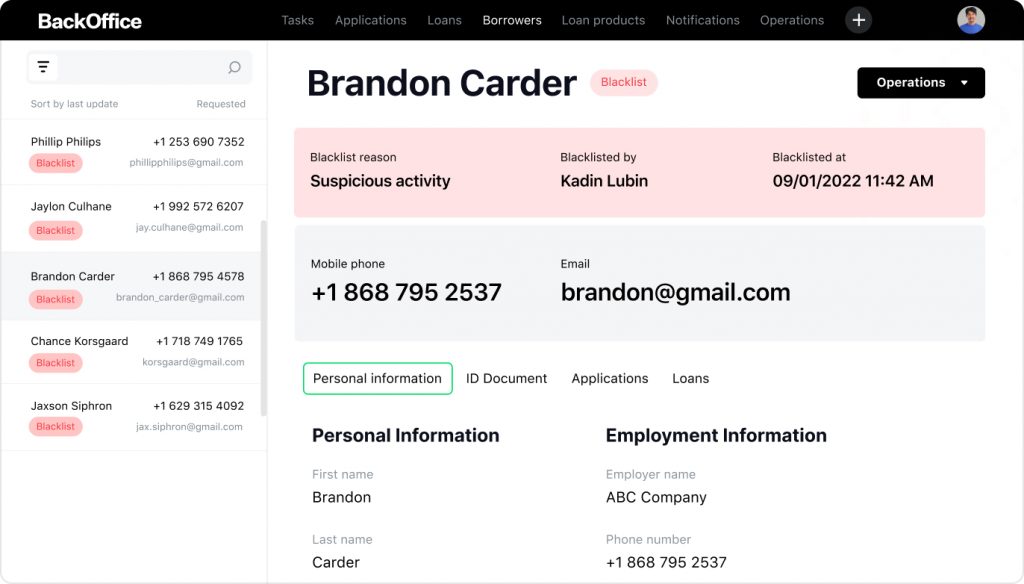

#4. Blacklist management functionality

In the newest version of HES LoanBox, you can create a blacklist of unreliable borrowers:

You can manage this list by adding customers to the blacklist and entering the reason why they are on the list. Also, you can check when this person was banned and all the personal information from their application. Based on the blacklist, you can automatically decline new loan applications from these borrowers.

#5. Secured loans and mortgages

We have added two new types of loans that you can manage using HES LoanBox:

- secured loans

- mortgages

So now, you can use this solution for long-term loans that are secured by some type of property but with lower interest rates and choose different collateral types when creating new products.

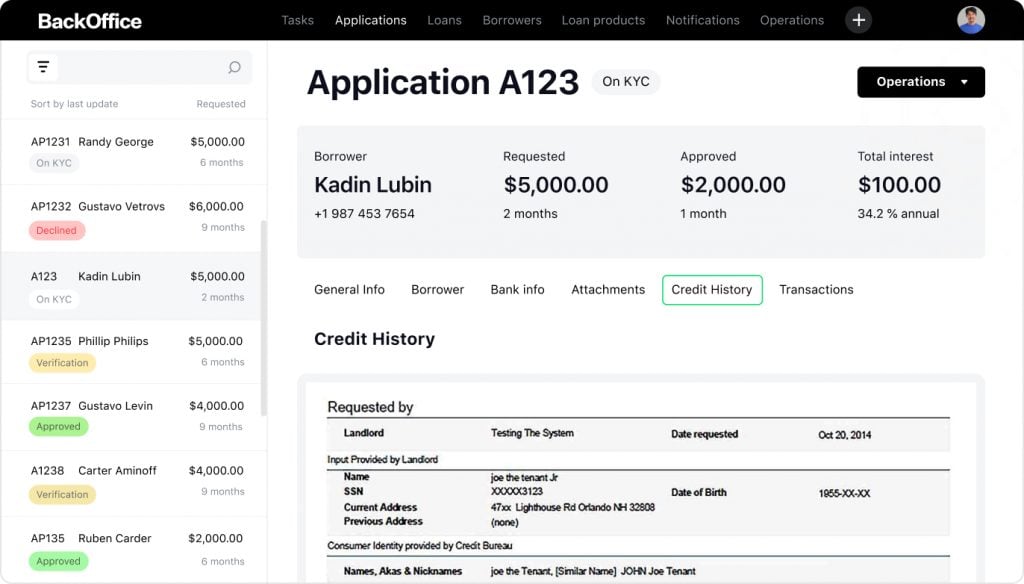

#6. Integration with CreditInfo

HES FinTech and VoPay Partnership: Lending Powered with Leading-Edge Payment Processing Creditinfo is a multi-country credit bureau that uses a centralized data exchange mechanism. That allows them to assess the credit risks of both companies and individuals.

Thanks to this integration, you can get information about the credit history and recommendations to approve potential borrowers and use this data in your decision-making process to reduce risks:

#7. Calculation constructor

And last but not least, we want to mention the calculation constructor. We made a backend part that allows us to build new calculation types using pre-built rules. As a result, we can develop faster and be more flexible in terms of calculation parameters and custom requests.

Conclusion

All these new features are only a small part of all the updates we made to our HES LoanBox during the last months. We are constantly working to improve our platform and thinking of ways to make it even more convenient and helpful for you. Stay tuned to not miss new features of our box, and if you want to see HES LoanBox in action, hop on a live demo tour with our team.